I appreciate you for bringing this matter to our attention, whitney.

To remedy the discrepancy in 401k contributions between payroll and the actual amounts for 2024, it's important to correct the payroll records promptly.

Since you've noticed that the 2024 contributions weren't updated in the payroll system, I recommend reaching out to QuickBooks Online Payroll Support. They will assist you in making the necessary corrections to your payroll records to ensure that your 401k contributions accurately reflect the intended amount per pay period for 2024. Here's how:

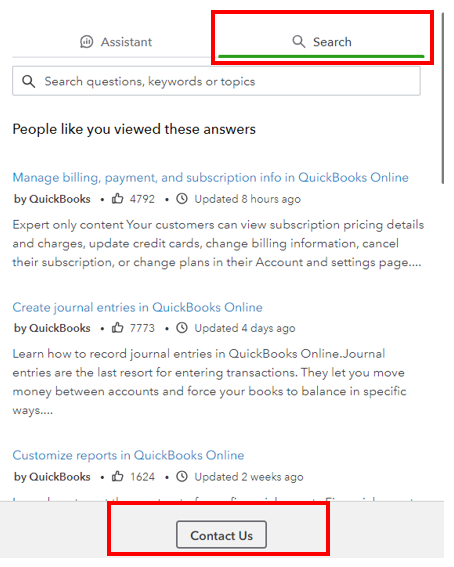

- Within your QBO account, go to Help in the upper-right corner.

- In the Search tab, click Contact us.

- Enter a brief description of your concern.

- Click Continue.

Additionally, you can generate payroll reports to gain a more detailed insight into your business's financial status. For more information, please refer to this article: How to Run Payroll Reports in QuickBooks Online Payroll.

Stay in touch if you have further questions about direct deposit and other payroll concerns. I'll be around to provide detailed instructions for them.