Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Payroll with Government Pension Instead of SS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll with Government Pension Instead of SS

We are a government entity that has a state pension plan. Our employees do not pay into social security but rather pay into the state plan. I have not been able to make this work except by entering their compensation as an "addition" rather than "compensation". Addition allows me to select what type of taxes the payroll is subject to but compensation does not. Is there another way I should be entering this to make it work properly?

Solved! Go to Solution.

Labels:

Best answer January 02, 2024

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll with Government Pension Instead of SS

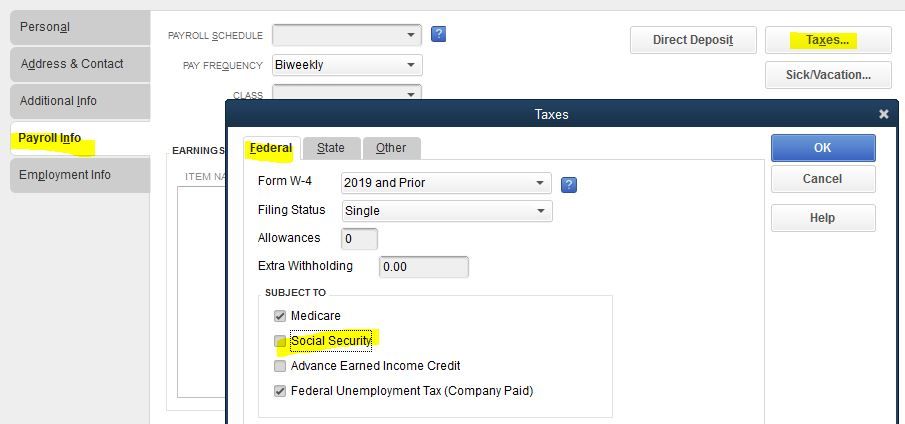

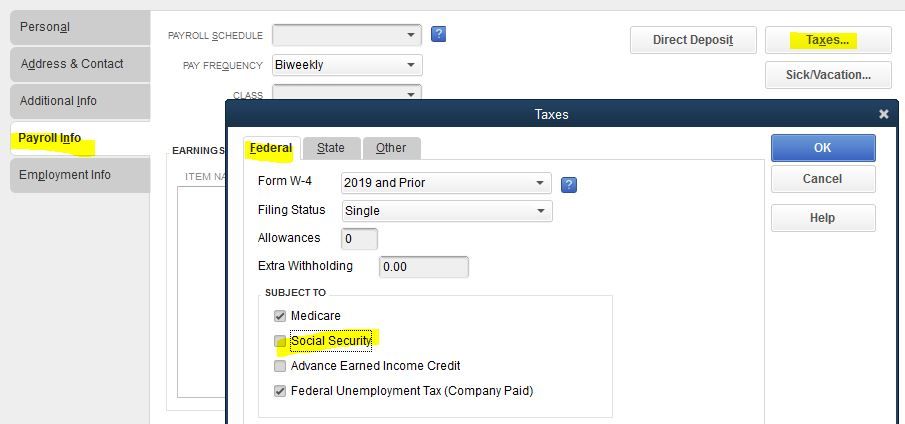

To eliminate Social Security from your paychecks, edit the employees and de-select it in the Federal tax setup:

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll with Government Pension Instead of SS

To eliminate Social Security from your paychecks, edit the employees and de-select it in the Federal tax setup:

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...