Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello! When entering payroll information for the paycheck I put 8 hours as Vacation instead of Sick Pay.

I have already printed the pay stub. Is there a way to change that, after it has been printed? It is the same pay rate. Thank you.

Solved! Go to Solution.

I appreciate you for reaching out to us here in the Community, missmissy. I'm here to help you correct the paystub information in QuickBooks Desktop (QBDT).

If it's a regular paycheck, as long as there are no changes in the amounts, you can edit it by toggling the correct item. However, if it's a direct deposit, you'll want to void the existing paycheck and create a new one.

Before doing so, let's create a backup copy of your company file to ensure you have the original data. You can restore it in case of accidental loss or damage.

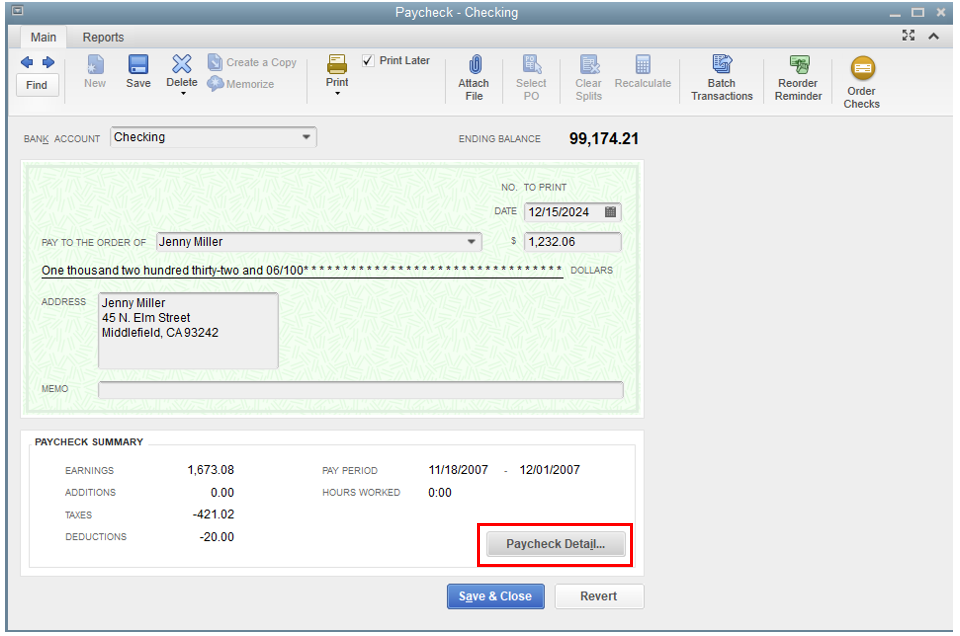

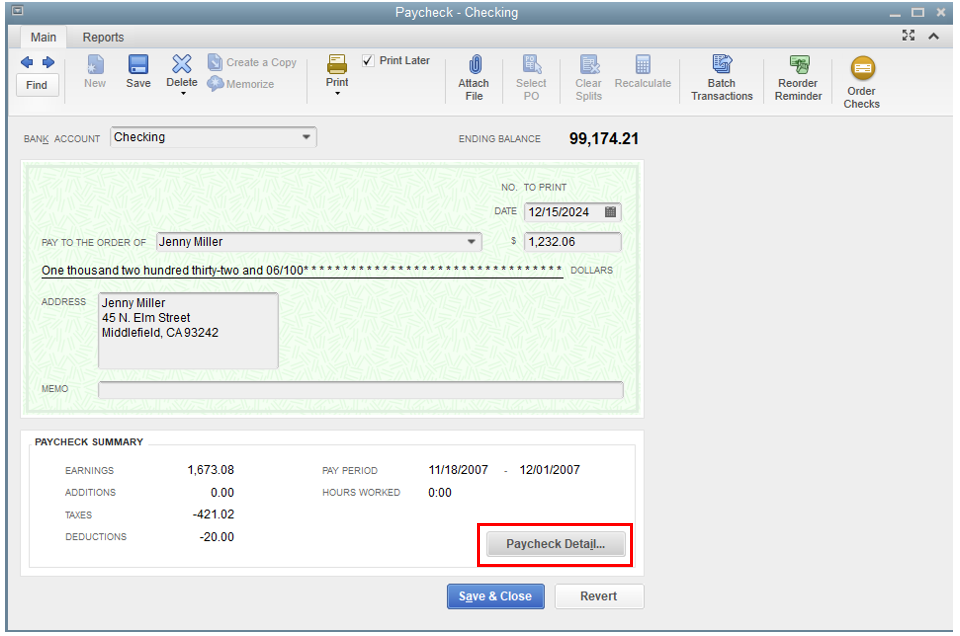

Here's how to edit a paycheck:

Here's how to void a direct deposit paycheck:

You can create a direct deposit offset payroll item when you recreate missing or voided direct deposit paychecks that are sent to employees' accounts. It is to zero out the net pay amount so that your employee doesn’t get paid again.

You might find it helpful to refer to this article to have a quick overview of your payroll totals, including employee taxes and contributions: Create a payroll summary report in QuickBooks.

Keep your post coming if you need more assistance with managing your paychecks in QBDT, missmissy. I'm always here to help. Have a great day.

I appreciate you for reaching out to us here in the Community, missmissy. I'm here to help you correct the paystub information in QuickBooks Desktop (QBDT).

If it's a regular paycheck, as long as there are no changes in the amounts, you can edit it by toggling the correct item. However, if it's a direct deposit, you'll want to void the existing paycheck and create a new one.

Before doing so, let's create a backup copy of your company file to ensure you have the original data. You can restore it in case of accidental loss or damage.

Here's how to edit a paycheck:

Here's how to void a direct deposit paycheck:

You can create a direct deposit offset payroll item when you recreate missing or voided direct deposit paychecks that are sent to employees' accounts. It is to zero out the net pay amount so that your employee doesn’t get paid again.

You might find it helpful to refer to this article to have a quick overview of your payroll totals, including employee taxes and contributions: Create a payroll summary report in QuickBooks.

Keep your post coming if you need more assistance with managing your paychecks in QBDT, missmissy. I'm always here to help. Have a great day.

This worked perfectly! Thank you so much.

You're always welcome, missmissySEI.

I'm glad to know that the steps I shared earlier were effective in resolving the issue of correcting paystub information in QuickBooks Desktop (QBDT).

If you require further assistance or have any other questions, please don't hesitate to reach out to us. We're here to help. Have a fantastic day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.