Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello all,

I have a major issue. I have two employees who work in two different areas and I need to keep track of the hours in the different department. I import the time sheets QuickBooks Time and when they come over to QBO they are split into the different departments.

I asked customer service if there was a way to assign two of the employees multiple classes, she said not now but that can change the classes and then I can assign them the correct class. She walked me through the steps and it did not work and now the employees all have the same class and I can't change them to the correct class due to the payroll checks being direct deposit and processed. Is there any way to fix this? My reports are all incorrect when it comes to me seeing how much we spent in each class.

Hey there, raerae6. Let's get your payroll report corrected.

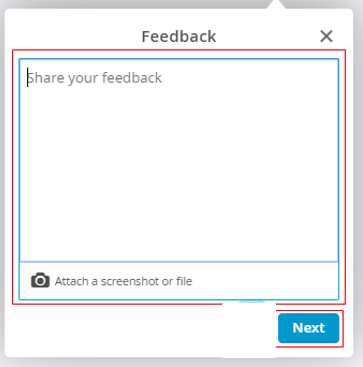

Since the option to assign multiple classes to employees is currently unavailable, I'd suggest submitting feedback within your QuickBooks Online (QBO) account. This way, it goes to our product developers to help improve your experience while using the program. Here's how.

On the other hand, to correct your payroll reports, you'll need to void the direct deposit paychecks and recreate them. Here's how to void the check:

After that, you can now re-create the paycheck:

If you're unable to void the paychecks, you can reach out to our QuickBooks Online Support for further assistance. As always, feel free to visit our Help articles for QuickBooks Online in case you need tips and payroll-related articles in the future.

You can always drop by if there's anything else I can help you with. I'd be more than willing to lend you a hand.

Hi, raerae6.

Hope you're doing great. I wanted to see how everything is going about correcting your payroll reports. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

I was told to change all the employees to Do not use class for payroll and update from the timeframe I need, then do a JE and put the correct entries in the correct class. How would I enter the JE?

The payroll check is currently 10/8/21 Employee Name $573 class 201

would I debt payroll for $573 class 201

credit payroll $573 to the correct class

?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here