Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowYou may have accidentally added these transactions from the bank feeds, @hightunlimited.

You can revert them by clicking Undo in the Categorized tab. This way, it removes your payroll from June showing in your register.

Here's how:

Once done, those transactions will go back to the For Review tab. From there, you have the option to remove it. Just select the checkbox and click Exclude.

You may also consider checking these articles if you need more information about managing your bank feeds:

Let me know if you need further assistance. I'm a few clicks away. Have a good day.

I apologize if I am not being clear. My bank accounts are fine and I do not need to transfer funds. The transactions for payroll and taxes are showing up in the register for both accounts, so I will not be able to reconcile. I'm not able to "undo" from categories because these are automatically populated and not items I added to the register.

I’m also unable to delete the transactions, so I’m stuck and needless to say frustrated because I’ve been at this for hours.

Thank you,

Thank you for getting back to us here on the Community page, @kanthony.

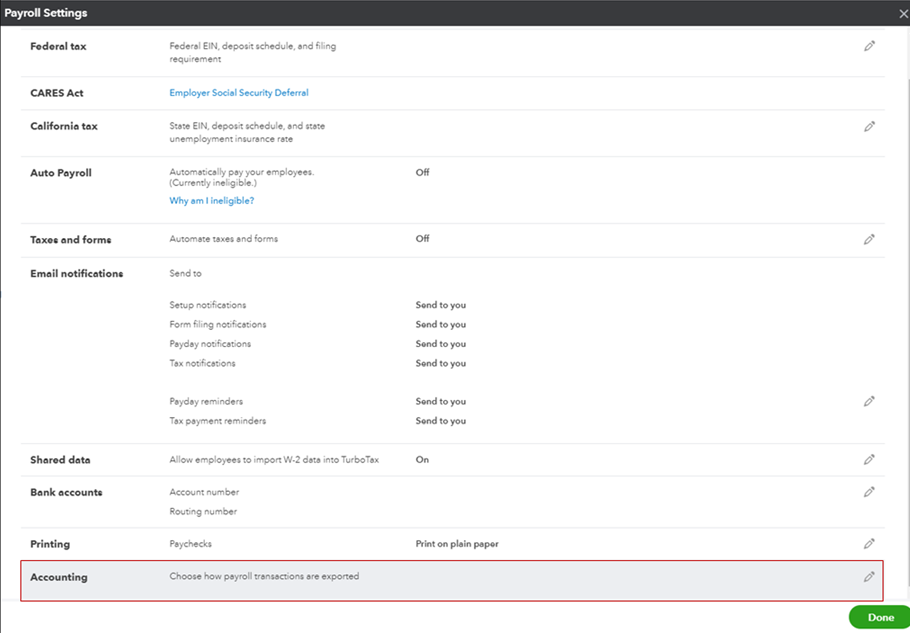

Since you can't delete the transactions, you can create a journal entry transferring the payroll expenses and taxes to post them to the correct account. You may reach out with a professional accountant for the specific accounts to use and help record the entries accordingly. Moving forward, make sure that the correct account is set up for your payroll from the preferences.

Here's how:

Also, ensure that the regular items are used for the wages, not the items used for PPP.

Lastly, feel free to open the topics from this link in case you need additional references while working with QuickBooks or payroll in the future.

Post again if you have any other questions. I'm always here to help. Have a good day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here