Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I need to add shareholder health insurance to my gross wages but I do not see it in the drop down list for adding deductions/contributions. Where do I go to do this?

Solved! Go to Solution.

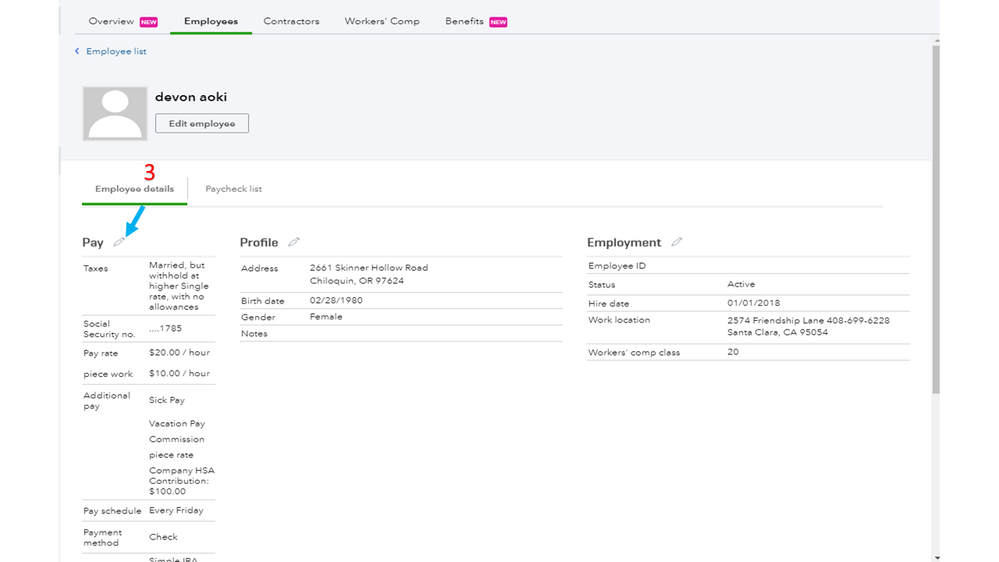

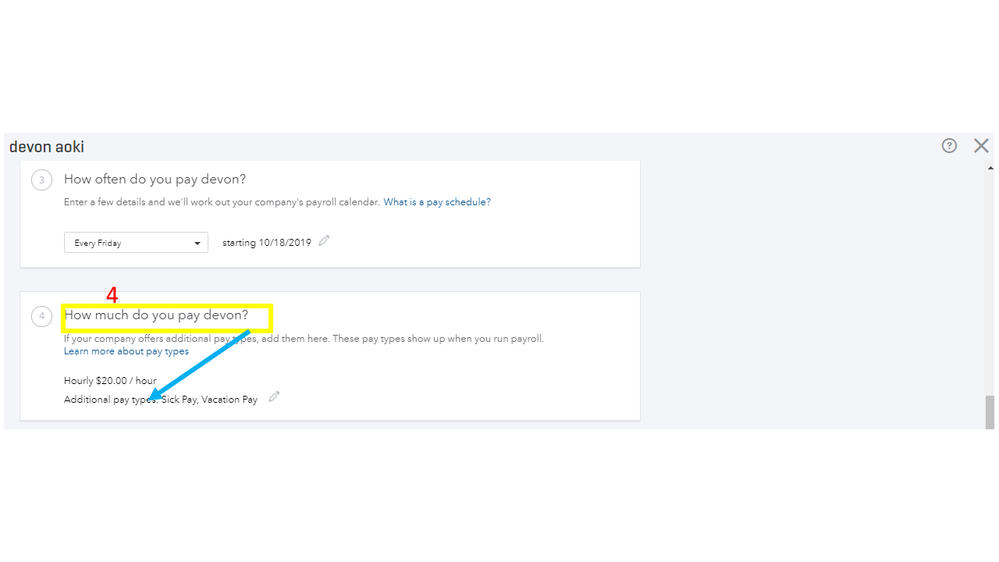

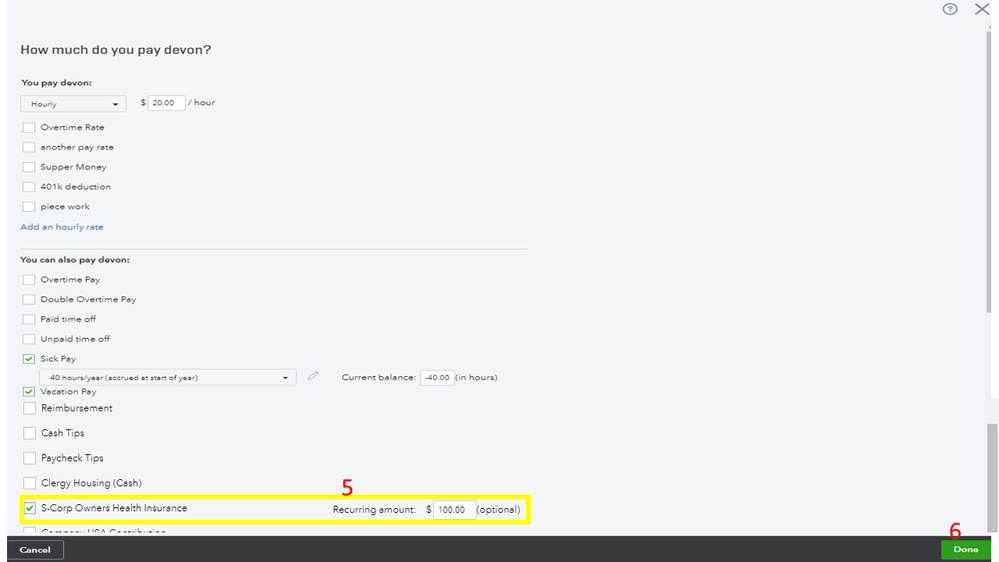

You can see it under the How much do you pay this employee? section, Mugsy.

