Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHas anyone in Arizona processed their A1-R form yet? Mine has the correct numbers for 2024, but generates a 2023 form. Unfortunately I didn't notice it until after I had submitted it for e-file. Anyone else have this issue?

Thanks!

Thank you for the input, @JustMe22. I have updates regarding the Arizona A1-R generating an incorrect year in QuickBooks Desktop (QBDT).

We've received similar cases where the user's Arizona tax form A1-R shows the previous year. I encourage you to contact our Live Support so they can gather more details about your experience and receive further instructions on how to rectify the issue. These are the steps:

For more details, refer to this article: Get help with QuickBooks products and services.

In addition, you can check out this reference to guide you in preparing your tax forms in QBDT: Year-end checklist for QuickBooks Desktop Payroll.

I want you to know that I'm here to assist you with any questions you have about your state tax forms in QuickBooks. Please don't hesitate to utilize the comment section for a quick reply. Take care!

If you've had others report the same issue, will Intuit be correcting the problem and sending out an update? I'm not sure why you're telling me to call your support department when this seems to be an Intuit issue, not a user issue. I don't need help to generate my forms, I need Intuit's software to generate the correct form. I have been using QB Desktop for 20 years and I'm pretty sure I'm not doing anything to cause this.

2024 and this is happening to me. When I open the form to file 2024 the whole form is for 2023 but I already filed that year.

I don't think Intuit is going to fix this. I just generated the form and printed it for my information only. Then I went to the state's website and filed my A1-R there. I didn't upload or file electronically through QB. I did it manually on the state's website and also did the web upload for my W-2s. Hope this helps!

This is terrible. We are pretty much paying for a steak and getting a hot dog.

Hello Intuit -

Now that you know it is a problem, will the incorrect A1-R form be replaced with the 2024 A1-R form? These forms are Due by Jan 31st!

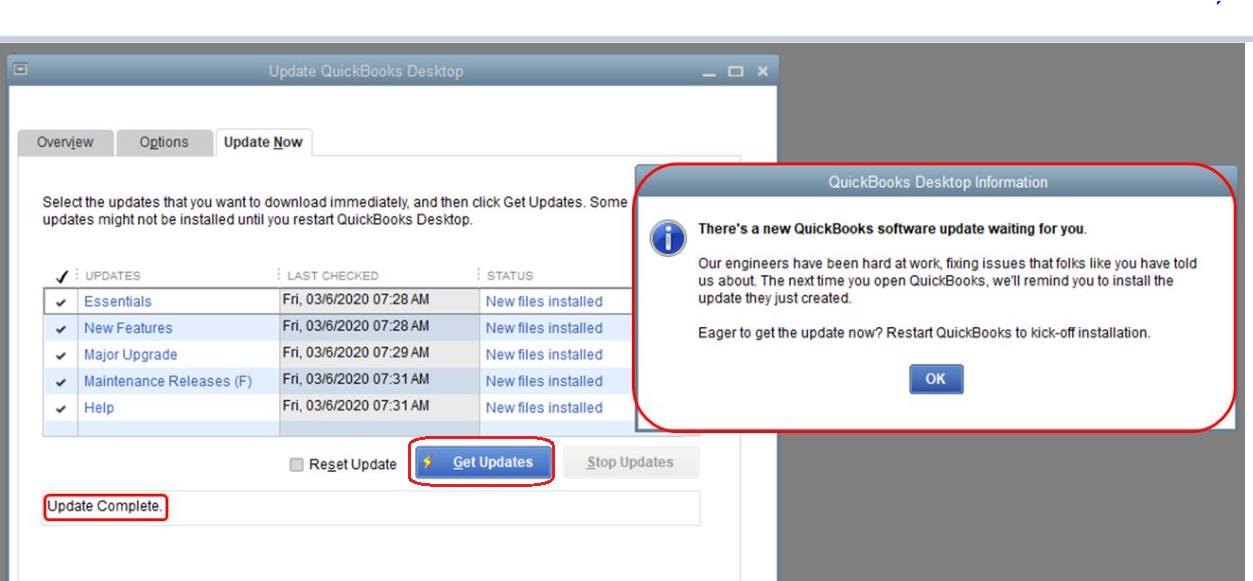

You'll want to ensure the QBDT version runs the latest release and has the updated tax table, Arizona123. This way, changes will flow into your system and help modify your current setup with the A1-R form. Let me walk you through the steps to achieve this.

QuickBooks will automatically download updates when they're available. When the update is downloaded, you'll see Update available on the status bar in the top right corner. To do so, follow the steps below:

For more information, please refer to this article: Update QuickBooks Desktop to the latest release. To get the newest payroll tax table and how you can download them, click this article: Get the latest tax table update in QuickBooks Desktop Payroll.

However, if the A1-R form is incorrect after performing the update, I suggest contacting our Customer Support Team. They can further investigate to ensure you have the correct forms and file them on time. To get in touch, click this link: Get help with QuickBooks products and services. Then, choose QuickBooks Desktop.

I’ll provide you with these links which will assist you in preparing and filing your tax forms in QuickBooks. These resources will guide you step-by-step, ensuring a smooth and efficient process.

Please let me know if you have any other payroll questions or need assistance regarding Arizona Form A1-R in QuickBooks. I’m here to help you. Take care always.

Arizona123. I just checked, and as of this morning, the form has now been updated. I had been updating my QB and checking the form daily and it wasn't updated until today. After you update, go into create payroll forms. Be sure to start a new form and not open a previous draft if you have one. Hope this helps!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here