Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt’s nice to see you in the Community, gregveachlaw.

Let’s write a check to record the interest paid into and out of a liability account. The process is a breeze, and I’m here to guide you.

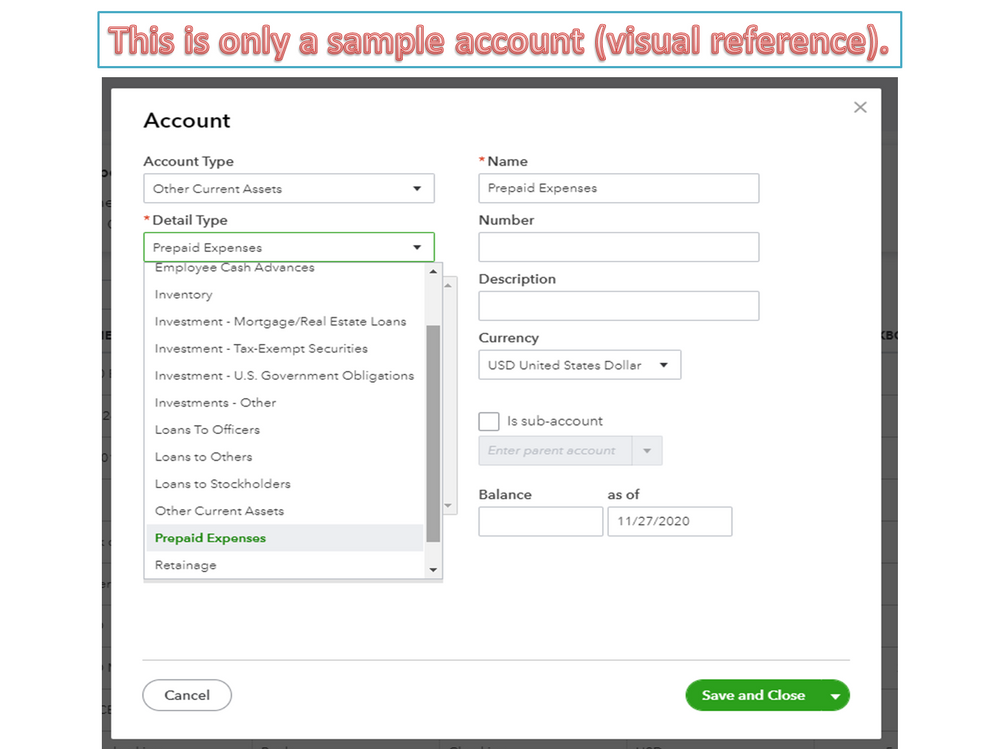

If you haven’t created the liability or expense account, go to the Chart of Accounts page to add them. I suggest consulting an account for a recommendation on the specific accounts to use to track the transaction.

To add the account, we’ll have to perform the process one at a time. Check out the steps below.

Follow the same process when setting up for the expense account. Then, pick the correct Account and Detail Types. Let me share this article for additional information: Add an account to your chart of accounts in QuickBooks Online

When you’re ready, let’s go ahead and record the transaction. Here’s how:

For future reference, I’m adding a guide that outlines the instructions of how to: Set up a loan in QuickBooks Online.

Stay in touch if you have any other concerns or additional questions about the product. I’ll be glad to help and answer them for you. Enjoy the rest of the day.

Greetings, gregveachlaw.

I'm back to make sure the information I shared answered your question? If you have any clarifications recording interest or the process, click the Reply button and post a comment.

I’ll be glad to lend a helping hand. Enjoy your day.

@gregveachlaw wrote:

How to record interest paid into and out of a Liability Account

If you have recorded liability payments that also include principal and interest in a liability account and now like to separate interest expense from this account you can write a journal entry.

From the left dashboard > + New > Other > Journal Entry

Debit = Interest Expense

Credit = Liablity Account

This will show interest expense and principal portion as a liability account.

Hope this is what you're trying to do it!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here