Hello there, lhodges9350.

When a worksheet shows 0, let's make sure you have the following:

- The date of the tax payment is within Q4 of 2019.

- Transaction type selected is Business.

- Account Category selected is Estimated Taxes.

If the transactions are downloaded from your bank, you can exclude them. Then, add the transactions manually and make sure to have the information above.

To exclude a transaction, here's how:

- Go to the Transactions page.

- Filter the date to show Last year.

- Select the transaction to expand the options.

- Put a check mark on the Exclude this transaction (this is for duplicates, reimbursements, customer refunds, and returned purchases) box.

- Hit Save.

I've got this article that you can use for reference: Exclude or delete transactions.

Once done, follow the steps in this article to manually add transactions in QuickBooks Self-Employed

You can also reach out to our Customer Care Team for further assistance.

Here are the steps:

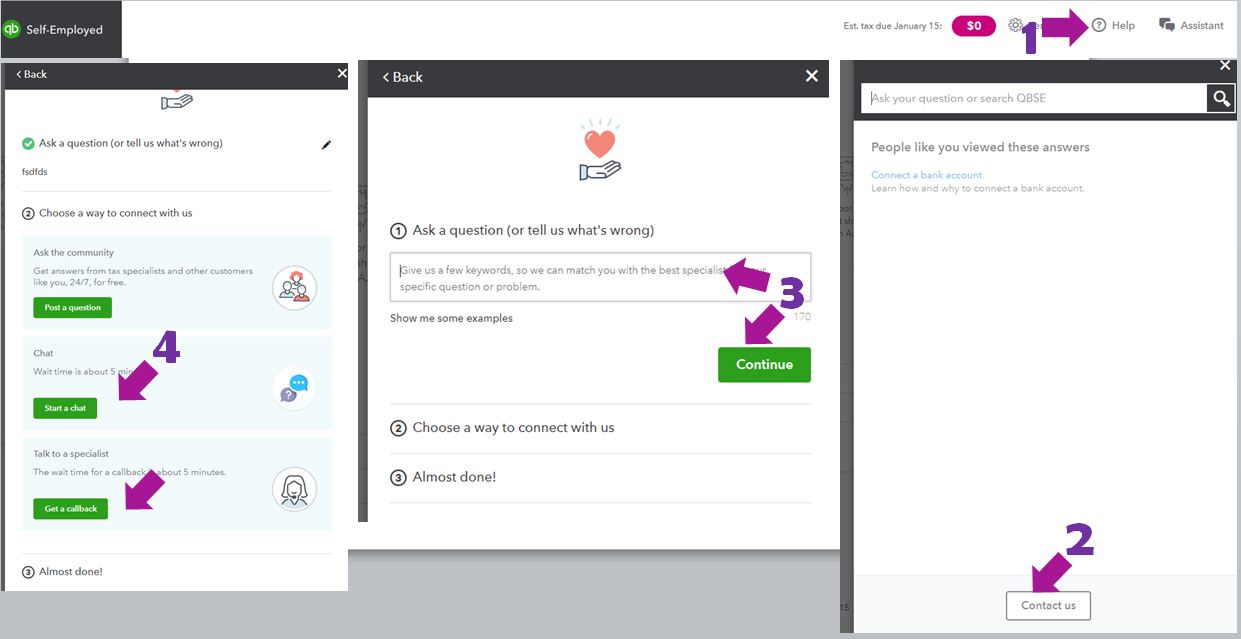

- Log in to your QuickBooks Self-Employed. You can click the Assistant option or click the Help icon located in the upper right-hand corner.

- In the Help window, click the Contact Us button at the bottom.

- Enter your question and click the Continue button.

- Select Start a chat or Get a callback.

Feel free to reach out to us if there's anything else you need. Thanks.