Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe received a partial premium refund from BCBSM due to COVID. We will be passing these savings on to our employees to offset what they have paid/will pay for their monthly premium.

I can reduce their payroll deduction by their refund amount but this doesn't give a good paper trail. I tried adding a new deduction called "BCBSM COVID Refund" which I planned to run as a negative deduction to offset their normal BCBSM deduction but QB Online will not allow me to run it as a negative amount.

Any suggestions on how to best process this premium refund so that we can clearly show employees it was a refund, offset the pretax deduction, and reflect the correct insurance premiums on record?

Hello, @

You can create a non-taxable reimbursement payroll item. Then, you can use this when you create the employees' paycheck.

Here's how:

Once completed, you can Create paychecks using the newly created pay type including the Reimbursement amount. Also, I'd recommend consulting your accountant. This way, you'd be guided in determining the taxability of your payroll items.

Feel me in if you have additional questions about recording a refund in Quickbooks. I'll be around to help. Have a good one.

I have the same issue, however our company only has 5 employees and the employer does not provide insurance to the employees. We pay bi-monthly and the company contributes $125 per pay check towards the cost of the employee premium. When we initially started using QB Online payroll service, we set it up as COMPANY CONTRIBUTIONS - HEALTH INSURANCE. But later found the option for the EMPLOYEE REIMBURSEMENTS. My problem is two of our employees did not have the COMPANY CONTRIBUTIONS removed, so it looks like the two employees are being reimbursed twice the amount per pay period, but the employee is not being paid for twice the amount (I have no idea if this makes any sense!). When running the P&L, Health Insurance has money on it as well as the Reimbursements. Is this going to screw up the Payroll Tax Expense? If so, how do I fix it for this year?

Hello there, @beth0210_bookkeeper.

Since the contributions were already made, you can contact your employee and have an internal agreement about the excess amount. This is to discuss if they want to reimburse the contributions or not.

In case they want a refund for the excess HSA contribution, you can add the reimbursement pay type. Just follow the steps below:

1. Select the Payroll menu.

2. Click Employees.

3. Choose the employee's name.

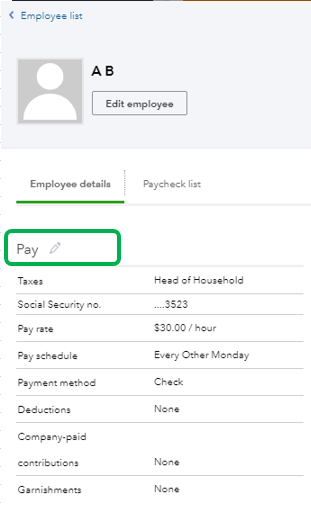

4. Tap the Pencil icon beside Pay.

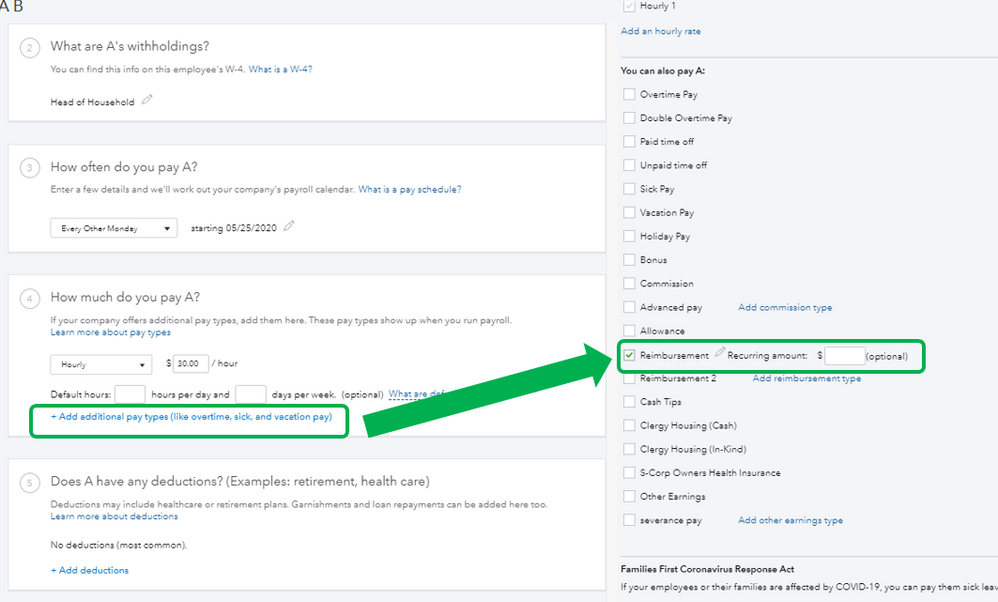

5. Under How much do you pay, select Add additional pay types.

6. Select Even more ways to pay drop-down, then select Reimbursement.

7. Hit Done.

The Reimbursement item appears in the Pay column when you create a paycheck for the employee. The reimbursement won't affect the total insurance amount paid to your employee. And, this payment won't show up on the W-2 form since it's a non-taxable pay type.

I'll be adding these articles that will guide you in managing your employee's contribution in QuickBooks:

• Company contributions to a Health Savings Account (HSA)

• Supported pay types and deductions explained

If you need to check on your employee's year-to-date data, you can run a variety of payroll reports in QuickBooks. This article can provide more details about them: Run payroll reports.

Stay in touch with me here if there’s anything else I can do to help you succeed today. Take care and have a good one•

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here