Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am running my payroll in desktop-pro for the first time and that too for the first employee who started on 12/9. However, paycheck for 12/1-12/15 period being generated as if the employee worked full two weeks. I have of course entered the start date in the employee record and the timesheet is there for the week of 12/9 to 12/15 for 40 hours; I also added another timesheet for 0 hours from 12/1 to 12/8. This is a salaried employee.

Please advise how to fix this.

Solved! Go to Solution.

I appreciate you getting back to us and updating the pay period, @newbee2.

Yes, you'll have to manually update the salary amount to get this fixed. As mentioned by my colleague above, QuickBooks will automatically default the pay period depends on the payroll schedule you've created.

Also, when you set up a salaried employee, hours recorded for the week won't matter. Thus, QuickBooks will depend on the salary amount you've set up for that employee.

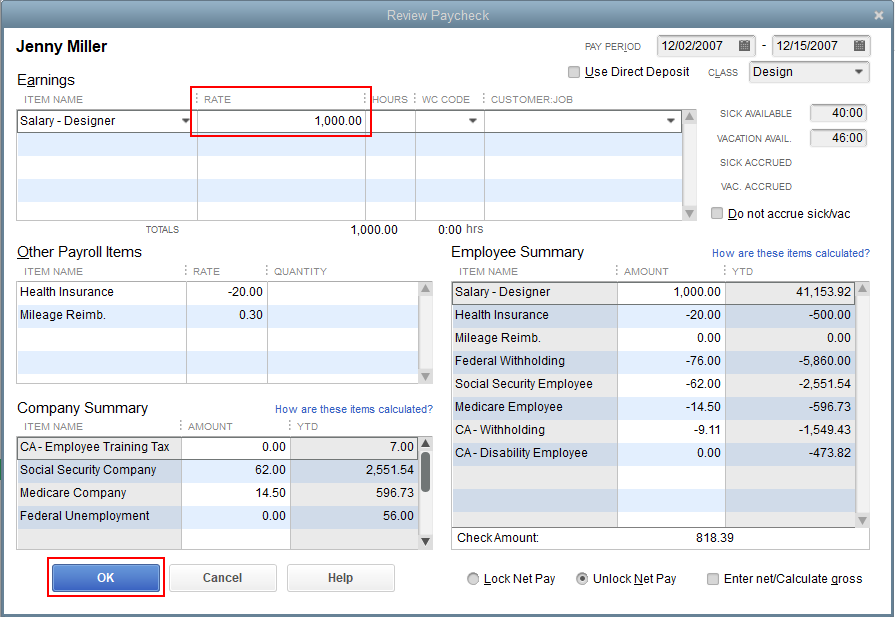

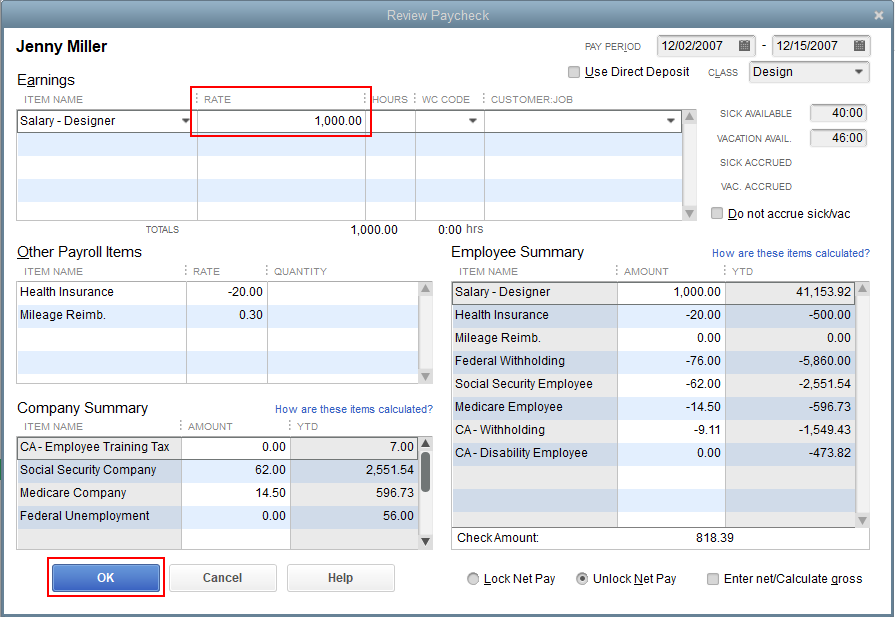

Here's how to update the salary amount:

In case you want to set up a scheduled payment or liability, you can check out this article for your future reference: Set up and Pay Scheduled or Custom (unscheduled) Liabilities.

Fill me in if you have additional questions with QuickBooks Payroll. The Community team and I are always here to help.

I'm glad you came here for support, newbee2.

Looks like you've setup this new employee's Payroll Schedule as Biweekly. QuickBooks automatically sets a default pay period for biweekly schedule.

For this specific paycheck, you can manually edit the pay period dates from the new employees Paycheck Detail.

Here's how:

In the future, if you wish to edit payroll schedules, you can have this article handy: Set up and manage payroll schedules.

If you have any other questions, be sure to let us know. I’m here to help. You have a wonderful day ahead!

Thanks - I did update the pay period and saved it but it didn't fix the amount. Do I need to manually update the salary amount too? I have to be honest - quite disappointed with QuickBooks that it can't do all that automatically given I have entered the hire-date in the employee profile.

I appreciate you getting back to us and updating the pay period, @newbee2.

Yes, you'll have to manually update the salary amount to get this fixed. As mentioned by my colleague above, QuickBooks will automatically default the pay period depends on the payroll schedule you've created.

Also, when you set up a salaried employee, hours recorded for the week won't matter. Thus, QuickBooks will depend on the salary amount you've set up for that employee.

Here's how to update the salary amount:

In case you want to set up a scheduled payment or liability, you can check out this article for your future reference: Set up and Pay Scheduled or Custom (unscheduled) Liabilities.

Fill me in if you have additional questions with QuickBooks Payroll. The Community team and I are always here to help.

RE: Do I need to manually update the salary amount too?

Yes, QB does not pro-rate the salary based on the hire date being mid-pay period.

Similarly, if you give someone a raise mid-period it doesn't automatically adjust.

Thanks everyone - appreciate the help. I am all set on this front.

Hey there, @newbee2. Thanks for updating us in the Community.

I'm glad that you were able to resolve the issue with the paycheck dates.

We're always available and here for you if you have any other QuickBooks questions. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here