Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Enter the amount as a negative health deduction. Will be added back to the check and if pretax adjustment will be made to YTD amounts.

Thanks for joining the growing family of QuickBooks Community, MackeAcct.

I'll be delighted to walk you through in processing a refund for your employee's over withheld health insurance.

Here's how:

The Reimbursement item appears in the Pay column when you create a paycheck for the employee once reimbursement pay type is added.

I've included an article that will help you in checking your employee's reimbursements.

If you ever need assistance working within the program, let me know by leaving a comment. I’m always glad to help.

This works for Desktop, but not Online.

Thanks

How does this adjust the total insurance amount paid? Need the net amount on the W-2.

Thanks for getting back, MackeAcct.

The reimbursement won't affect the total insurance amount paid to your employee. And, this payment won't show up on the W-2 form since it's a non-taxable pay type.

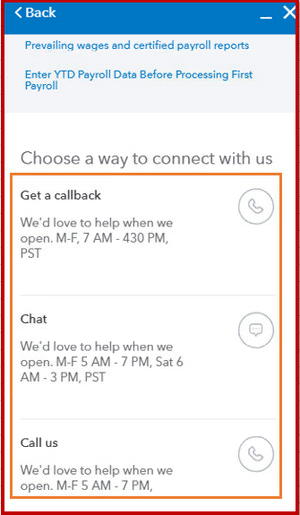

I suggest contacting our QuickBooks Online Payroll Support Team so they can correct payroll for you. By doing so, they'll help ensure the net amount is correct on the W-2 form.

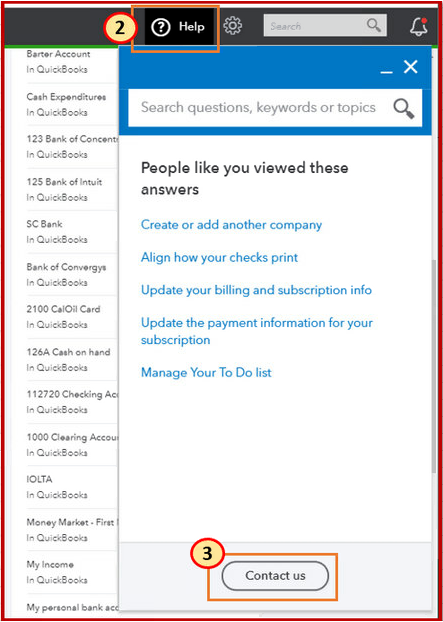

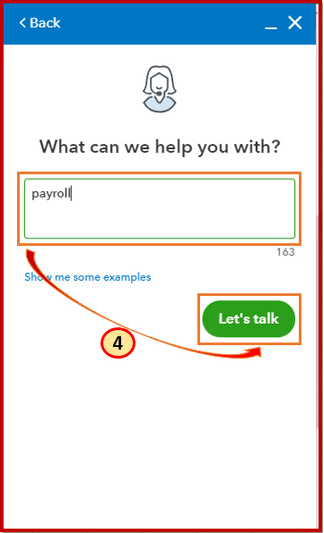

Here's how to get in touch with them:

To ensure your concern is address on time, check this out: Support hours and types, then go to QuickBooks Online. It includes available days and hours in pacific time.

I've added these articles on how QuickBooks populates the boxes and how pay types impact your payroll forms:

Keep me posted you have follow-up questions and I'll get back to you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here