Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello! I have field installers that are paid PIECE RATE as opposed to an hourly rate of pay. I also have field and shop employees that are paid hourly. The hourly employees are simple, it's the Piece Rate employees that are a challenge. To make it more challenging, some of our installers are paid both Piece Rate and/or hourly (depending on the work). I have to track hours worked for the Piece Rate paid employees due to wage/hour laws and we offer benefits so we have to track eligibility. I cannot figure out how to use timesheets for Piece Rate collection from field employees - and apply the payroll expense (including ER expenses such as ER taxes & WC) to the applicable Project. I have a T&A application that I use for scheduling and time collection - along with the ability (with use of custom fields) for the installers to add their piece rate pay for the day (it varies depending on the job). What I do not have is a way to account for those labor dollars (and ER expenses) on the Project to track actual costs per job. Any ideas or help is greatly appreciated.

Hello there, @OlympicCabinetry.

Thanks for posting in the Community today. You can use the Project feature in QuickBooks.

It helps you the calculating of costs connected with a project. To get started with job costing in QuickBooks, you'll need to change your settings to monitor spending by a customer.

Then, update your customer list, products, and services settings, and then send estimates and bills to your clients.

See thiese articles for additional details:

Get back to this post if you have other concerns. I'm always around to guide you.

Thank you for your response - but it does not address my question. I need to track PIECE RATE, not hourly and there is no way to do that easily. I am trying to obtain information about T-Sheets (to see if it supports Piece Rate), but I am not getting very far.

The Time Activity tracking in Project only has Cost Rate/Hr and Time worked - there is no way to add Piece Rate - or even a flat dollar amount. I can run reports by Hours or Payroll Expenses, but the only way I have been able to get payroll expense data is with manual JE, which takes a considerable amount of time,

Let me help ensure your payroll concern is properly addressed, OlympicCabinetry.

