Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowYou can create a new catch up deduction item for the Simple IRA, @indyoxifresh.

In QuickBooks Online (QBO), the option to edit the IRA deduction item is unavailable. QBO follows IRS and each item has its maximum amount limit.

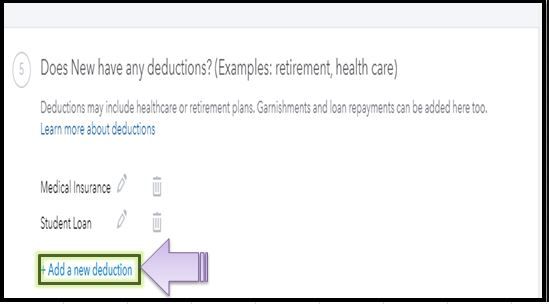

Here's how to add a new deduction item:

To know more info about the retirement plan deductions and contributions in QBO, please head to this retirement plans link.

Also, to have a view of your created company deductions, you may open the Payroll Deductions/Contributions report. Here's how:

Feel free to come back here again if you have other concerns about retirement plans in QBO. I'm here if you need further assistance. Have a good one.

How do I get to step 5? You skipped over step 3 & 4?

I'm here to share the complete steps to add a new deduction item, Elojo.

Here's how:

For more information about the process, I suggest checking this article: Add or Edit a Deduction or Contribution.

Additionally, I encourage you to visit this article to help you track your business finances: Run Payroll Reports.

In case you have follow-up questions about running payroll, I suggest clicking the Reply button. This way, we'll be able to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.