Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickBooks Desktop: How do I setup and use a new payroll item for tracking the new Qualified Overtime Compensation for 2026 that came with the Working Families Tax Cut Act?

Hi there, CMeGo.

QuickBooks Desktop can track standard overtime pay, but there’s no official confirmation yet on updates for Qualified Overtime Compensation under the new requirements.

As a workaround, you can manually set up the payroll item, update your program and tax tables, assign the item to employees, and enter qualified overtime amounts.

Here’s how to update QuickBooks Desktop and your Payroll Tax Table:

Then create the “Qualified Overtime Tracking” payroll item. If it isn’t available automatically, set it up manually:

After creating the payroll, assign the payroll item to employees eligible for Qualified Overtime Compensation:

Since Qualified Overtime Compensation for 2026 is pending, manually calculate and enter the qualified overtime amounts:

Use payroll reports like Payroll Summary to track Qualified Overtime payments, and keep your tax tables updated while monitoring QuickBooks for new updates.

Feel free to reply below if you have further questions.

Yes my customer has the same issue. No "other earnings" option. 2023 Enterprise. I checked a 2024 version of Enterprise and it wasn't there either.

Hi, CMeGo and David. Let me clarify and guide you through the correct steps for handling the Qualified Overtime Compensation in QuickBooks Desktop (QBDT).

Qualified Overtime is already built into QBDT as long as you’ve downloaded and installed the latest Payroll Tax Table (PTT), version 22602. You can verify this by navigating to the Employees menu and selecting the Get Payroll Updates option.

You’ve both correctly pointed out that the Payroll Item Type list doesn’t include the Other Earnings option. This is because the program automatically incorporates Qualified OT for standard rates (1.5x or 2x) without needing additional items.

If your company uses an OT rate that’s different than standard rates, you’ll need to manually calculate the Qualified OT portion yourself and create a Company Contribution payroll item to track it.

For a more detailed walkthrough, here's how:

Please feel free to respond with any questions or updates on your progress. We're happy to assist both of you.

I am still having issues after selecting "addition" as the Payroll item type. after naming it and selecting the Expense account you are asked for the "Tax tracking Type" there are several options to choose from. Then a couple screens later it Says "Calsulate based on quantity". The options are quantity, hours or neither. then it asks Gross vs Net. And finally, it asks for default rates.

Please let me know how we should fill in the remaining items.

Thank you.

Thank you for taking the time to follow the steps provided by my colleagues on how to manually add the qualified overtime amounts. Allow me to guide you through setting it up effectively.

Regarding the Tax Tracking Type, since there isn’t a specific type for this item yet, we recommend consulting with an accountant to determine the best tax type based on your business needs. Their advice will help ensure accurate tracking and compliance.

In the Calculate based on quantity section:

When deciding between Gross vs. Net, note the following:

For Default Rates, if you want the rates to be automatically applied to future employees, ensure you set them in advance. If you prefer manual input, leave the field blank and enter rates for each employee as needed.

Additionally, you can also apply this setup to your employee’s wage rate since the new Qualified Overtime Compensation tracking has not received official confirmation yet.

Finally, to ensure the setup is optimized for your business, we recommend consulting an accountant for tailored advice.

If you still need further assistance, please click the Reply button below.

Qualified OT Tracking is set up under Company Contributions per update.

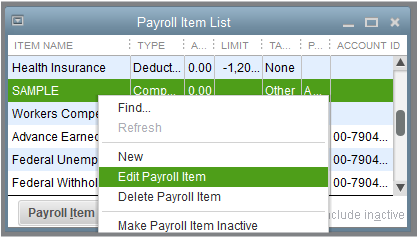

Edit payroll item:

Liabliity Account Payroll Liablities

Expense account: Payroll Expense:wages

Tax Tracking" Qualified overtime tracking

Taxes (select nothing)

Calculate based on hours

Rate is 1.5

No limit

Qualified tracking is a compnay contribuiton

Liablity Payroll liability

Expense: Payroll Expense: Wages

Tax Tracking Qualified Overtime Tracking

Taxes (no selection)

Calculate this item based on hours

Rate: 1.5

Limit empty.

I am using the standard QB payroll item "Qualified OT Tracking"

Why is it set up as a Company Contribution?

I thought the Qualified OT Tracking item was only for tracking the overtime?

Why is it creating a payroll liability? Do I have it set up wrong?

Hi there, @mvollmer.

Although it may seem unusual, this setup is intentional. When this tracking item is added, QuickBooks uses the Company Contribution setup because it serves only as a tracking tool and doesn’t affect pay or taxes.

It's worth noting that this setup creates a payroll liability since the item is mapped to your Liability Account. QuickBooks does this purposefully, especially when set up manually, to ensure balanced tracking in your chart of accounts.

If configured correctly, this shouldn't create extra financial liabilities. QuickBooks recommends linking both the Liability account and Expense account for this item to the same account, such as Payroll Liabilities, so that the tracking doesn’t impact your books.

Regarding your question about whether the item is set up incorrectly, your setup is not wrong. However, if it’s generating liabilities that don't match your expectations, I suggest double-checking the account mappings for the item.

