Glad to see you in the Community, RebChris.

Thanks for being detailed about your concern. This gives me a better picture of what happened to your payroll.

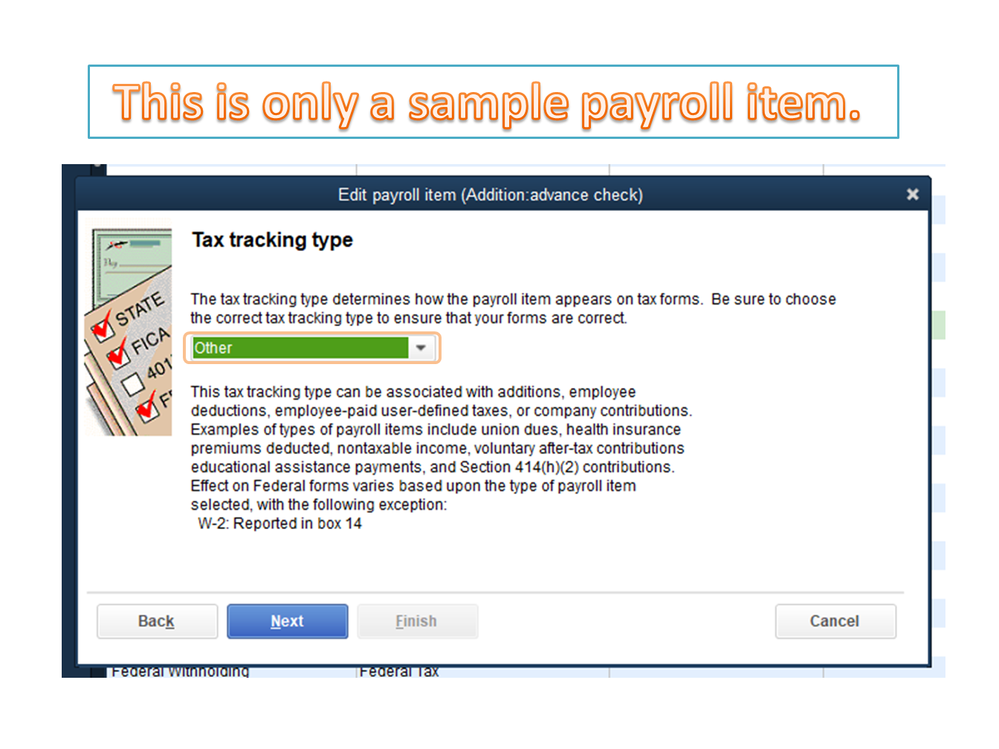

I can provide clarification on why the advance checks were added to the gross wages year to date. This can happen when the tax tracking used for the payroll item is incorrect.

Wages, such as regular pay or salary, are automatically tracked as Compensation, in which the amounts are included in the gross wage. To rectify the issue, allow me to help on how to check the item selected in the Tax Tracking screen.

Here’s how:

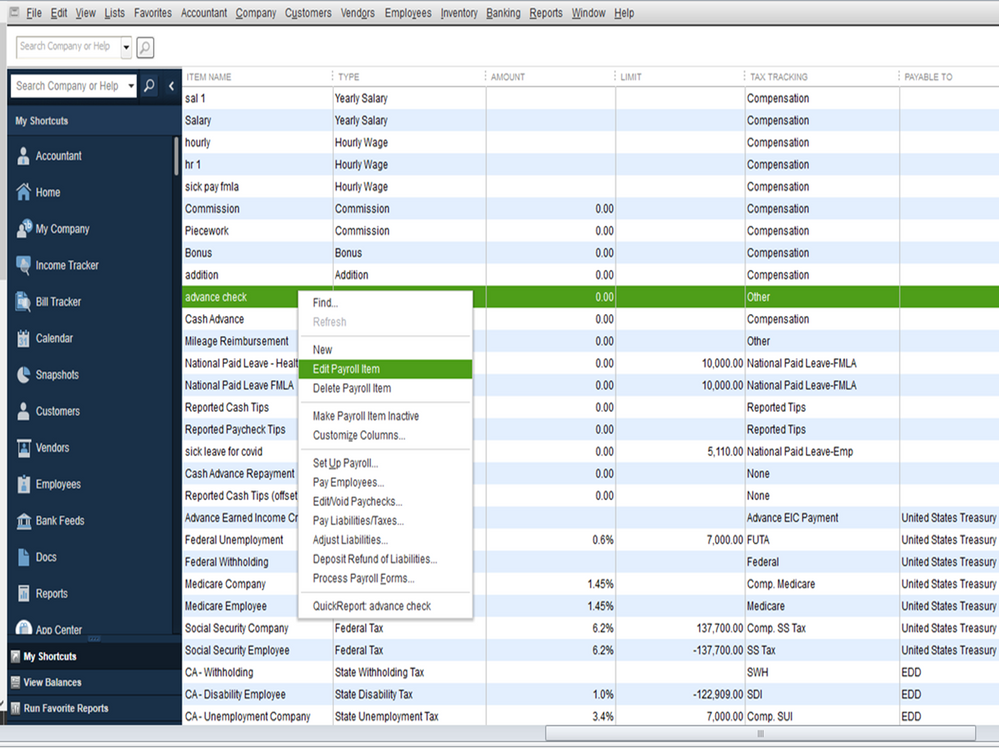

- Go to List at the top menu bar to select the Payroll Item List.

- Right-click your mouse beside the payroll item and choose Edit Payroll.

- Click Next until you reach the Tax Tracking window.

- From there, check the description for the item used selected in the Tax Tracking drop-down.

- The information entered will determine how the payroll item appears on tax forms.

If you’re unsure which one to choose from, I suggest consulting with an accountant or tax adviser. They can provide recommendations on the appropriate pay type and ensures the advance checks are tracked to the net wages. Click on this link to find one of our QuickBooks-certified accountants: ProAdvisor.

This information will get you going in the right direction correcting your payroll information.

For future reference, check out the How to fix common Payroll errors in QuickBooks article. It contains a list of reports that can help resolve tax forms problems.

If you need assistance with any payroll processes, post a comment below. I’ll jump right back in to assist further. Have a great rest of the day.