Thanks for sharing a screenshot of your Payroll Center, mwf3636.

It's possible that there's another payment that's causing the liability to zero out. Let's run the Payroll Liability Balances report. This will help us check if the 941 balance is zero which might have caused the amount to not show up in the Pay Liabilities tab.

Here's how:

- Go back to the Payroll Center and proceed to the Pay Liabilities tab.

- Click Payroll Liability Balances under Reports.

- Change the date to All in the Dates section and choose Total Only in the drop-down list for Show Columns.

- Check the amount under the Balance column for 941 taxes. 941 consists of Federal Withholding, Social Security, and Medicare taxes.

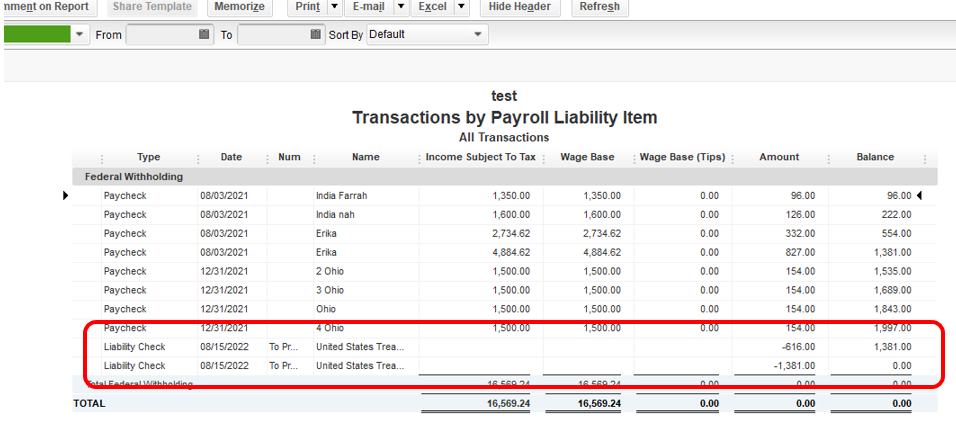

- If you're getting zero, double click on the amount. Then, scroll-down to the bottom of the list and review if there are extra liability payments that are causing it to zero out.

- You might need to delete them if you find one to get the balance back to the Pay Taxes and Other Liabilities tab.

- To delete it, double-click on the transaction and click the Delete button.

Once done go back to the Pay Taxes and Other Liabilities tab and check if you can already see the liabilities.

You can also double-click on the liability itself to see the breakdown of each amount.

I have these articles to share with you for additional references:

You also mentioned that you don't want to send the payment directly to EFTPS. If you'll be processing it outside of QuickBooks and just want to record the transaction, change the selection from E-payment to Check.

Please keep me posted if the 941 taxes are now back in the unpaid section. I would be glad to get back here if you need more help from us.