Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI just purchased QB Enterprise and Enhanced Payroll. I have two small separate companies set up. Do I need to purchase a separate payroll subscription for both of them? Or can I use the same subscription service key for both of them? They have separate EIN's.

Thank you,

You can manage payroll for up to 3 different EINs with one license.

How many user licenses do you have? If you only need 10 users or less, having QB Desktop Accountant Plus + a third-party payroll app will be cheaper than QB Desktop Enterprise Gold.

You can effectively manage your company's payroll information with your subscription, ELM. I'll provide details below.

You can use one payroll subscription to handle payroll for different companies, even if they have different Employer Identification Numbers (EINs). Each QuickBooks Desktop Payroll service lets you add up to three EINs. If you have the Enhanced for Accountant Payroll service, you can add as many as 50 EINs.

Please note that each EIN can only be linked to one company file. If you try to create more than one company file with the same EIN, it could cause errors in your payroll processing.

You can read through this article for more information: Add a new company to your payroll subscription.

If you want to learn how to set up your new QuickBooks Desktop Payroll Enhanced, this guide will provide you info: Get started with QuickBooks Desktop Payroll Enhanced.

Furthermore, QuickBooks provides various payroll reports that offer detailed information about employee gross pay, deductions, and tax data. You can refer to this article to learn how to access them: Run payroll reports.

Consider me your ongoing support if you have any other payroll concerns. Assistance is just a post away.

I only have two employees for the 2nd company and at most, seven employees for the primary account. Is there a less expensive subscription that can be used?

Thanks,

Elm

You can efficiently manage both your company's payroll data using your subscription, @ELM. Let me share some valuable information about this.

QuickBooks Desktop Enhanced Payroll allows you to manage up to 50 Employer Identification Numbers (EINs). You can also add another company file to your subscription if it hasn't used QBDT Payroll before. If it has, please contact our customer care team for a service key.

To add your company file, here's how:

For more information, you can read this article: Add a new company to your payroll subscription.

I'll also include these articles you can read if you need guidance in managing your payroll e-filing in QuickBooks:

If you have other questions or need further assistance in handling your payroll and employees, please don't hesitate to reach out to this forum, @ELM. We're always around to help.

You may explore QB Desktop Accountant Plus + a 3rd party payroll app. You can still request a refund for your QB Desktop Enterprise license within 60 days if necessary.

www.fiatlux.co.id/single-post/quickbooks-desktop-after-september-2024-what-next

Thanks for your response. Just to clarify.- I have two companies. I already have a payroll service key. Can I use that service key for both companies? Both companies have separate EIN numbers and are set up accordingly.

Thank you,

ELM

Thanks for checking back in, @ELM.

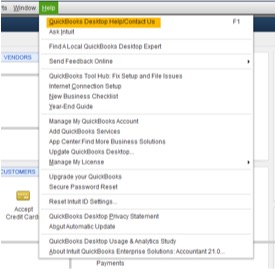

You will need a separate service key for any additional company you add to your payroll subscription. To obtain the key, contact our Payroll Support Team. Feel free to use the steps below to connect with our team directly.

Please don't hesitate to let me know if you have any additional questions or concerns. Have a good one!

How do I get the Enhanced for Accountant Payroll? I am ready to purchase the Enhanced for Accountants desktop version, and need the payroll for 50 EIN's.

We appreciate that you wanted to purchase the Enhanced Accountant Payroll for QuickBooks Desktop (QBDT), Larsond. We're here to provide information about this feature you wish to purchase.

Thank you for your interest in purchasing Enhanced Payroll for 50 EINs for QuickBooks Desktop. We'd like to let you know that effective June 1, 2022, this product will only be offered as a part of our QuickBooks Enterprise Diamond bundle, which includes Assisted Payroll. If you're an existing Assisted Payroll user, don’t worry! Your subscription will continue as usual, and you’ll still receive full product support.

Here are some links to articles about Enhanced Accountant Payroll: Announcing changes to QuickBooks Desktop Payroll.

Please refer to this article for guidance on paying your team quickly, accurately, and on time with QuickBooks Desktop Payroll Enhanced check this article for more information: Get started with QuickBooks Desktop Payroll Enhanced.

Feel free to visit our support site for more helpful tips and resources that you can use anytime: Self-help articles.

Let us know if you need help subscribing to the Enhanced Accountant Payroll subscription. We're here to assist you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here