We understand the importance of completing your forms accurately to ensure compliance with tax regulations, Priya.

The DE9 or Quarterly Contribution Return and Report of Wages reconciles the payroll taxes you've paid with what you actually owe. The DE9C or Continuation form reports individual employee wages and withholdings for the same quarter.

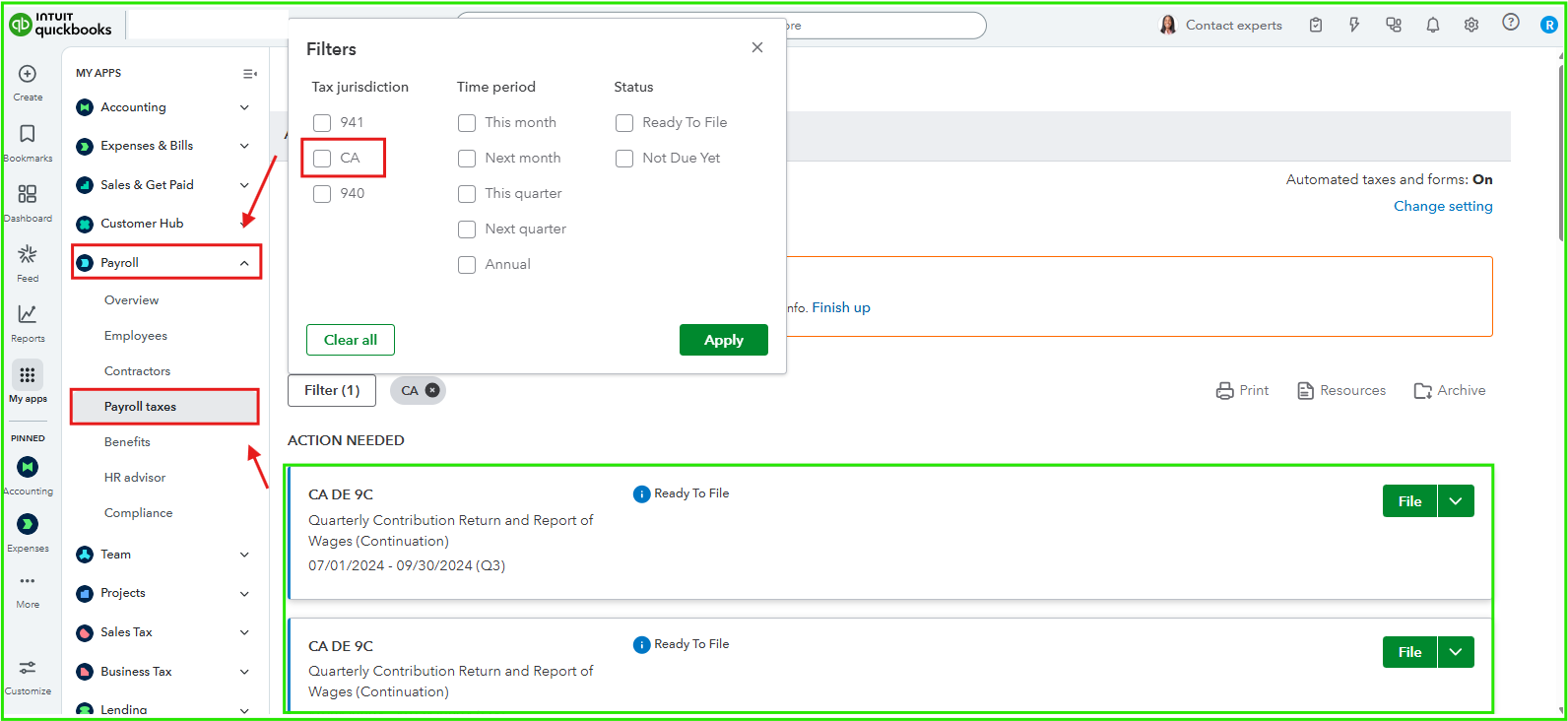

To locate these forms, please head over to the payroll tax section:

- Go to the My Apps section and select Payroll.

- Then go to the Payroll Taxes section in QuickBooks Online.

- Select the Filings tab.

- Look under Action Needed or use the Filter option to find DE9 and DE9C forms.

If you don't see these forms, you may have missed the deadline. You can run Payroll Summary or Payroll Tax and Wage Summary reports to gather payroll details for manual filing.

Once you’ve prepared the forms in QuickBooks Online, you can file them electronically through EDD e-Services for Business. For detailed guidance, I recommend contacting EDD directly for assistance.

If you have additional questions or concerns, please reply to this thread. We'll be around to provide further help.