Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAfter Quickbooks support asked me why Texas has no state income tax I lost my patience and figured I'd just ask here.

It's a single member LLC registered in Texas, got quickbooks payroll to pay the owner in hopes they would deduct income, social security and medicare tax and file all forms with the appropriate agencies.

Owners are not required to pay FUTA or state unemployment, so the owner is set up as an employee exempt from these payments. Payroll ran fine deducting federal income, social security and medicare taxes.

During the setup support was able to save "appliedfor" in one field that normally would show Texas unemployment account number. We rejoiced too soon.

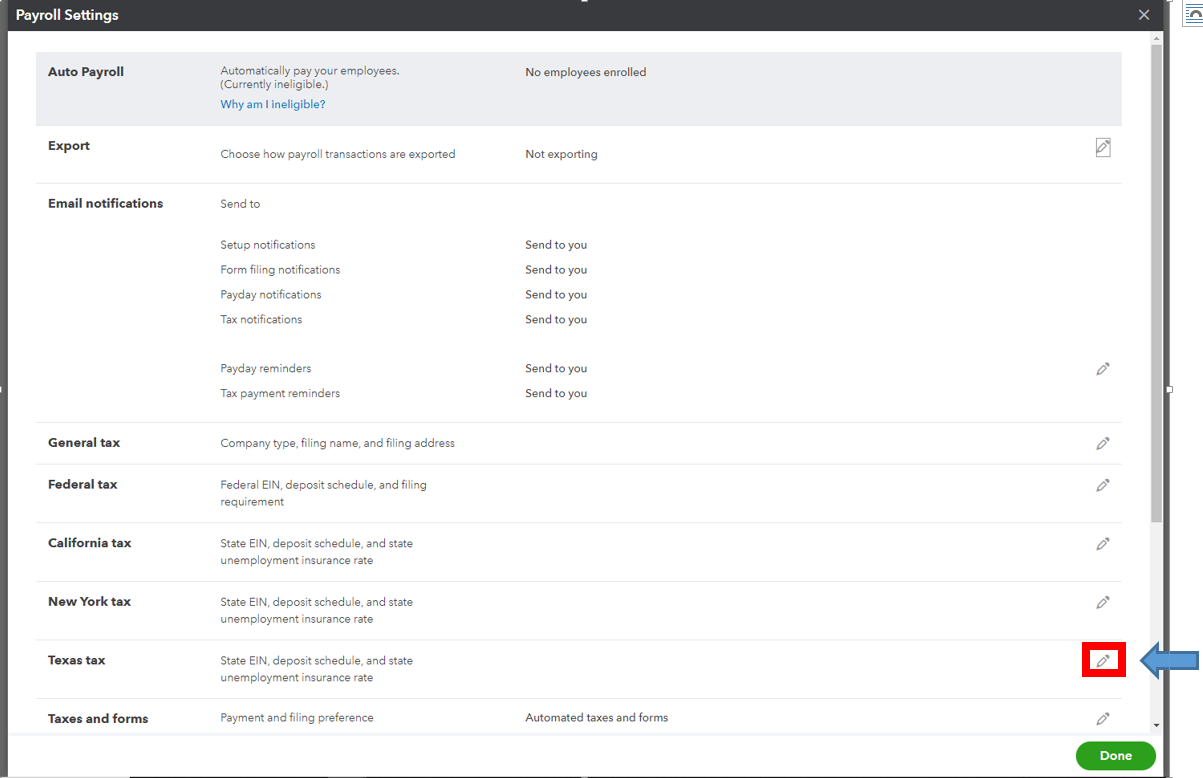

Now Quickbooks is asking :

Hi there, proreo.

I'm here to ensure you're able to enter the Texas Tax in QuickBooks Online (QBO).

You'll just need to complete the payroll setup in QBO. Texas numbers require 11 digits. We can use the number zeroes to proceed.

Here's how:

For your reference, you can check out this link on how to add or edit your state account number: Changing a state account number.

Feel free to leave a comment below if you have other concerns about setting up your state payroll tax. We're always here to back you up.

I think Intuit should work on this, so that we don't have to put bogus numbers in the system.

I am also attaching the "funny" screenshot when your colleague asked me why Texas doesn't have income tax LOL

You nonchalantly avoided that part

hey there I am super late to this but it has been near impossible to get any help on this ONE tiny box that apparently stumps everyone at QB. Glad to see I am not the only one, and the only number that "works" in that box is my EIN. So I am going with tthat I guess...??

Thanks for joining the Community and getting involved with this thread, briddle22.

You can obtain a Texas tax account number by registering your business with the Texas Workforce Commission. Once you're registered, you'll be provided with an account number and tax rate. Your number will be 9 digits long, in the format XX-XXXXX-XX.

This number can also be found on your Employer's Quarterly Report (Form C-3). You can additionally reach out to your state agency directly if you have any questions about your tax account number or registering.

I've included a couple detailed resources about working with payroll taxes which may come in handy moving forward:

If there's any additional questions, I'm just a post away. Have a lovely Friday!

Hi Moderator,

The point of this thread, is how NOT to pay Texas Unemployment Taxes if you are the Owner AND the Employee.

In Texas, if you are a Sole Proprietor LLC, and the Employee, you do not have to pay Unemployment Taxes.

We are still trying to figure out how to work around this issue. Any suggestions?

Thanks!

Yes, I think I just added, (or had to ask support to do it) a dummy number and then I just ignore the Texas payroll filings for the LLC owner. I don't know how I would have done it if there were employees in Texas.

You also need to set it up and say that "employee" is exempt from "

"

It's in Payroll part of QB in employee profile section.

That will trick QuickBooks into calculating just social security, Medicare taxes and income tax.

We did this as an experiment.

Much better solution, don't use payroll. Just set aside 30-40% of what you pay yourself (on a high yield savings account perhaps) and pay it when the taxes are due. Let's say for each $100 you take from the LLC, take $35 and put in savings.

When you do your taxes you will likely owe a lot but who cares, you have that money and made 5% interest lol

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here