Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, JenWI.

Paying and filing of Wisconsin tax returns are currently unavailable in QuickBooks Online Payroll.

The payment and form module is still being validated at the moment and will be available after the preparation is complete. The option to send out your payment and form will be available after the preparation is complete.

Let me share this article with you for additional details: Forms unavailable (blocked) - Federal and State Forms.

I'll be around if you need anything else.

Thank you for the information and the link to the article. I don't think I would have found that on my own because the automatic message is incorrect.

The article says that the message should read "This form will be available soon. Please check back later."

The message I got was quite misleading because it said that the tax period wasn't over. I highly recommend updating the automatic message to match the article language, and perhaps include the article link.

Thank you.

I forgot to mention the outstanding problem which is that I can't record the payment as paid manually (which I've done directly on the WI state site).

I get:

Thank you for getting back to us here on the Community page, @JenWI.

As a workaround, you can record the payment as a check in QuickBooks Online (QBO). This can be done by following these steps:

Leave a comment below if you have any other questions. I'm always here to help however I can. Have a good day!

Yes, I know how to create a check, and I've done so. The issue is that now that the check has cleared, I can't Match it. I had to Add it, and the item is still in my Pay Taxes queue. I can't clear it from there because the only action I can take is to click "Okay" when I get the "too soon to pay" message. Do you know how this will be or can be resolved? Thanks!

Good day, JenWI.

Once you manually create a check, you'll be able to match it to the downloaded payment in QuickBooks Online (QBO). Just click on the Find match radio button and choose the check to match them.

Otherwise, record the check once the option to pay becomes available on the Payroll Tax page.

Let me share this article in case you want to learn how to enter payroll paychecks manually in QBO.

We'd love to hear from you if you have further questions. Have a good day.

If you re-read my previous message, you'll see that I'm reporting that "Find match" did not work. No match was returned, and I had to use Add. I cannot wait until April to record my check once everything is online again or I won't be able to reconcile my account on a monthly basis.

I’d be glad to help you find your way back to finish your reconciliation, JenWI.

It's likely that the status of the check (the one you manually added) is reconciled or cleared. This won't appear in the suggested match list, so we'll want to unmark it to fix this.

Also, looking back at your previous post, it looks like the entries are doubled. The check was created and the bank transaction (the cleared check) was added to your register. We'll fix this by undoing the added bank transaction.

Here are the steps:

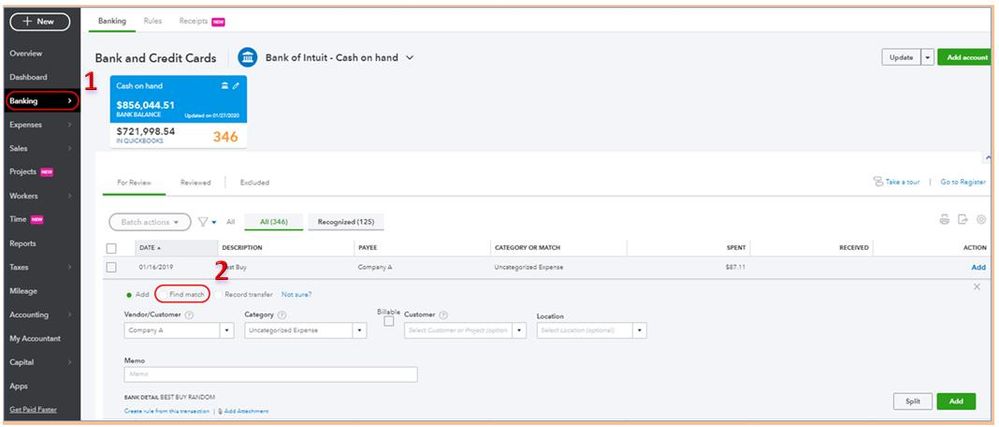

Let’s go back to the Banking tab to check if you can find the check transaction and match. Please be guided by the steps below:

You can now verify that it matched under the Review column. (See screenshot for reference on how it looks)

For future reference, I included this resource that contains multiple articles to troubleshoot reconcile issues that I recommend: Reconcile Hub.

I'm just a post away if you have any other questions about matching your transactions. I'll be happy to help you further. More power to your business!

If you read my post, the problem that I am having is that Find Match returns "no match found" result. I went ahead and followed the steps you suggest to try again, and I still get the same result. I am not able to Match it and can only Add (which is why I did that instead of Match).

Any other ideas? Or updates on when this will be resolved for WI, since Feb payroll is almost here?

Thank you!

I can see that you've been through a lot already in resolving this issue, JenWI.

Let's double-check if we've selected the correct bank account and the date to see if this might have been the reason why we're unable to find a match.

Once verified and still get the same result, I'd suggest contacting our Customer Care Support team so they can do a screen share with you and take a look into your account to investigate this further.

You can check out our support hours and contact them at a time convenient to you.

Please let me know how the call goes. I want to make this is taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.