It depends on the account you're using, as QuickBooks Desktop (QBDT) Payroll and QuickBooks Online (QBO) Payroll offer different functionalities, Megan47.

If you use QuickBooks Online Payroll, it will use a set of default accounts for payroll items. When you set up payroll, QuickBooks automatically creates these accounts in your Chart of Accounts to track various aspects of payroll expenses and liabilities.

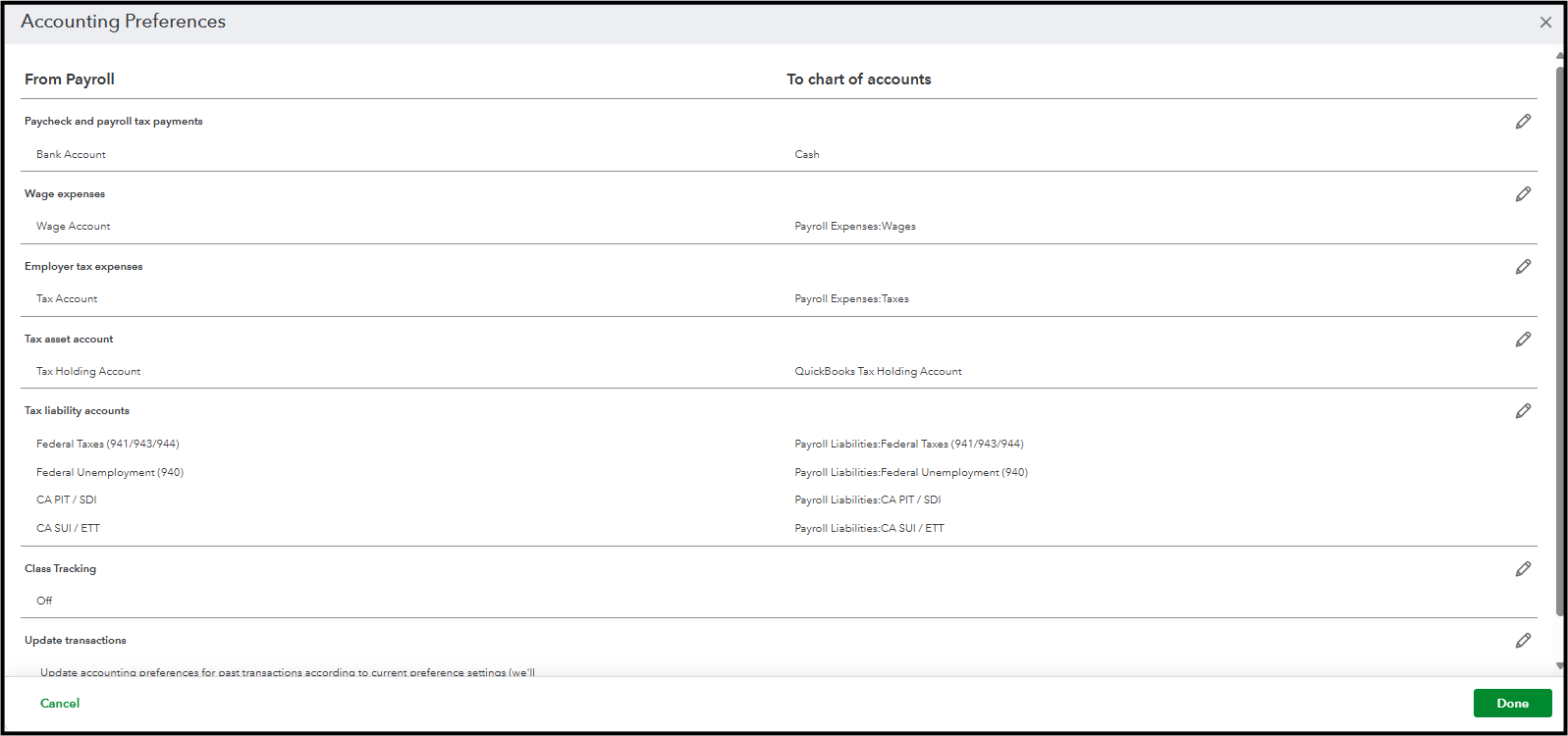

Here’s how you can map your payroll items to different accounts in your Chart of Accounts:

- Go to the Gear icon and select Payroll settings.

- Proceed to the Accounting section and click the Pencil icon on the right-hand side.

- Scroll down to the Wage expenses, Company Contribution Expense Accounts, and Employer tax expenses section.

- Click the Pencil icon on the right-hand side.

- Assign each payroll item to the different expense accounts in your Chart of Accounts.

- Click Done.

Once complete, the amounts for these items will automatically be transferred to their respective accounts in your Profit and Loss report. Refer to this article if you need more changes to your payroll settings: Change Your Accounting Preferences In QuickBooks Online Payroll.

While QBDT payroll requires you to link each payroll item to a Chart of Accounts account, it's a one-time setup process for each new item. Once a payroll item is created and linked to an account, QuickBooks Desktop will automatically use that link for all future payroll runs.

If you need to correct those items to their designated accounts, you can manually open and edit a payroll item to change the account it links to. Here’s how to correct a payroll item:

- Navigate to the Lists menu and select Payroll Item List.

- Right-click on the payroll item you want to change and select Edit Payroll Item.

- A setup window will appear. Click Next through the screens until you get to the window that shows the linked expense or liability account.

- Select the correct account from the dropdown list.

- Click Next until you reach the end, then click Finish to save your changes.

Please know that when you change a payroll item's linked account in QBDT, it will affect all past and future transactions using that item. This means that QuickBooks will automatically update your historical payroll records to reflect the new account mapping.

If you have other concerns, you can revisit this page. We’re here to help.