I'm here to ensure you can correct your accrual balances, LP.

QuickBooks is dependent on the information entered within your employee's profile. In this case, I recommend updating your time off policy or the current balance based on the information you want to reflect on the system.

Here's how:

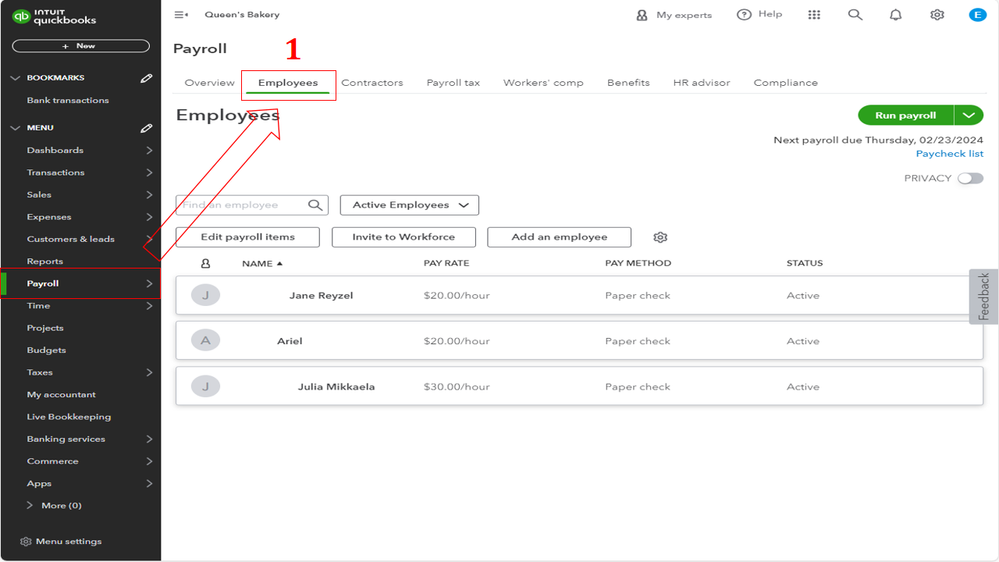

- Go to the Employees page.

- Choose a specific employee.

