It’s great to see you in the Community, Ken1946.

We’ll have to enable the feature and then add your real estate agents as 1099 contractors. This is to ensure you can start tracking for 1099 payments.

The process has never been easier. Let’s go to the Preference window to accomplish this task.

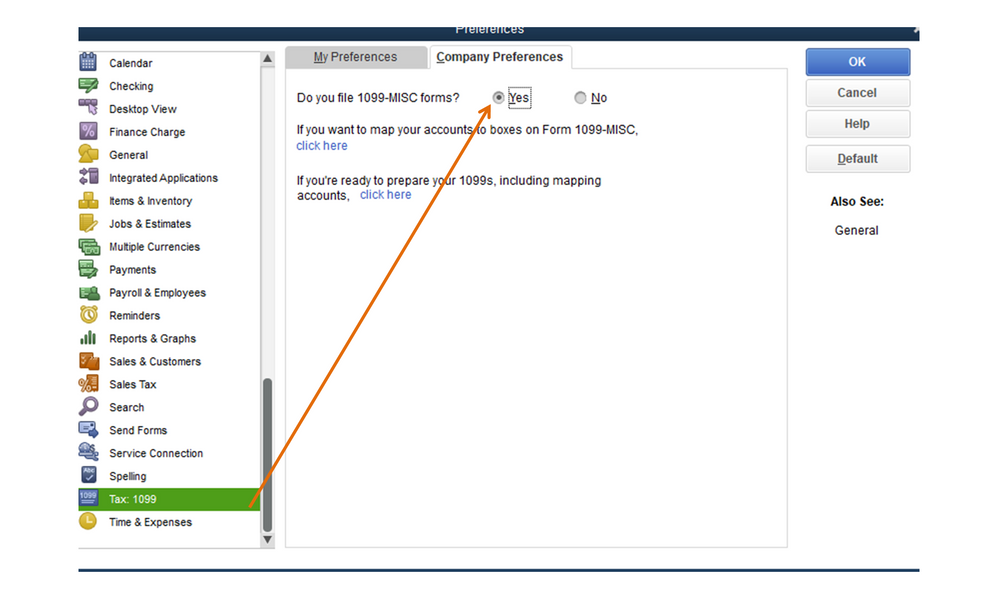

- Go to the Edit menu at the top and choose Preferences.

- In the Preferences window, tap the Tax: 1099 menu to select the Company Preferences tab.

- Mark the radio button for Yes in the Do you file 1099-MISC forms? section.

- Press OK to save the changes.

To add the vendors:

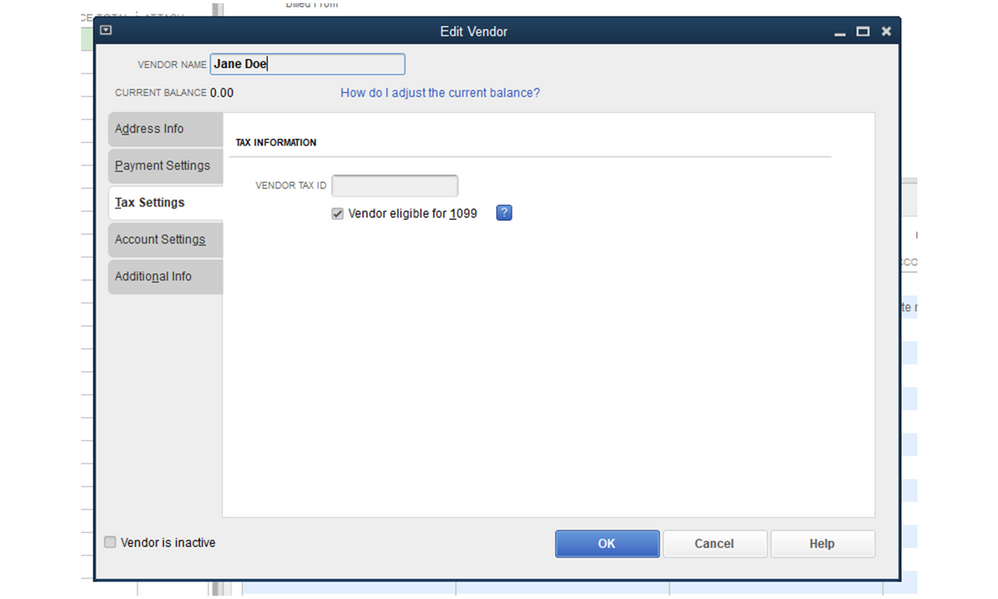

- Click on the Vendors menu at the top and select Vendor Center.

- Press the New Vendor drop-down in the upper left to choose New Vendor.

- Fill in and complete the field boxes. You can get the information on the W-9 form.

- Hit the Tax Settings tab on the left panel to open the Tax Information screen.

- Key in the tax ID and mark the box for Vendor eligible for 1099.

- Click on OK once done.

The Prepare and file 1099s with QuickBooks Desktop guide outlines the instructions on how to process and file the tax return. Additionally, this publication contains answers to frequently asked questions about the Form 1099-MISC: IRS.

Keep me posted if you have any clarifications or other concerns. I’m more than happy to answer them for you. Enjoy the rest of the day.