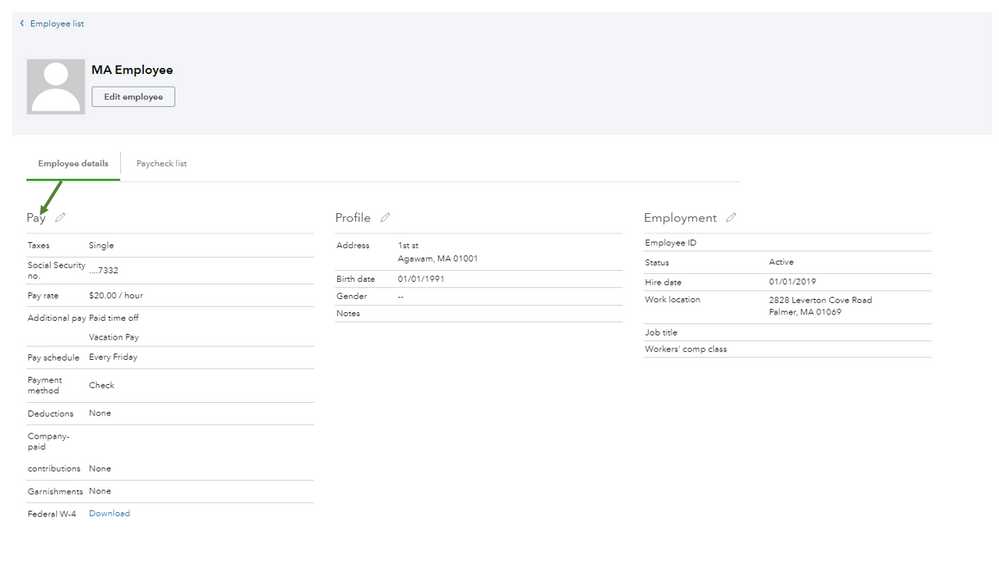

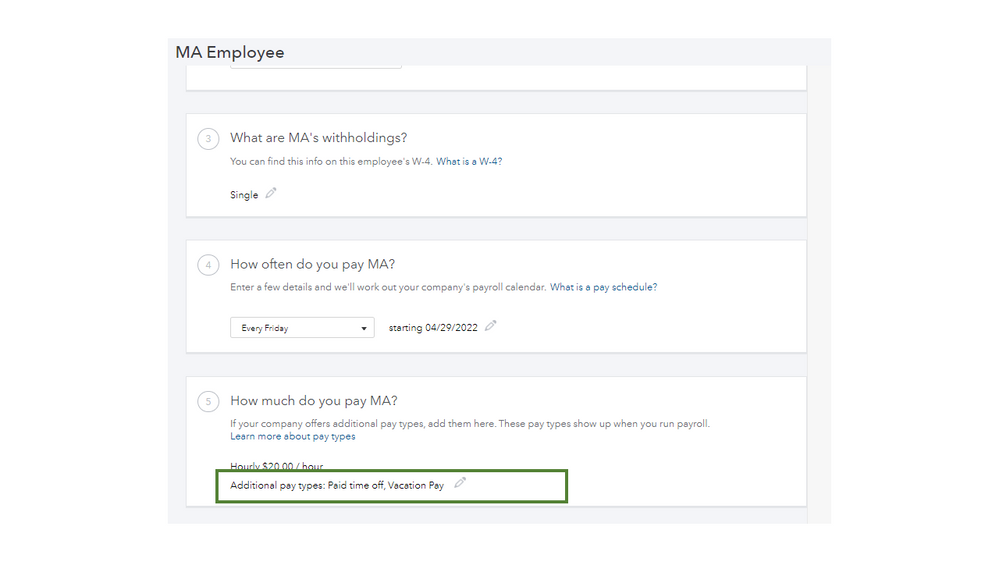

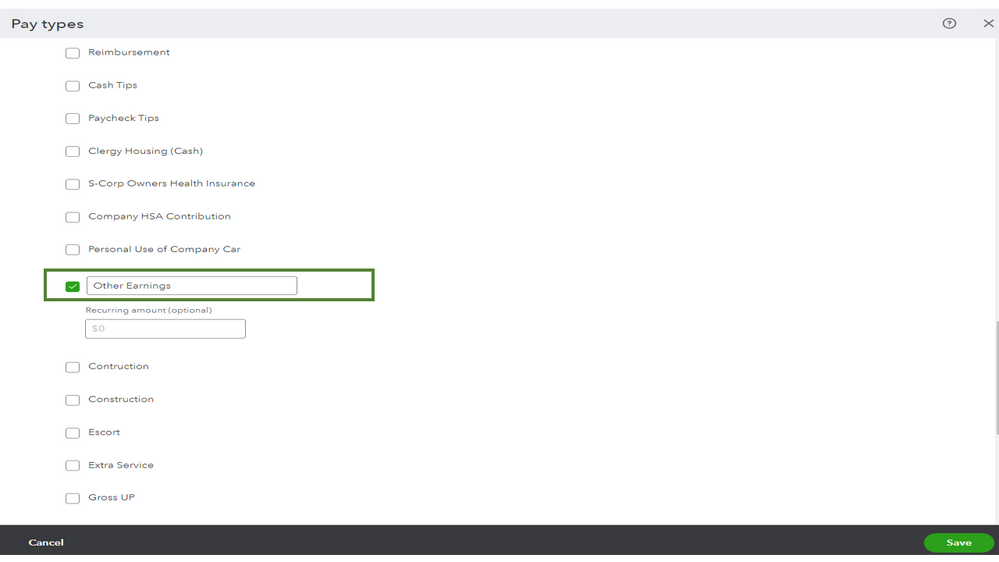

In QuickBooks Online (QBO) Payroll, the piece rate item or field is unavailable at this time. Alternatively, you can utilize the Other Earnings pay type and rename it (piece rate). Then use it when creating paychecks for your employees.

Here’s how:

After adding it, you’ll have to manually multiply the amount by the quantity. Once you have the information handy, enter it into the paycheck.

If the alternate solution doesn’t fit your business need, I suggest you let our product engineers know that adding the piece-rate payroll item in the Payroll and Projects features is a great idea.

We listen to our customers’ voices and suggestions to ensure we're able to cater to your needs while working in QBO. I’m here to show you the steps on how to send feedback.

For additional resources, you can browse this article to learn more about setting up multiple and different hourly rates for employees: Pay an employee different hourly rates. It includes instructions on how to do it in each payroll version.

Drop a comment below if you have any clarifications in setting up a piece-rate item. I’ll jump right back in to help you. Enjoy the rest of the day and stay safe.

Please let me know if you figured out the piece rate portion of payroll. I am trying to figure it out as well. Very frustration!

I hear your sentiments, ID2023. I recognize the convenience of having a way to add a piece rate pay item for your employees in QuickBooks Online (QBO).

At this time, the option to utilize a piece rate for employees in QBO is unavailable. You can add employees' regular salary or hourly rate, and you can also add multiple hourly rates/wages, bonuses, commissions, overtime, and fringe benefits items to pay them.

While this feature is unavailable, sending a feature request to our Product Development Team would be a great way to help improve your experience. Our product developers review all the feedback they receive to ensure we’re meeting the needs of our customers. Here's how:

Additionally, you can check out these articles for more information about managing employees' pay types and adding or editing a deduction item on their paychecks:

Leave a comment below if you have questions or concerns about managing your payroll transactions in QBO. I'll be here to lend a helping hand.

I know the feature isn't available on QBO but is there a workaround for paying a piece rate?

Greetings, @Dgurr. I extend my gratitude to you for your participation in this discussion and for inquiring further regarding the process of paying a piece rate within the QuickBooks platform.

Currently, the only workaround we can use to pay the piece rate is to create an additional hourly pay/rate for your employee's regular salary or to use the Other Earning pay type, as suggested by my colleague Rasa-LilaM. Afterward, you will manually multiply the quantity and input it into your employee's paycheck. For more information about pay types and set-up hourly rates, see these articles:

Alternatively, you can explore third-party apps that integrate with QuickBooks to manage payment for piece rates. While we cannot recommend specific third-party applications for you to use, you can explore available options through our App menu. I'll guide you on how:

I'll be sharing these resources that will guide you in creating payroll and running reports in QuickBooks:

Please do not hesitate to inform me if there are any additional ways in which I can be of assistance in managing your payroll transactions. I'll be more than happy to help. Have a good day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here