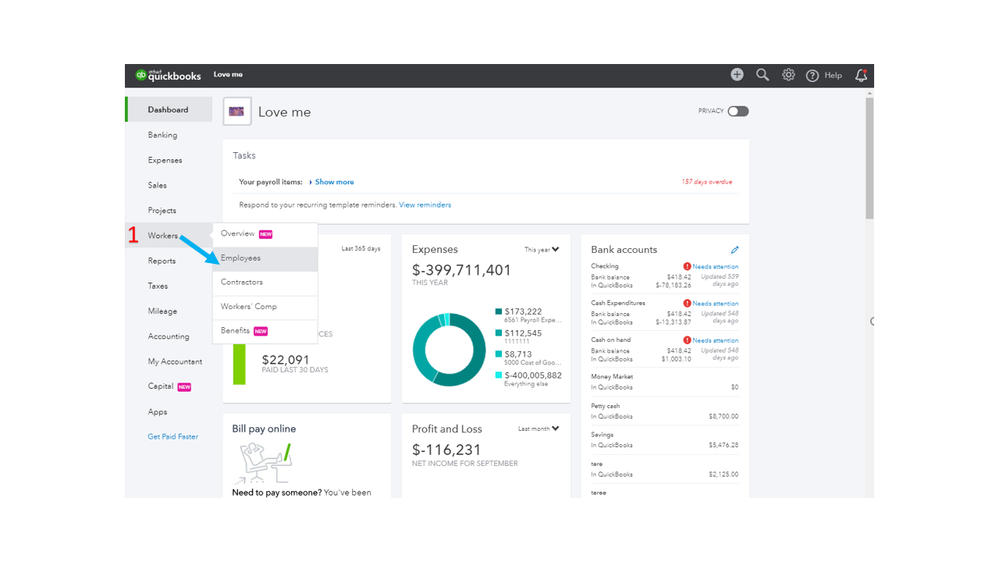

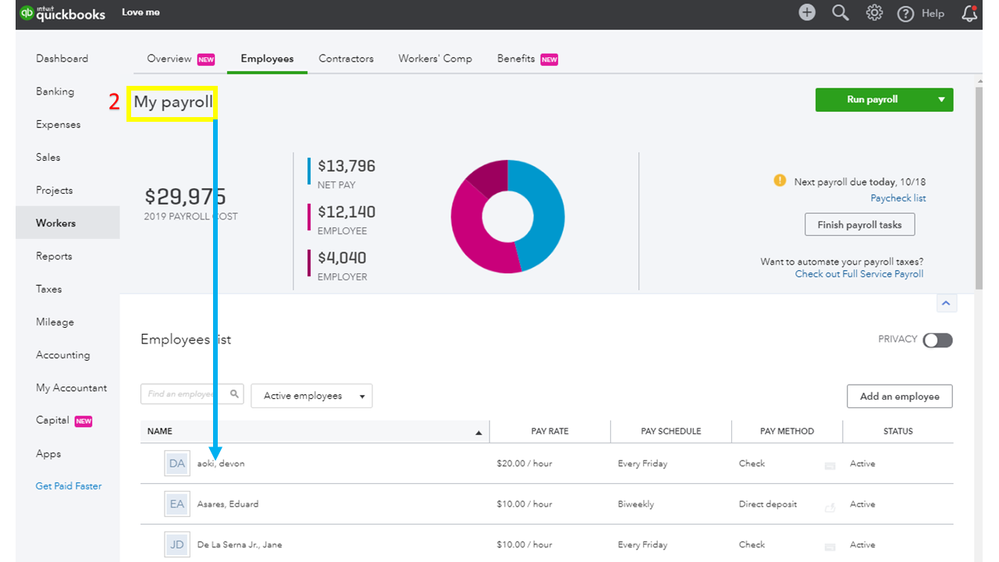

Here are the steps:

I'll be here if you have additional questions.

You can see it under the How much do you pay this employee? section, Mugsy.

Here are the steps:

I'll be here if you have additional questions.

Thanks for joining this thread, @tahoeblue08.

I know you’ve already accessed the employee’s profile, let’s open it again and then go to the You can also pay section to check for the S-Corp 2% Health Insurance pay type. Here’s how:

However, if the payroll item is still missing, login to your account using the incognito mode or private browsing. When using these sessions, none of your information is saved or tracked along the way.

Follow the keyboard shortcuts below to open a private browser:

If you’re able to see the S-Corp Owners Health Insurance box, switch back to the regular browser and clear its cache to start fresh. This process also boosts its overall functionality.

For additional resources, here’s an article with detailed information about the supported pay types in QuickBooks. It also provides a quick overview of how it's reported on the tax forms: Supported pay types.

You’re always welcome to visit the Community if you any questions about QuickBooks. Please know I’ll be right here to make sure you're taken care of.

I have done all of this but it is still not listed as an option under "Even More Ways To Pay". I've contacted support over a week ago and they could not assist me. They said they'd have someone contact me when it's resolved but I have not heard a thing from anyone.

There's an open investigation about this, Lisa Snarr.

Other users were also unable to see the option to add S-Corp Owners Health Insurance. Our product engineers are working to get this resolved as soon as possible. For now, I recommend contacting our QuickBooks Support do you will be added to the list of affected users.

Here's how:

Note that it may take longer than usual. Our support is receiving high volume of calls right now. You can check this article for the support hours: Support hours and types.

