Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are starting a new company file to streamline activity and get rid of many redundant items in inventory. How do I add the payroll history to the employee's file? Also, The vacation/sick table needs to be changed. It says 2017 and I need to update it to 2023

Solved! Go to Solution.

Good day, @Vivver1. I'd be delighted to guide you through the step-by-step procedures to get rid of redundant inventory items and add payroll history to your employee's file. I'll also clarify things about your want to modify the vacation/sick table.

Let's start by either deleting or merging unnecessary inventory items in QuickBooks Desktop. Before doing so, it's important to review the items and determine which ones you want to keep. Below are the steps to do this:

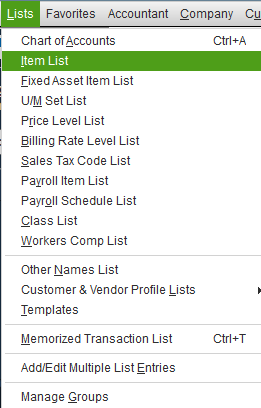

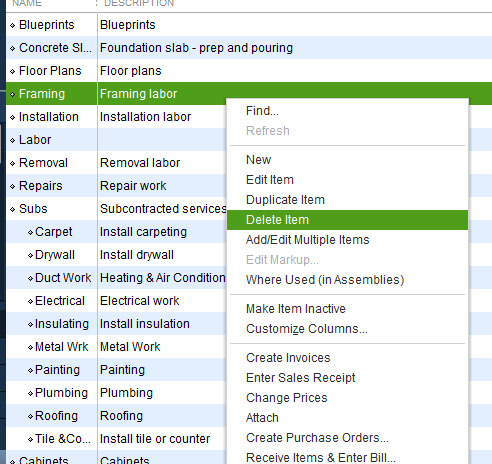

To delete items:

Note that QuickBooks won't let you delete an item if it's ever been used in a transaction. If you don't need it anymore, you can hide it. When you hide an item, it's removed from the list but not from your books. See this for more details: Hide an item in QuickBooks Desktop.

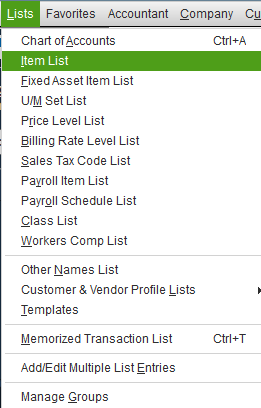

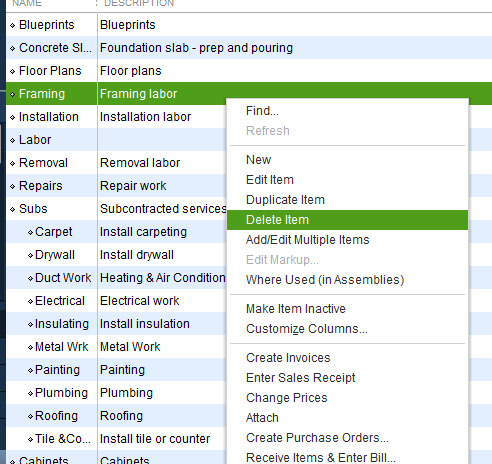

To merge items:

Reminders before you merge:

After that, it’s time to add your employee’s prior paycheck info. You can use their pay stubs or payroll reports from your prior payroll service.

Finally, I'd like to ask for further information on what specific vacation or sick table you're referring to. This enables us to investigate more thoroughly and walk you through the next steps to take.

You'll also want to learn more about how you can file and pay your federal taxes, simply browse this link: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

Please keep in touch so we can assist you further with payroll or QuickBooks. Keep safe!

Good day, @Vivver1. I'd be delighted to guide you through the step-by-step procedures to get rid of redundant inventory items and add payroll history to your employee's file. I'll also clarify things about your want to modify the vacation/sick table.

Let's start by either deleting or merging unnecessary inventory items in QuickBooks Desktop. Before doing so, it's important to review the items and determine which ones you want to keep. Below are the steps to do this:

To delete items:

Note that QuickBooks won't let you delete an item if it's ever been used in a transaction. If you don't need it anymore, you can hide it. When you hide an item, it's removed from the list but not from your books. See this for more details: Hide an item in QuickBooks Desktop.

To merge items:

Reminders before you merge:

After that, it’s time to add your employee’s prior paycheck info. You can use their pay stubs or payroll reports from your prior payroll service.

Finally, I'd like to ask for further information on what specific vacation or sick table you're referring to. This enables us to investigate more thoroughly and walk you through the next steps to take.

You'll also want to learn more about how you can file and pay your federal taxes, simply browse this link: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

Please keep in touch so we can assist you further with payroll or QuickBooks. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here