Thanks for checking in with us, usermomof2inhemet.

I can share some information on how taxes work in QuickBooks Self-Employed.

QuickBooks tracks your self-employed income and expenses. As long as you categorize your transactions properly, the system will automatically calculate your taxes that need to pay each quarter.

To categorize your transactions, here's how:

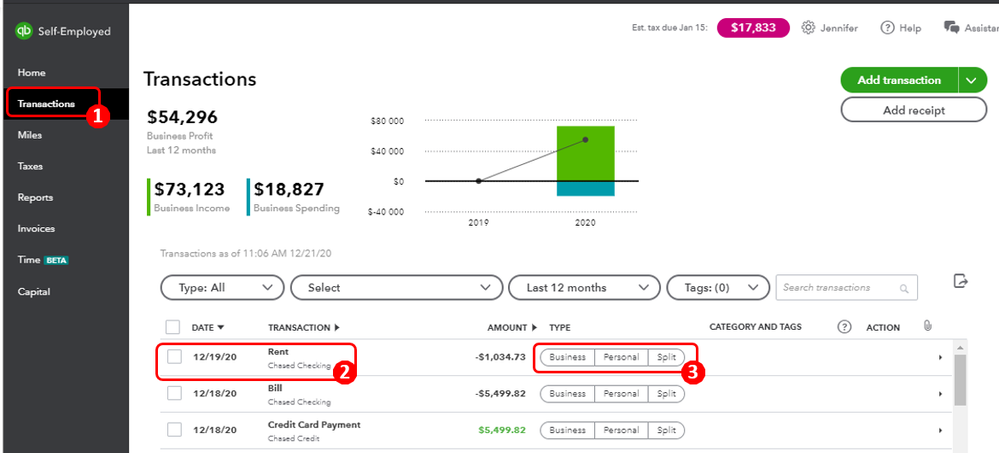

- Click Transactions in the left panel.

- Find a transaction on the list.

- Choose Business if the transaction was for business, or select Personal for personal. If the transaction was both, select Split.

- Review the transaction in the Category column. QuickBooks tries to categorize transactions for you.

- If you need to modify the category, click the category link. Select a general type, and choose a more detailed category.

-

Hit Save if you're done.

You can read through this article: Complete guide to filing self-employment taxes. It provides more details regarding quarterly due dates as well as on what form you need to file.

Let me know if you have any other concerns or questions by leaving a comment in this thread. I'm always here to answer them for you. Have a great week ahead!