Hello there, @mjs1.

Thank you for posting here in the Community. I'm here to help record the payroll liability check in QuickBooks Desktop (QBDT).

To record the refund, you can enter the information under the Refund Deposit for Taxes and Liabilities window.

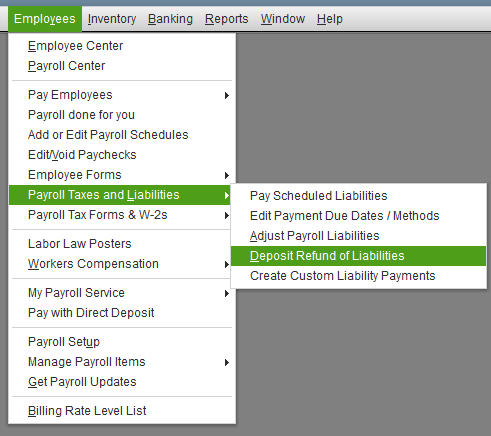

- Go to Employees at the top menu bar.

- Select Payroll Taxes and Liabilities.

- Click on Deposit Refund Liabilities.

- Select the name of the vendor who submitted the refund check.

- In the Refund Date field, enter the deposit date.

- In the For Period Beginning field, enter the first day of the pay period that the refund affects.

- Select how you want QuickBooks to handle the deposit.

- In the Taxes and Liabilities section, select the payroll item/s affected by the refund.

- In the corresponding Amount column, enter the positive amount.

- (Optional) Enter a note in the memo field.

- Select Ok.

To learn more on how to enter a payroll liability refund check, you can check this article: Record a payroll liability refund check.

That should help you record the liability refund. If you need further assistance with the process, you may get in touch with our Payroll Support Team. For the support's contact information:

- Go to: https://payroll.intuit.com/support/contact/?infosrc=qs&service=16&infosrc=qs.

- Click on select the product you are using under Contact US.

- Select your product.

- Select Payroll (if you're using basic, standard, enhanced and assisted payroll).

- Click on View Contact Info.

Let me know if you have any other payroll concerns, I'm always here to help you. Have a great day ahead!