Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It’s great to see you in the Community, robert53.

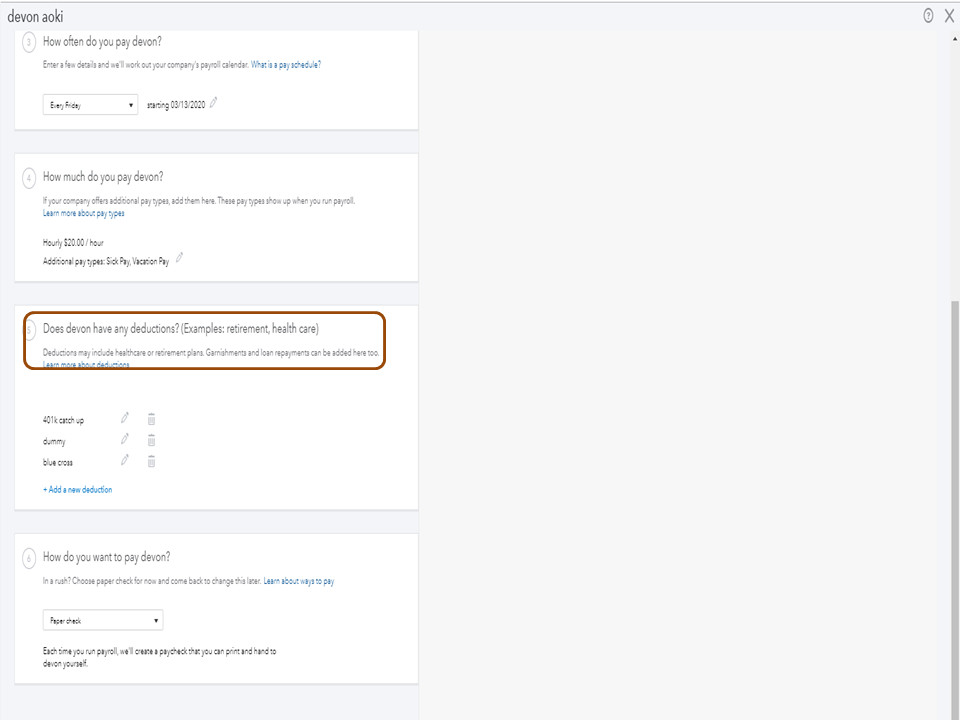

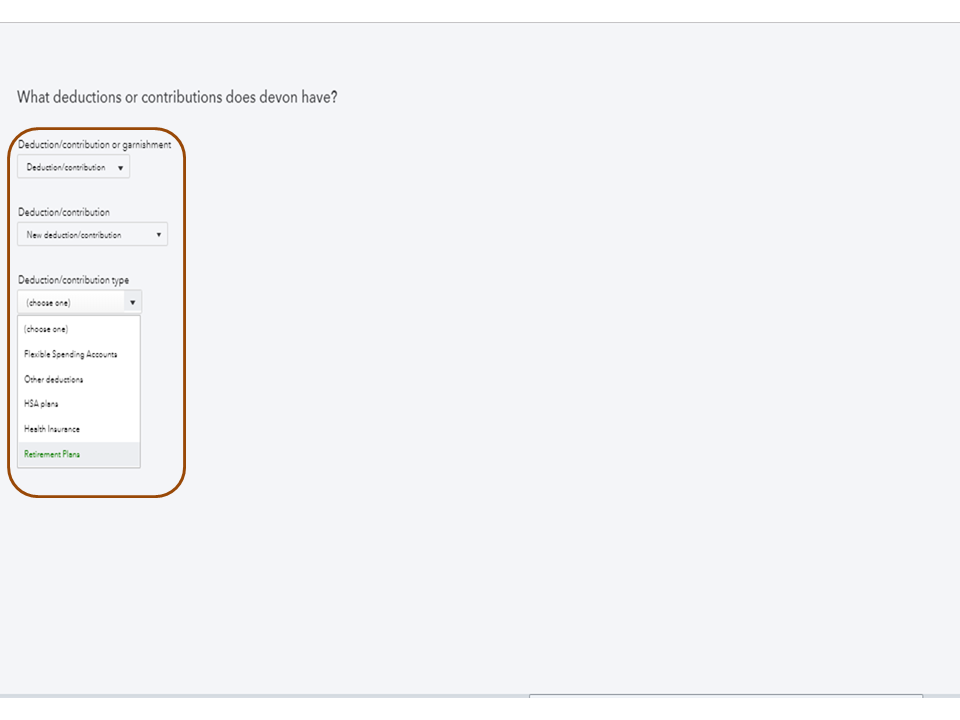

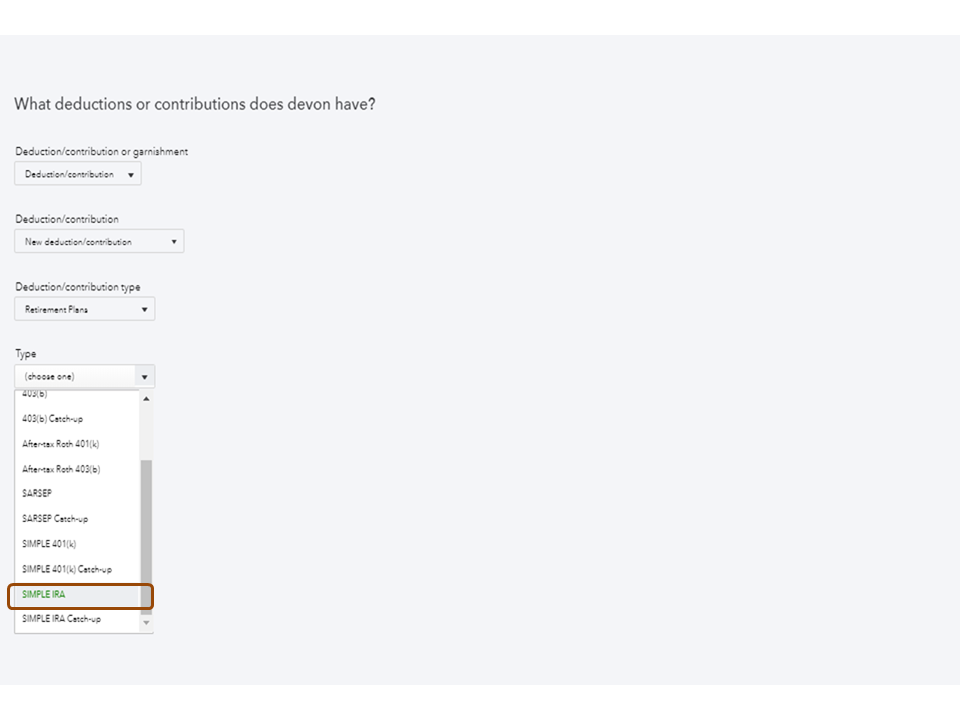

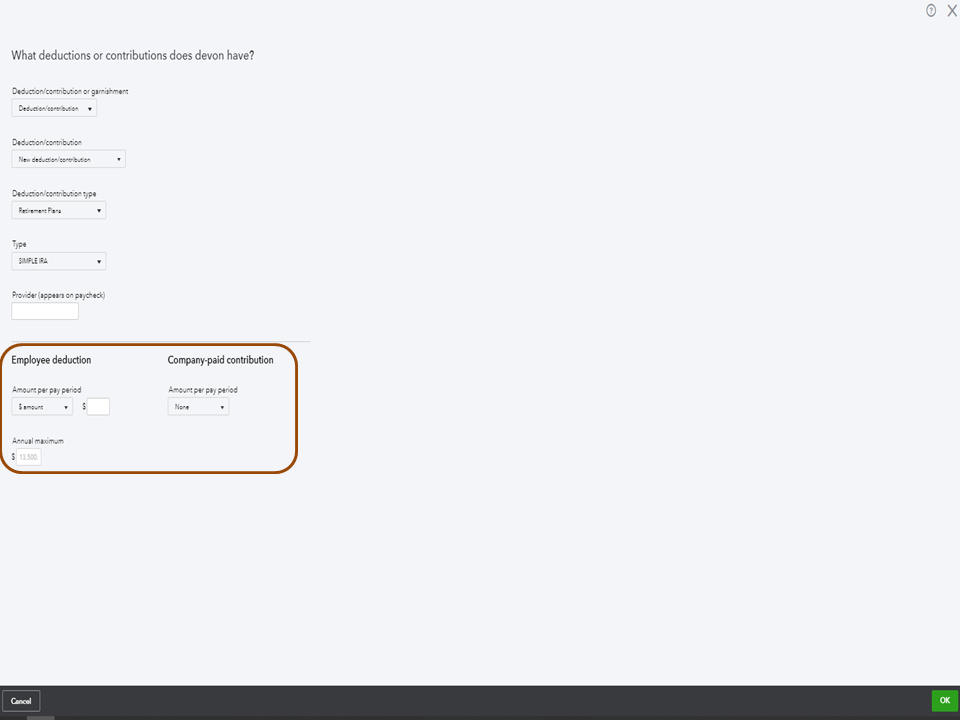

To pay the Simple IRA employer contribution to employees, let's set up the payroll item in your company file. Adding it is as easy as 1,2,3.

Here’s how:

Perform the same procedure to assign it to your employees. When creating paychecks, the employer contribution will automatically show on the workers’ payroll information.

For additional resources, check out the Retirement plan deductions/contributions article. It provides an overview of how to assign the payroll item to employees and steps to remove the deduction.

Let me know if you need further assistance while working in QBO. I’m more than happy to help you. Enjoy the rest of the day.

This does not actually take the employers contribution out of the checking account that is tied to payroll correct? This is just informational for the employee? We have our Simple IRA for employees through a separate company and we physically go in each week online and deposit through their portal. Thanks!

Thanks for actively joining this conversation, @WoodsTrans. To answer your questions, yes it does not take the employer's contribution out of the checking account that is tied to payroll correct.

