Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

We use QuickBooks Desktop and use the Payroll module. We submit our 941 reports via mail (print from QuickBooks). I am somewhat familiar with the process and now I am taking over for it full-time.

My question is. We are now completed with our quarter and there is a small balance due ...like $2.76 on line 14 (difference between line 12 and 13a). I do know that over time there are rounding errors etc., but what is the process for paying this amount in QuickBooks?

I don't really want to send a check to the IRS for $2.76 and certainly want it to clear in accounting nicely. We submit payments through ETPS.

I am unable to get in touch with our previous payroll / bookkeeper and do believe this isn't too complicated so I am reaching out to the community for some input.

Overall, otherwise everything is fine and appears ready to file.

Hello there, @wsenti0.

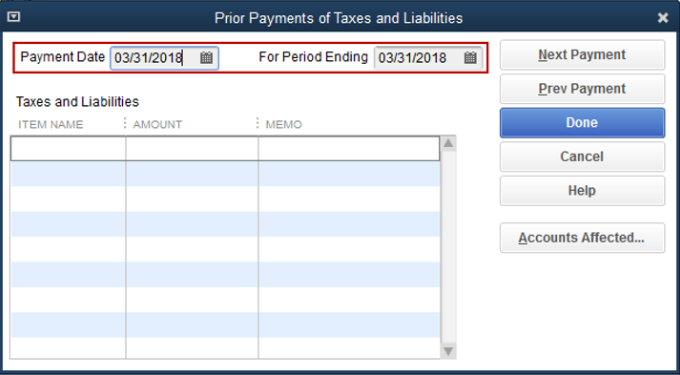

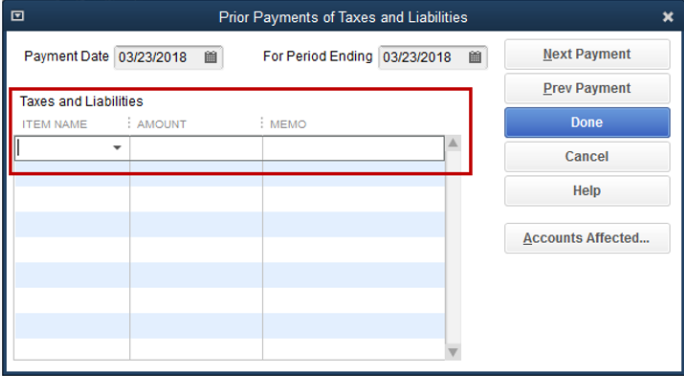

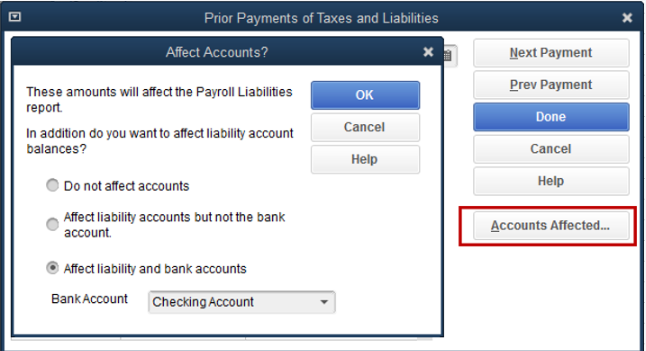

We can make the payment through the EFTPS website and record it as a prior payment in QuickBooks. Then, make sure to affect federal withholding to clear the difference.

Here's how:

I've got a link here that provides you with articles about managing your payroll: Pay employees, enter timesheets, and send payroll forms.

Please drop a comment below if you have other questions. I'll be right here to help you out. Have a great day!

Hi,

Thank you for the reply, but my question was how do I find out where this discrepancy has come from. This $2.76 could be from withholdings, SS, or medicare. This would break down in some format between the 3 categories when remitting payment through EFTPS.

The payroll liabilities shows nothing owed, so this $2.76 clearly has to come from rounding over the course of the quarter.

The only way I can come up with solution is to look at the payroll reports and to the calculation manually to come up a breakdown to reconcile these accounts for then remitting payment.

Thank you for continued help.

I'm glad you've come up with a solution to help fix the $2.76 rounding difference, @wsenti0. This way, you can reconcile your accounts when remitting the payment.

I'd recommend customizing those payroll reports you've pulled up in the software. These will help you focus on the details that matter to you and your business. For more information, check out this article: Customize Payroll And Employee Reports.

Also, I suggest visiting this website: Resource Hub. It provides you related topics about managing your payroll and workers in QuickBooks Desktop (QBDT).

Please know you can always create a new post in the Community if you have other concerns. I'm cheering on your continued prosperity while using QBDT, @wsenti0.

Hi,

My question is still where this difference / variance could be coming from. I see nothing owed under the "Pay Custom Liabilities", but when running the 941 return prep it shows the the underpayment of $2.76. Is this common? And what is the general best path for reconciling and correcting, with this small amount then paid through EFTPS.

Thanks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here