Maintaining accurate payroll information is crucial for ensuring that your employees are compensated correctly and on time, Christine. I'm here to provide step-by-step guidance to help you navigate this process effectively.

Before anything else, it's important to note that your primary work location is determined by your company's designated area, meaning that transferring your work location to a different state is unavailable. Also, the State field will automatically populate once you enter a specific address. If you need to change your address, make sure that it is located within the same state to avoid any issues.

On the other hand, if you need to create a work location that is from a different state, you'll have to create it within your specific employees who are assigned to work at that location:

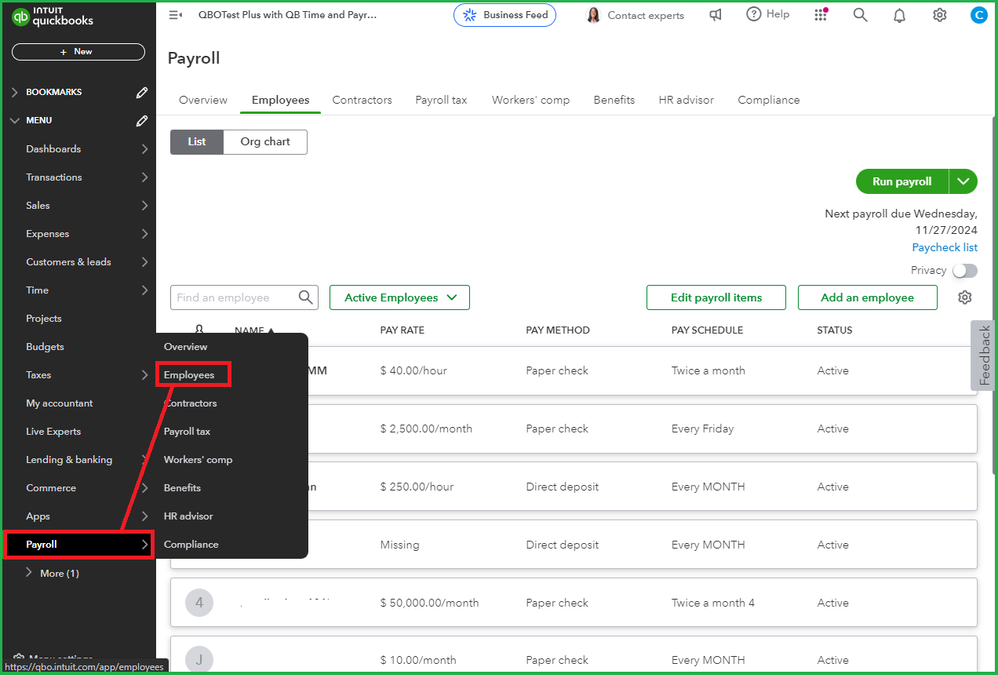

- Sign in to your QBO account.

- Go to the Payroll tab and select Employees.

- Select the particular employee.

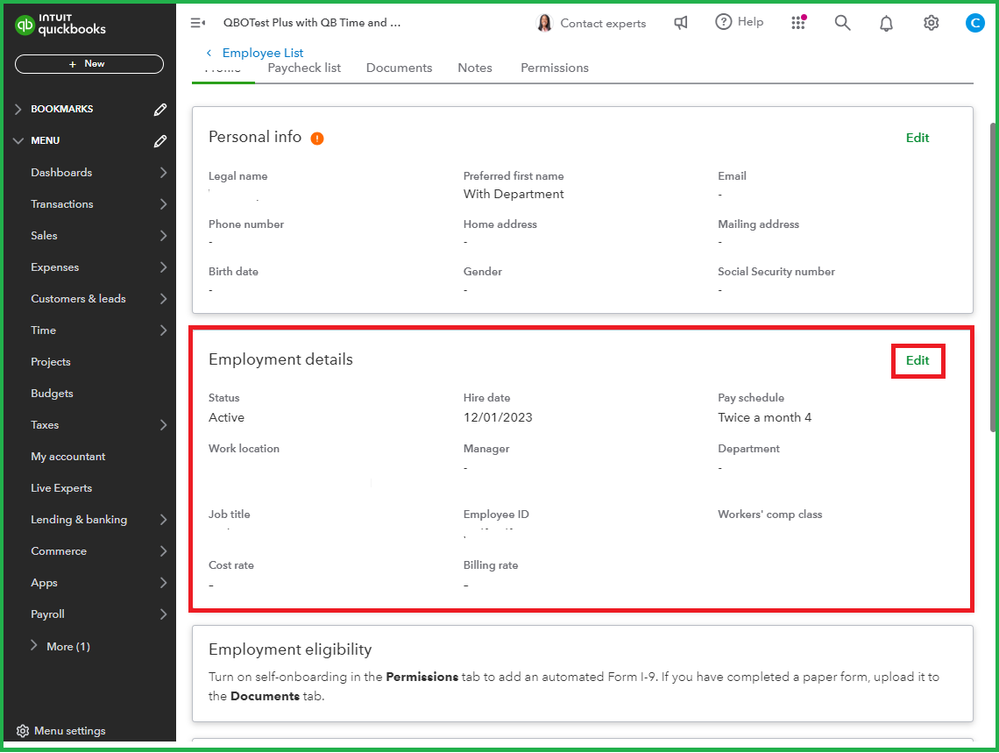

- In the Employment Details section, click on the Edit icon.

- Edit the Work Location for that employee.

- Make the necessary changes, then click Save.

For more information on adding or changing employees' work locations, you can visit this article: Set up and manage work locations in QBO Payroll.

I’ll share this useful resource that guides you on how to effectively set up your payroll system and schedule it to run automatically, ensuring timely and efficient payments without the hassle of manual processing: Manage your Auto Payroll in QBO Payroll.

Whether you need to update personal details, adjust pay rates, or make other changes, I’ll assist you in making sure everything is up-to-date and compliant. Have a productive day.