Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've got the details you need about tracking vacation pay in QuickBooks Online Payroll (QBOP), @suesailor.

Yes, the vacation pay will accrue on overtime and double overtime hours. However, we use the regular rate to calculate it. Just make sure to choose per hour worked as the Accrual Frequency for this policy. See the screenshot below for your visual reference. For more details, check out this article: Set Up And Track Time Off In Payroll. This link contains steps on how to set up time off, update your existing policy, and add paid or unpaid time off.

Moreover, I'd suggest running the Vacation and Sick Leave report from the Reports menu. It provides you a summary of your employees' time off accrual and usage info, such as vacation pay. Just click the amount in the Current Vacation Available column to view the details. I've attached a screenshot below on how the report looks like in QBOP.

I'll be right here to help if you need further assistance. Have a great rest of your weekend, @suesailor.

Is there a way to not accrue PTO hours when an employee works overtime?

Hello there, MBXcel.

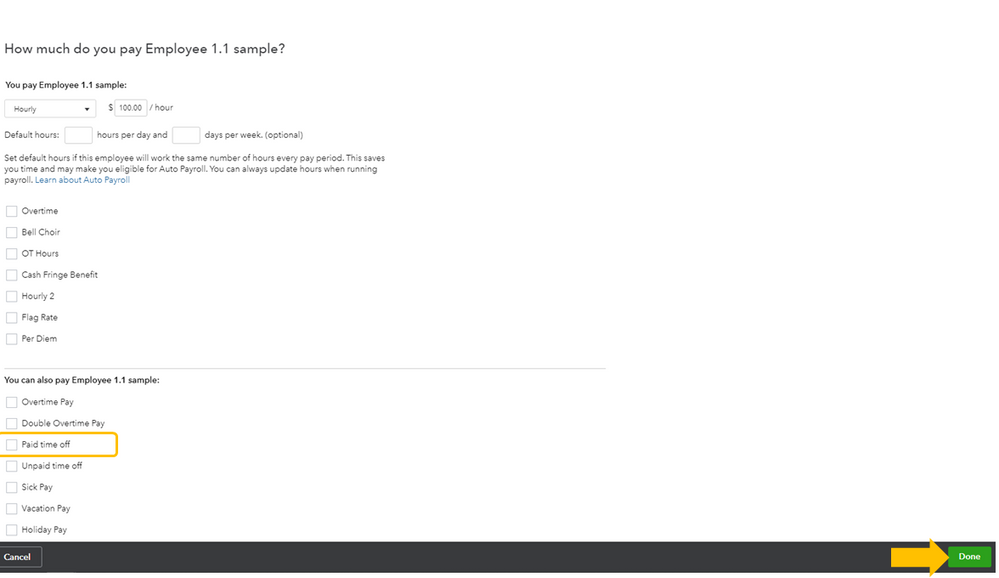

Yes, there is. QuickBooks allows you to not accrue PTO hours when your employee works overtime. We'll only have to uncheck the Paid Time Off option in our employee setup. Let me guide you further. Here's how:

If you use the default hours, the system will use the default hours when running payroll. If you want to pay your employees different hourly rates, you can utilize the Add additional pay types option to add another hourly rate. You can check this for additional reference: Pay an employee different hourly rates.

I'd always want to help. If you have more questions about payroll or anything related to QuickBooks, don't hesitate to post them. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here