Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I run a summer camp for teens in PA. We had a seasonal employee from Alabama who received 2 paychecks in July + August and no PA taxes were withheld. I think in QB when I entered her payroll / taxes info I forgot to enter state withholding. I just caught my mistake today when issuing W2's. I think I need to amend her paychecks to include the PA withholding and also amend Q3 PA UC-2 and her W2. How do I do this? Thanks in advance for the help!

Solved! Go to Solution.

Thanks for visiting the Community today, Judsonmillar.

We’ll have to create a liability adjustment to correct the W-2 information for your employee. To get the amount to be adjusted, let’s run the Payroll Summary Report. I’m here to guide you on how to perform these tasks.

To build the report:

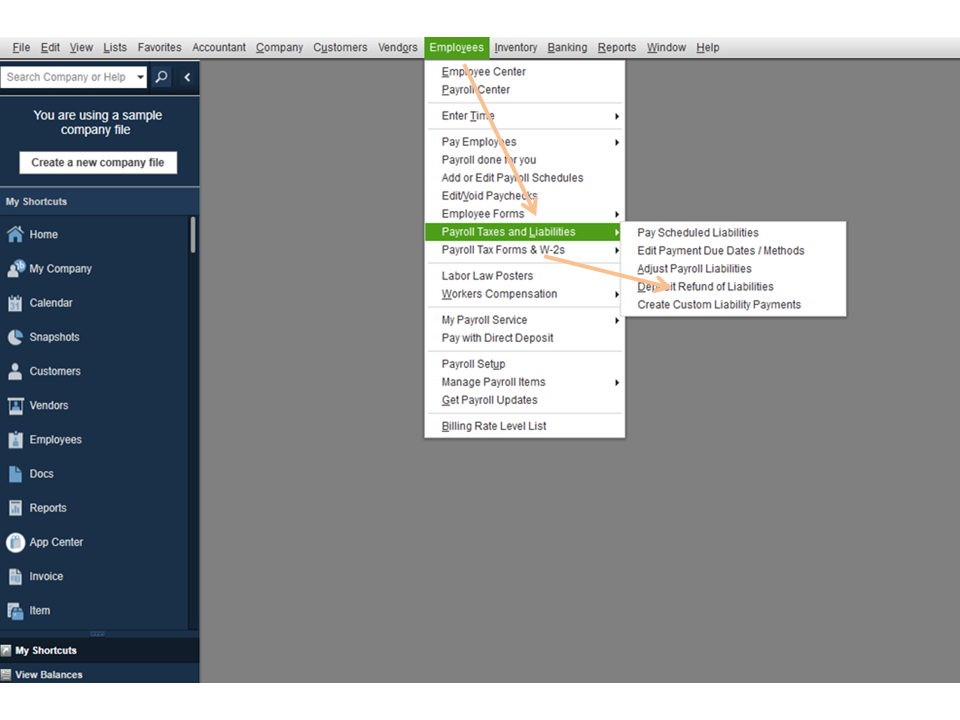

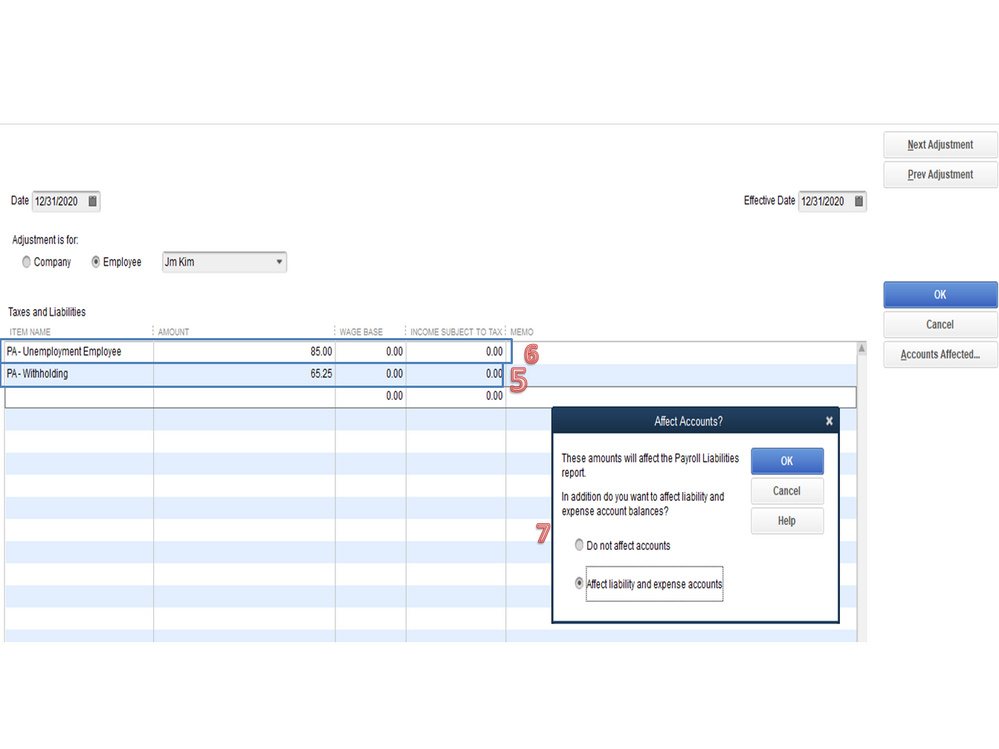

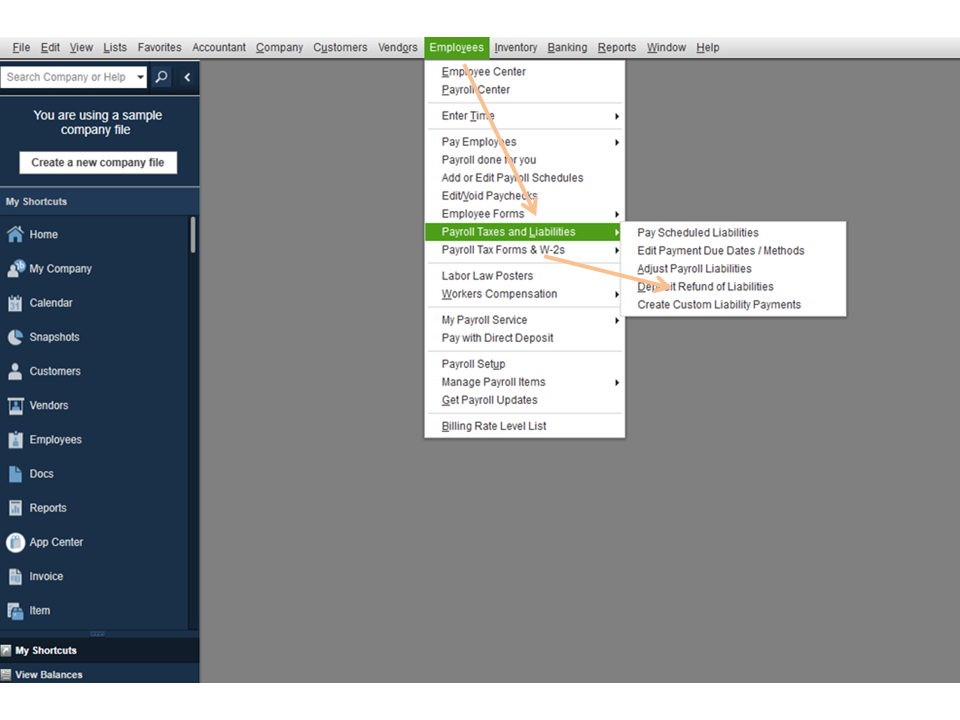

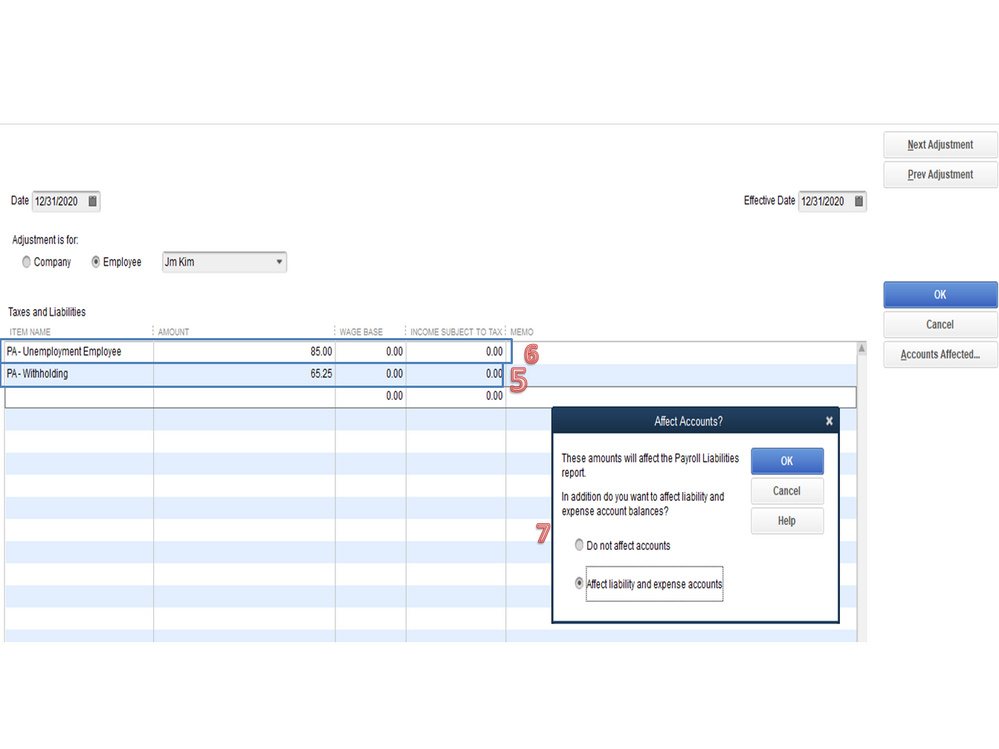

To adjust the liabilities.

Check out this guide for more insights about the process: Adjust payroll liabilities in QuickBooks Desktop.

After performing these steps, open the W-2 form to check the information. I also suggest contacting the state agency since you’ll be amending the PA UC-2. They’ll guide you on how to handle this type of situation.

Also, the following article outlines the complete instructions on how to create the W-2 forms. Choose QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard to view more information: Print your W-2 forms.

Reach out to me again if you have any clarifications or questions. I’ll be right here to answer them for you. Have a great day ahead.

Thanks for visiting the Community today, Judsonmillar.

We’ll have to create a liability adjustment to correct the W-2 information for your employee. To get the amount to be adjusted, let’s run the Payroll Summary Report. I’m here to guide you on how to perform these tasks.

To build the report:

To adjust the liabilities.

Check out this guide for more insights about the process: Adjust payroll liabilities in QuickBooks Desktop.

After performing these steps, open the W-2 form to check the information. I also suggest contacting the state agency since you’ll be amending the PA UC-2. They’ll guide you on how to handle this type of situation.

Also, the following article outlines the complete instructions on how to create the W-2 forms. Choose QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard to view more information: Print your W-2 forms.

Reach out to me again if you have any clarifications or questions. I’ll be right here to answer them for you. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here