You'll want to check out the resource shared by my peer above. Let me share it again with you. Read through this article: Retirement plan deductions/contributions. It gives you an insight into how to assign the payroll item to employees.

Feel free to message again should you have other questions. We're always delighted to assist.

You still didn't answer the question. We have set up the deduction for the employee correctly. It is showing up in their paycheck correctly. They are being paid through payroll correctly. The problem is that the SimpleIRA (or SEP in my case) amount still has to be paid. How do we "trigger" paying the employer contribution so that we can write the check or transfer the money. The article you sent and the answers above do not address this at all.

In QB Desktop, I would go into the Employee Center>Payroll>Pay Liabilities, Create Custom Payments to select the date range. It would list all of the employees SEP payroll items to be paid and I would select them and click Create. This would then and send them to my bank account so I could print checks.

What are the equivalent steps to actually CREATE THE CHECK to pay the employer deduction?

Thanks for joining this conversation, las.

Allow me to hop in and share information about the paying employer deduction (SEP-IRA contributions) in QuickBooks Online (QBO).

Currently, there isn't a direct way to create a custom payment for the SEP-IRA contributions in QBO. What you can do for now is to create an expense transaction and ensure to record the payments under "Other Current Liability" in your chart of accounts. However, you'll have to consult with your accountant or a tax expert for the best advice on how to record this properly.

Here's how to an expense transaction for the SEP-IRA contribution:

For more information about managing and setting up a retirement plan deduction or a company contribution in QBO, check out this article: Set up a retirement plan.

You'll also want to learn on how to make payroll tax payments in QBO. This is to prevent penalties due to late payments. Please refer to this article for future reference: Pay and file payroll taxes and forms in Online Payroll.

Please let me know in the comment section if you have follow-up questions about this or anything else. I'm always here to help. Keep safe.

This seams to be yet another aria that QBO is like Oh maybe some day in the distant future (30 years form now) we should maybe make it easy like it was in the Desktop version. There are some really cool features in QBO BUT PLEASE GET US THE FEATURS WE NEED!!!!!!! OR CHARGE US LESS. Until you actually develop your software!!!!

There seems to be another area where Quickbooks online has not developed their software. Please get a software that actually has the features that Quickbooks Desktop had NOW or charge us less until you do!!

Or at least Give us better tutorials other than "Ask Your accountant to help you!" NO!! I PAY YOU TOO MUCH TO NEED TO GET MY ACCOUNTANT Involved every time I need to do a basic task!! SO FRUSTRATEING!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here