I appreciate your patience and understanding on this matter. Let me know if you have other questions in QuickBooks.

I've been in Lisa's boat since last winter. Moved on since there was no answer. I was also "promised" that my case was "escalated" (after many hours on the phone with QB payroll support) since, once again, "S-Corp Medical" (or anything related to S-Corp) is NOT listed under "Additional Ways to Pay" in my QBO. This was going to be "resolved" and I was going to be "emailed". I have yet to see that email (it's now July).

When will this issue be resolved? Will this feature ever be added to all editions of QBO? We pay $70/month for QuickBooks Plus and $35/month for QuickBooks Self Service Payroll. Is there something missing from our subscription?

Hello there, tahoeblue08.

The investigation mentioned in the previous replies has been resolved already. Please reach out to our Payroll Support Team so they run a new investigation since you experienced it again.

I'll be here if you have more questions. Have a great day!

Hello,

I recognize that according to these boards this issue has supposedly been "resolved." But S-Corp medical still does not appear as an option in our QBO program as it does in all the screenshots I find as examples on this board.

What is more frustrating, though, is that when I've had time to sit down and work on this (I do not do the books full-time for our family business as I have other jobs), I cannot reach a live person by phone and I have signed into the chat feature to request a live person as early as 11am and let it sit ALL DAY and still have not been able to connect with ANYONE. I have tried this is several days (not always that early) and continually get the message that I'll be connected "in five minutes" to someone on chat (from within the Help feature in QBO) but no one ever connects and then the Help Desk closes.

I know you all are busy but I used to be able to get help, especially with payroll issues, by just calling a number. What happened at QuickBooks? (Oh - and yes, I've left a callback number .... that does not work either as I've never been called back.)

