Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHello, MgtConsultant.

Let's work together and ensure your W-2 forms are correct before the year ends.

We can use the Payroll Summary report to determine the current data of the W-2 amounts. This also works if you haven't run any payroll yet after converting. Here's how to pull it up:

Alternatively, we can also pull up a preview of the W-2 forms. This can work if you've already used QuickBooks Online Payroll after migrating.

Normally, official copies are available on January 13 but you'll be given a period to review it before this date.

Here's how to review the W-2 form:

I should also mention that in order to do this, we'll want to turn off the payroll and tax form automation.

Now, we have a couple of scenarios to begin the W-2 amount correction.

If you have already run payroll before within QuickBooks Online, we can delete and recreate the paychecks with the correct amounts. Although, I'd recommend checking this article first to know more about the deletion process: Delete or void employee paychecks.

Normally, paychecks would be converted to regular checks after migrating to Online. There may be some issues if you delete these.

So, if you're unable to delete or correct the amounts for the W-2 form, we can contact one of the payroll agents so they can adjust the numbers for you.

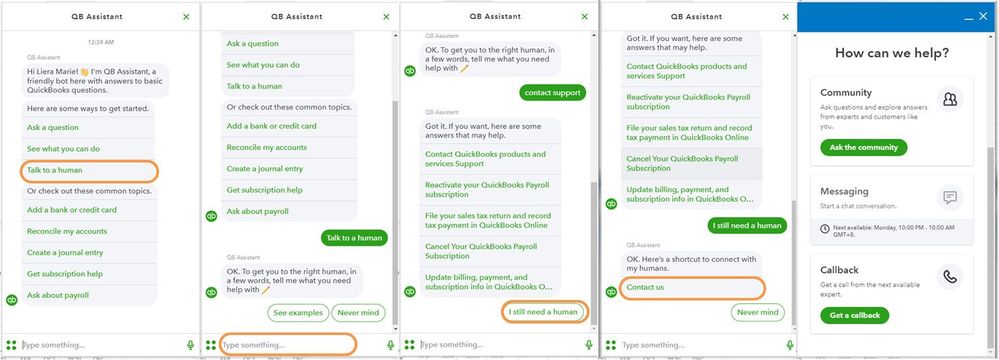

Here's how to reach them:

I'm sure you'll have other payroll-related tasks in the future. So if you need a guide for the year-end or simply want to file your taxes, check out these articles:

Let me know if you have more questions about the tax forms in QuickBooks Online. If you happen to have any difficulties with your entries or reports, feel free to include your concerns. Always here to help.

I have already run payroll. Your solution sounds really complicated. Is there any other way to get a glimpse of my 2022?

Hi there, MgtConsultant.

I'd be happy to share with you how to see YTD W2 in QuickBooks Online.

As mentioned by my colleague above, you can find the YTD information by pulling up a report in QuickBooks Online (QBO). Running the Payroll Summary report shows you your employee's total wages, deductions, contributions, and taxes as well.

This will give you a view of the information that will be included on the W-2 at the end of the year. Ensure that you set a date range for this year to see the correct information.

You can follow the steps shared by @jamespaul on how to pull up these reports in QuickBooks Online.

On the other hand, you can contact our Customer Care Team. They can take a look at your account and review the W-2 forms for corrections.

Here's how:

For more details about our support availability, refer to this article: Contact Support.

If you have further questions about W-2, please check out this link: Form W-2 FAQs.

For more reference bout running payroll reports in QBO, you can open this article: Run payroll reports.

Aside from your payroll reports, you can also learn more about handling your other financial reports through this link: Create and manage reports.

If you have any other questions about getting the YTD payroll report, let me know by adding a comment below. I'm always here to help. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here