Hello, @raintree2.

You may have paid your 941 taxes already. Also, it's possible that 941 tax payments were already recorded in QuickBooks. That being said, let's first review the tax payments recorded in QuickBooks. This way, we can avoid making duplicate tax payments.

Here's how:

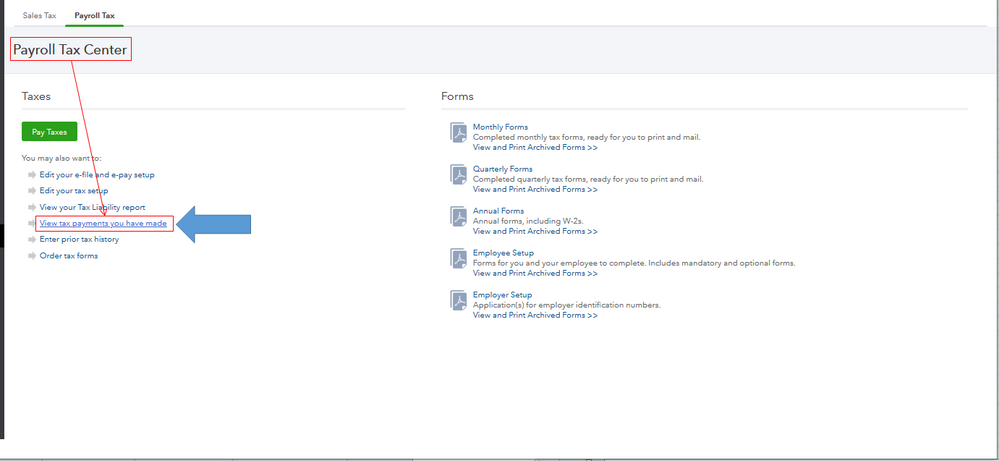

- Go to the Taxes menu.

- Choose the Payroll Tax tab.

- From the Payroll Tax Center, click the View tax payment you have made link.

- Review the Payment Date.

You can refer to this article for more detailed information about viewing the status of your e-payments: Check e-filing or e-payment status.

If you're not seeing the 941 tax liability that you're trying to pay, you can pay it from the Payroll Tax Center or through your Payroll Overview tab.

Pay 941 through Payroll Overview tab

- Go to the Payroll or Workers menu.

- Choose the Overview tab.

- Locate the Pay Overdue taxes prompt.

- Click the Pay link.

Pay Taxes through the Payroll Tax Center

- Go to the Taxes menu.

- Choose the Payroll Taxes tab.

- From the Taxes section, click the Pay Taxes button.

- Select Create payment on the tax you want to pay.

- Pick E-pay.

- Click Approve.

You can browse this article to learn more about the more detailed instructions in making electronic tax payments in QuickBooks: Pay and file payroll taxes online.

Know that you're always welcome to post if you other questions about processing payroll-related transactions. Wishing you and your business continued success. Have a great day!