Welcome to the QuickBooks Community. I can share some information about the 1099 form, RockOn2011.

The option to create the 1099-Misc form using the Automated Clearing House (ACH) payments in QuickBooks is unavailable. The ACH only processes payments and information from one bank account to another.

Also, the 1099-MISC is a feature in QuickBooks that needs to turn on before filing it and setting up a vendor. If you haven't enabled it, you can follow the steps below to activate this one:

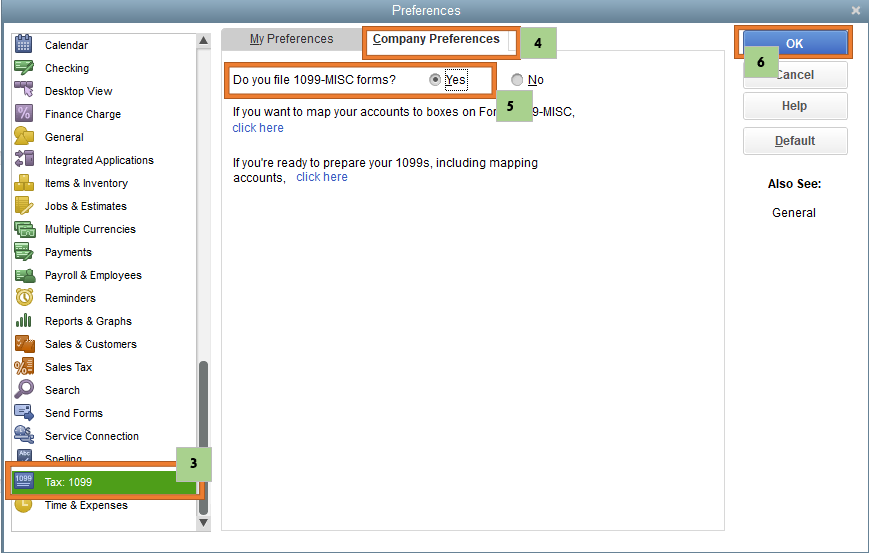

- Click Edit on the top menu.

- Select Preferences on the Toolbar.

- From the left tick Tax: 1099.

- Choose the Company Preferences tab.

- Next to Do you file 1099-MISC forms? tap Yes.

- Hit OK to save the preference.

For more details about setting up, filing, and printing 1099 Misc form, you can check out these articles:

Please let me know if you have further questions with the vendor form by replying to this post. I'm here to help.