Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOnce you run a payroll for an employee, their data will reflect on your 941 form in QuickBooks, ajteslicko.

Aside from that, the employee's information should be entered accurately, and the processed payroll should fall in the correct quarter (the 941 timeframe you're trying to check or file). Your tax setup would also play a significant role in this matter. For these, I recommend double-checking the accuracy of the worker's information and your 941 tax setup.

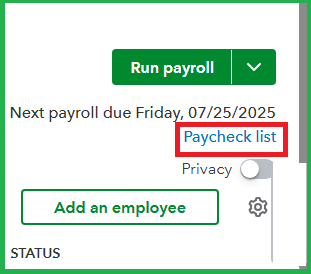

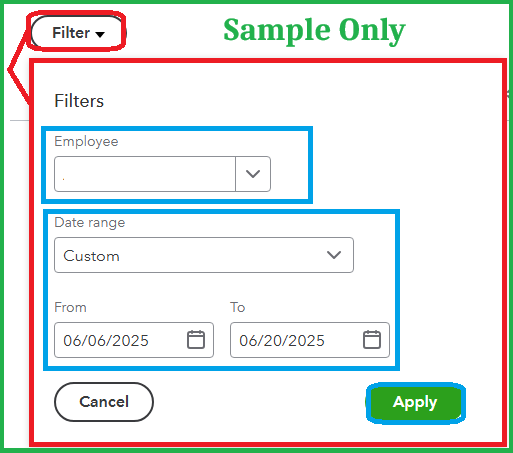

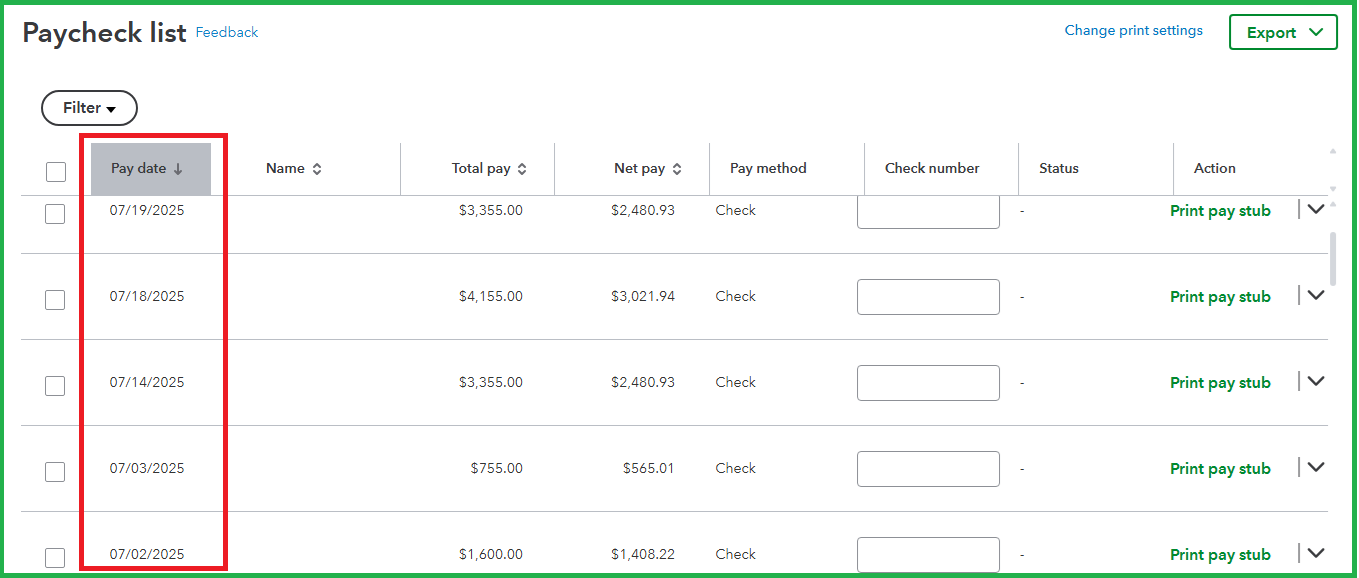

Then, review the Pay date to which the paycheck belongs (the date to which the check was processed):

If the employee has a paycheck under the quarter you've reviewed, submitted, or paid 941 for, but the worker's data does not show any records of their overall wages, taxes, and deductions, I suggest contacting our Live Support Team. They're fully equipped with the needed tools to review your situation accordingly.

It's also important to note that the 941 forms in QuickBooks do not directly display the employee's name. It only shows the overall taxes paid, including Social Security, Medicare, and withheld income taxes. For more information about this topic, access this article: How QuickBooks populates Form 941.

Should you have additional concerns, click the Reply button.

@ajteslicko It's almost certainly because none of your employees' paychecks had a pay period including the 12th of the third month of the relevant Quarter. Per Line 1 of the 941 report, this is the requirement, mostly due to nonsense with the Bureau of Labor Statistics.

If this were Desktop, it'd be as simple to fix as right clicking the field and choosing the Override option, then typing in the new number, but if I'm correct in my first paragraph, you do not actually need to change the employee count.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here