Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join now2021 was my first full year of using QB Desktop. I have 85 employees. When the new year started, several employees were missing multiple deductions even though they were set up in their payroll file. Apprenticeship Schooling we deduct $25/wk out of their check with a limit. 6 out of 15 employees deducted correctly. I have 401k loans. 10 employees out 12 deducted for 401k loans. My biggest problem is "tool" purchases made by employees. We let them charge and payroll deduct. 34 employees are showing no deductions even though they are set up in the payroll set up file with the $25 along with their limit. This is happening every week since the new year. We pay weekly and I have been making these deductions manually. Why would it be hit or miss and why can't I get it corrected so it will work? This is causing my payroll to take 2x longer. I can't revert because it happens every week. Looking for suggestions to try to correct this.

Hi there, @06230368V. It's our priority to ensure employee deductions are included when running payroll.

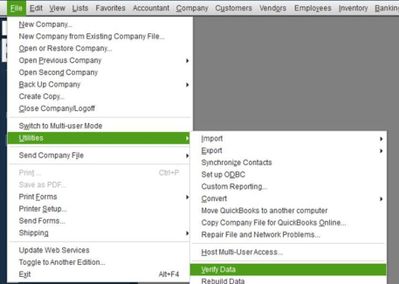

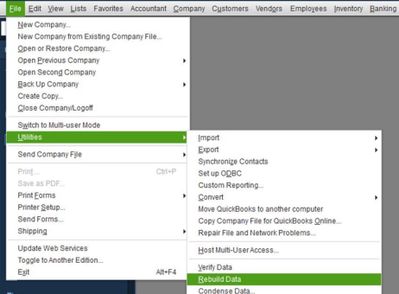

We can perform basic troubleshooting to identify what's causing the issue. You can run the Verify/Rebuild tool. Verify will detect any damaged data. Rebuild will attempt to fix the damaged data detected. It also allows your QuickBooks software to refresh the data inside the company file. Make sure to create a backup copy of your company file before doing the Verify and Rebuild process. If there are changes that occur, having a backup copy allows you to restore it to undo the changes.

Follow the steps below on how to verify data:

Next, here's how to rebuild data:

Then, follow these steps to get the latest payroll tax table update.

After that, update your QuickBooks Desktop to the latest release from our official website.

Lastly, you can create a test paycheck to check if deductions are calculated. If the same thing happens, you can follow the steps in this article to further isolate the issue: Payroll items on paycheck are not calculating or are calculating incorrectly.

Drop me a comment below if you have other concerns or follow-up questions. I'd be more than happy to assist you again.

It sounds like, perhaps, some of the deduction payroll items have limits entered on them. As explained when adding or editing a deduction, if there is a limit on the item, that limit is used, even if the limit in the employee is larger. Could that be the case here?

I tried what you suggested by troubleshooting and there doesn't seem to be an issue and it still doesn't work. When I initially set up the payroll items, I set them up to "Annual restart each year" - that is how I did it in my old payroll system. I was recently told that I was supposed to set them up as a "one time limit" - honestly I'm not sure how they should be set up. I thought annual restart meant that at the end of year, whatever was due from the limit in the employee setup file would adjust the new limit total. With that said, I still cannot get the deductions to take. It's the same employees every week with the same problem. I'm not sure why it worked for some employees and not others. Any suggestions where I go from here? Also I changed the Annual Restart each year to one time limit in the payroll item. Will that cause issue? Also, I did not add a limit amount in the Default rate and limit section. I left that blank. Any help would be great.

The Annual Restart limit will reset every new calendar year, 06230368V.

Changing the type of limit will only affect how QuickBooks determines when to stop deducting the item in the employee's paycheck.

Once you set it to One-time limit, QuickBooks will no longer calculate the deduction once the amount is reached, regardless if a new calendar has started.

I've also read the responses in this thread and it looks like all possible troubleshooting steps have already been shared. In this case, I would recommend reaching out to our Payroll Support Team. They can take a closer look at this deduction and help you determine why it's no longer working.

Here's how to reach out to them:

Additional contact information and business hours can also be found here: Contact Payroll Support.

Post more questions or add another reply to this thread if you need anything else. The Community is always willing to jump right back and help you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here