I''m glad to help get the report you need, buzz4.

You can easily access a report of tax payments you've already made. I'll show you how to do that in QuickBooks Online Payroll.

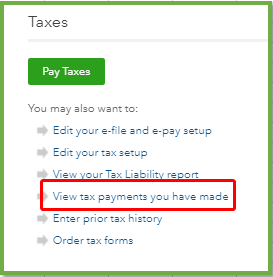

To access a report that lists tax payments you've already made follow these steps.

- From the left menu select Taxes, then select Payroll Taxes.

- Click View Tax Payments you have made.

- Select or enter the desired date range, then select Update Report.

- Select the payment date to view the details of the payment.

You can also run the Payroll Tax Payments to see payments you made electronically or manually in QuickBooks. Check out this link for additional information: Run payroll reports.

If you need to pull up payroll forms, you can access them easily in the system. You can browse this link for instructions and detailed steps: Archive and view old payroll tax forms.

Stay in touch with me if there's anything else you need concerning payroll. I'm always glad to help you.