For more information, please refer to this article: Impact of the No Tax on Overtime provision to QuickBooks Payroll.

Don't hesitate to reply if you have further questions. I'll respond to you promptly.

Our question is a little different, it seems. The new OT Qualified Tracking payroll item was entered correctly (by QB Update) with the most recent update. When we ran Payroll on JAN 5th with the new update, the item showed up correctly in Company Contributions and Other Payroll items, both had the new Item added. HOWEVER, NO calculation was made for the Qualified amount, automatically.... even though the employee had weekly OT.

Do QBDT users have to enter this Item, manually, in every Employee's Other Payroll items? We are NOT going to calculate this item manually, every pay period for every employee. We'll switch accounting software before we do that. This should NOT be this difficult a task to implement.

Hi,

You need to Edit the payroll item and add the rate of 1.5, additionally make sure it is calculating it based on hours.

The payroll update added payroll item Qualified OT Tracking as a Company Contribution.

Edit payroll item

Liability account: Payroll Liabilities (should be there)

Expense account: Payroll Expenses: Wages (however you have it set up)

Tax Tracking: Qualified Overtime Tracking (should be there from the update)

Taxes: Leave Blank

Calculate this item based on hours (obviously do not include sick and vacation as those do not create overtime)

Rate is 1.5

Limit (none)

In each employee file under payroll add Qualified OT Tracking to the additions and deductions column.

When you creating checks in that box it will the total hours 48

Below in company contribution is will calculate the amount based 8 hours of OT..If you are biweekly by 80 hours so forth and so on.

Our payroll is not manually calculating the Qualified OT either.

And there is no way to set this payroll item up so that it ONLY calculates on OT hours (not straight time hours).

(HINT HINT QB - allow a calculation option so that it only calculates on specific payroll items - like OT hours only, or straight time hours only, etc)

It appears that every time an employee has OT we'll have to put in the rate and the hours to make it calculate correctly. This is a huge task to do for every employee, every paycheck!

AL OT exemption was able to calculate OT in QBDT - so you'd think the FED OT exemption could calculate it also!

AND, in Payroll Item Setup, under the Box "calculate based on Quantity", the radial box includes BOTH REG and OT hours! So far, we do not see a way to select ONLY on OT hours and apply a calculation to those hours. Either we're REALLY missing something (simple) or this new Field was not well thought out by QB programmers.

On the paycheck detail it will show Qualified OT at 48 hours, (however your scheduled payroll is set up) In the employer contribution section it will show an amount that is only the 8 hours OT and the correct dollar amount. Not the ot $$$ amount.

Make sure it is set up correctly. it calculates on hours (without sick or vaction) don't mark that box . The rate is 1.5 and of course no limit

This is because the calculations are not set up. Only the Payroll item is added. You have to go in and edit the payroll item: Calculate on payroll hours, and the rate 1.5.

The hours (all hours) should post in the additions and deduction box and the amount of the calculated overtime will appear in the company contributions window.

I hope this helps

This APPEARS that this Tax Tracking type WOULD BE simple IFFF the Tax Tracking item could select ONLY on OT hours. The default "out" by QB is: the item will calculate AUTOMATICALLY IFFF the "original" Hourly and OT payroll items in QB are used. THIS QB setup has been in continuous use since.... 2009 AND was NOT setup by the current CFO or CEO. We have no idea what the original payroll items were. And, more to the point, most complex businesses have far more than just two payroll buckets!! ALL OT buckets should be able to be "mapped" to this new Tracking item. Otherwise, a one time calculation at year end may be the only option. Even THAT is an issue because pay rates change during the year, as do OT incentives.

You are an over thinking like I am! It calculates on total hours depending on how your payroll is set up. Weekly, bi-weekly. This is why when calculating by hour you don't the sick and vacation hours as those are not considered hours towards overtime. It will post the total hours,but only calculate on the OT hours. It does work! I was a skeptic as well.

Furthermore, I also have two buckets Labor cost of good sold and overhead, but neither of these matter, remember this is not affecting any payroll number just an amount on the W2 for the employees tax filing. I was ready to add new P&L accounts just for OT...I get it:) I did a couple unscheduled checks to ensure it was going to be right and not affect any of my existing accounts with a $$$ amount.

The "amount" put into the "contributions" field is 1.5 x (the total) Hours... NO hourly "rate" is used. For example. Bi-weekly payroll. Employee at $21.00 per hour for 80 hours. $31.50 for 10 hours of OT. The Contributions box in the payroll summary shows 1.5 x 90 total HOURs of work and enters 135 at the "amount". 135 is 1.5 times the HOURS. It is NOT the amount of the deductible Wages for that period. That number is $11.50 (premium pay) x the 10 hours of actual OT = $115.00

Quickbook recommends that the Liability account and the expense account stay the same. Why did you change it to payroll expense vs leaving it as a payroll liability?

Jill can you advise me if this qualified OT will calculate if the hours are spread out to several jobs. We are a contractor that does job distributions. QB advised it needs to be entered manually because there is not one line item that shows 40 hours of labor. Please advise

How do you change it so it only picks up the OT hours and not the total hours ( Hourly and Overtime)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here