Forgive my frustration, but, given that this seems to be a faulty software issue (with the S-Corp option even listed), who am I supposed to reach out to for help if not someone at QuickBooks?

I appreciate the details a lot, @tahoeblue08.

We always want you to have the best experience in reaching our QuickBooks Tech Support Team. In regards to the investigation case, INV-30544, this was closed a year ago. You can contact them and reopen this case since this was unresolved in your state.

Since we're unable to pull up your account here in the Community, I'd recommend reaching them back using one of these links below:

There they can pull up your account in a secure environment. It may take a couple of minutes for an agent to chat with you.

Please know that we have limited staffing these days and have reduced hours due to COVID-19. They'll be available from Monday-Friday that starts from 6:00 AM to 6:00 PM. In case you need details in reaching them, you can check their support hours and types.

Keep me notified by tagging me (@Jovychris_A) if you need further assistance. I'm always here ready to help. Take care!

Going a step further:

The shareholder paid the health insurance and is reimbursed at the same transaction.

The instructions presented were exactly what was set up to include the health insurance as wages on his W-2 but now there is a second step to include the reimbursement in his wage each pay period. This is not working.

Reimbursement

Health Ins.

S-Corp Owners Health Insurance

Thank for joining us here in the Community, @cindy lucy.

I'd like to ensure that we're on the same page so we can get this issue sorted out.

May I ask what specific part of the process is not working? Did you create your own reimbursement pay type? Have you encountered any error messages?

Any further details or screenshot about this concern is much appreciated. This way, I'll be able to narrow down this matter.

Please get back to me with more information by leaving a reply below. I'll be keeping an eye out for your response on this. Take care!

Adding the S Corp Health Insurance also posted to a liability account. The company is not paying the health insurance so right there requires an adjusting journal entry to zero the liability. I believe that there is a debit to health insurance, credit to liability.

I added "health insurance" as an extra pay item as the means to reimburse the shareholders each pay period. I believe that entry is also a debit to health insurance and credit to cash.

The AJE is debit liability credit health insurance each pay period.

If I could assign the health insurance to the liability account vs the expense: health insurance then no AJE.

Good morning, cindy lucy.

Thanks for following up with those additional details.

In this instance, I recommend reaching out to the QuickBooks Online Support Team. Agents have the necessary tools, like screen-sharing, to take a look at your account and determine what's causing this issue. Additionally, due to the amount of users mentioning they're having the same troubles on this thread, there may need to be another ticket opened. An agent will be able to do that as well and get this problem escalated as quickly as possible. Here's how to contact the team:

1. Click the Help button in the top right corner.

2. Select Contact Us.

3. Enter Support in the field and choose Let's talk.

4. From here you can select to receive a callback at a time that's convenient for you.

This article provides these steps if you ever need them again in the future: Contact the QuickBooks Online Customer Support Team

Feel free to comment below and let me know how the conversation goes. I'll be here to help in any way that I can.

I believe what I suggested is my resolve, allow the add or deducts the option of assigning any of the chart of accounts as the posting for the payroll items. When a transaction is NOT to be paid from QBX, just as in desktop, assigning both expense and liability to the same account eliminates it. Or, allow a one sided memo item for the S Corp Heath Insurance. I have clocked an embarrassing amount of non-billable time to this from the beginning when as others have said, the options were not even appearing on the screen, I cannot call another agent at this time. The AJEs are what I am doing until a day when my brain can handle it.

My apologies for the misunderstanding, cindy lucy!

I see now and I appreciate you sharing your findings. I hope others will give this route a try and have the same success.

How will this show up on the W2?

Thanks for joining us in this thread. I'd be glad to join the conversation to help with your payroll-related questions, Stephanie.

S-Corp health insurance increases the amount in boxes 1, 3, 4, 5, and 6 of the W2. It is also reported in box 14 of the tax form.

Let me share these articles so you can read more details about this payroll item and how it's being reported in the tax forms:

Let me know if that answers your question about tracking S-Corp health insurance in QuickBooks. I'd be willing to jump right back and help you again if you need it.

I don't believe S-Corp health insurance affect boxes 3, 4, 5, and 6. It only impacts boxes 1, 2, and 14. I would double check your facts, because health insurance is not subject to FICA under code section 105.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here