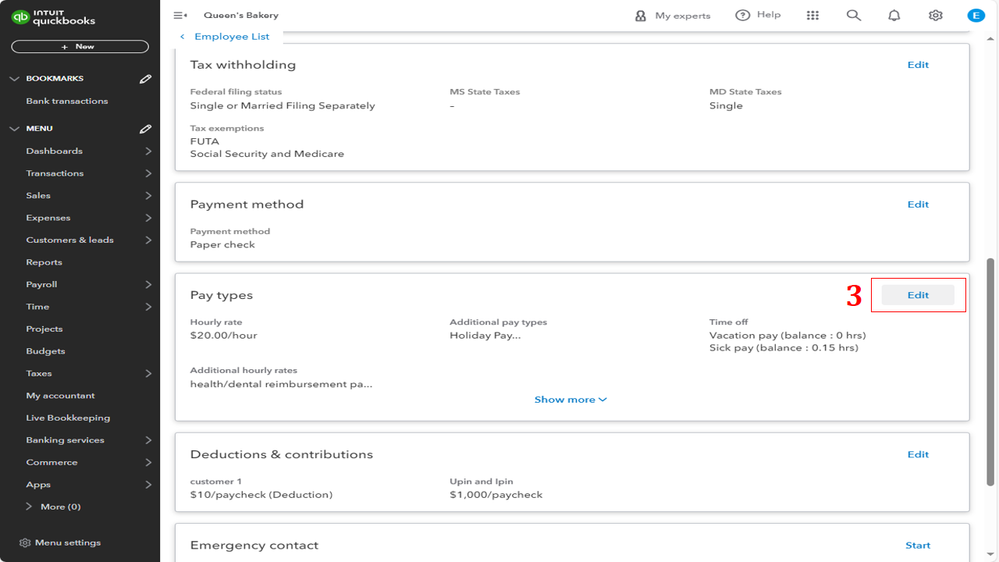

- From the Pay types tab, hit Edit. |

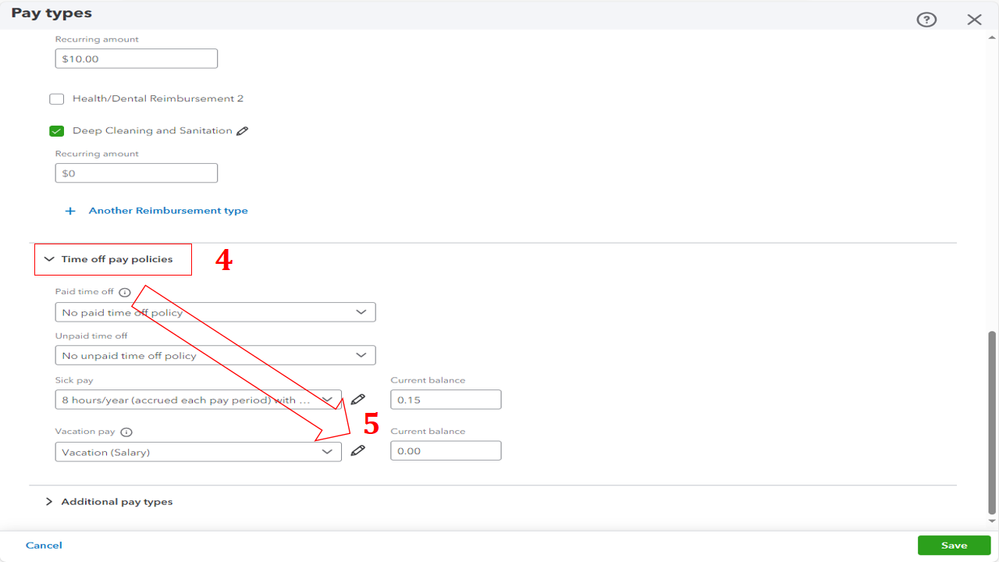

- Scroll down to the Time off pay policies.

- Select the pay policy and click the Pencil icon.

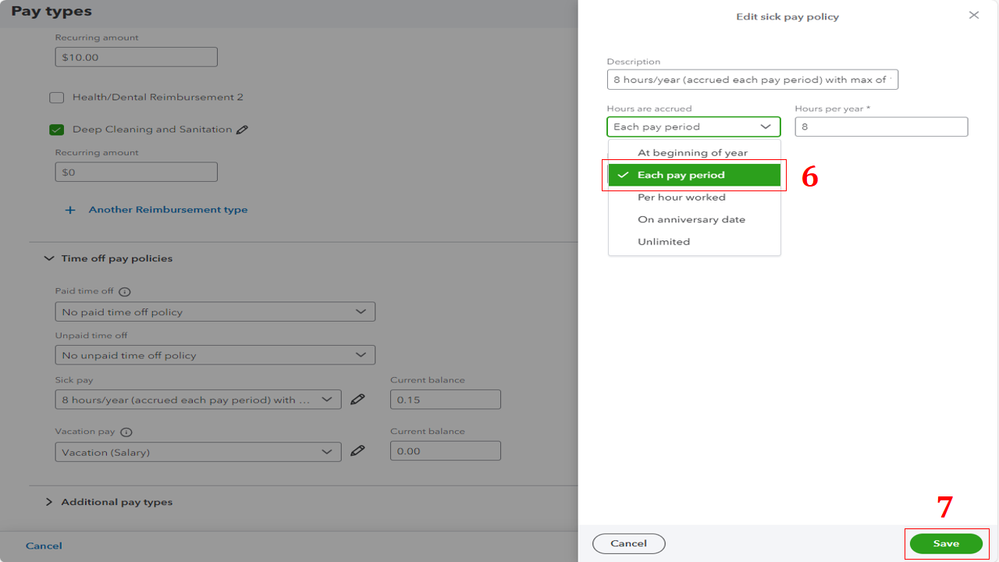

- On the Hours are accrued dropdown menu, choose Each pay period.

- Click Save.

You can refer to this article for more info: Set up and track time off in payroll.

Moreover, you can visit this article to learn how to create a separate check for sick pay: Enter sick pay or vacation pay hours for salaried employees.

You can comment on this post if you have more queries about managing your employees. We're always here to assist. Keep safe!