How you'll pay yourself will depend on your business structure, @sgangidi. If you're a sole proprietor, you can use an owner's draw instead of adding yourself as an employee. I'll go over some details to explain it further and walk you through the process.

The Owner's Draw is how an owner pays himself rather than taking a salary from the business. It's an equity account used by QuickBooks to track withdrawals of the company's assets to pay an owner.

To get started, let's set up an Owner's Equity account in the Chart of Accounts. I'll guide you on how:

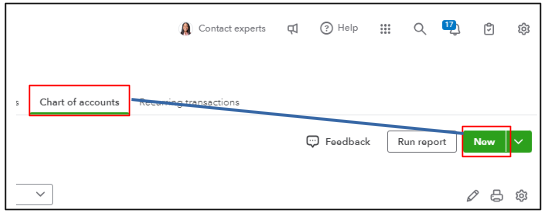

- Go to the Gear icon⚙ and select Chart of Accounts.

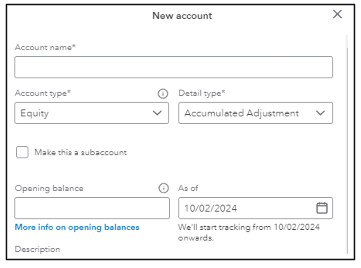

- Click New and enter an Account name.

- Select Equity or Qwner's Equity as an Account type, and then choose the Detail type from the dropdowns.

- Fill in the necessary details.

- Once done, click Save.

When you're ready to pay yourself, create a regular check in QuickBooks, not through payroll. Make sure to affect the Owners Equity account you previously created. Here's how:

- Go to + New, then select Check.

- From the Payee dropdown, select who you want to address the check.

- On the Bank Account dropdown, select the account you want the money to come from.

- Fill out the rest of the fields accordingly.

- Hit Save and close.

By managing your payments as an owner's draw or distribution rather than an employee salary, you'll stay compliant with tax rules while maintaining clarity in your QuickBooks Online records.

For future reference, you can generate payroll reports to view payroll information, which is helpful in filing taxes.

Let me know in the comments below if you have more questions about Owner's Draw in QuickBooks Online, sgangidi. I'll be more than glad to provide further details. Have a good one!