Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the Community, tframer10!

Are you referring to sales tax? If you're required to track sales tax for more than one tax agency, you may consider setting up a combined tax rate. With this, your customer sees only one tax rate on their sales form. However, the sales Tax Center keeps track and splits out the appropriate amounts for each agency.

Here's how:

When you record sales transactions for projects, make sure to include the appropriate tax code. It's important to note that sales tax laws and regulations can be complex and vary by state and locality. You may want to consult with a tax professional or accountant to ensure that you are complying with all applicable laws and regulations.

When it's time to pay sales tax, go to the Taxes menu and click on Sales Tax.

Otherwise, if you're referring to the withholding tax of your employees, you may need to change the work location when running payroll. You can refer to this link: Set Up Employees and Payroll Taxes in a New State.

I'd be glad to see you again. Don't hesitate to add a comment below if you need further assistance with managing sales tax. Have a nice day!

No I am not referring to sales tax. I am referring to tax withholding on wages earned in another state. We a re a contractor and our employees sometimes work in another state where they are required to pay income taxes even though they do not live there. We can't be the only company who does this.

I appreciate your prompt reply and sharing additional details of your concern, @tframer10. Allow me to chime in and help you with the tax withholding of your employees.

Since your employees work in another state, you'll need to change the work location every time you run payroll for each state. This way, you can add the tax withholdings of the state they're working.

Here's how:

Here's an article you can read to learn more about your employee's work location: Set up and assign a new work location.

Also, I'd suggest contacting your accountant or the state they're working for the tax forms. This way, you can prepare the forms to be needed in the future since QuickBooks are unable to file both states at the end of the year.

Additionally, let me share these articles you can utilize to help manage your employee's paystubs and run payroll reports in QBO:

I've got your back if you have more questions. Just add your reply in the comment section so I can assist you further. Have a good one.

Here is the issue in doing that. During the pay period an employee will be working in two different states. How can I make sure they only pay the proper stste taxes on the wages earned in each state during the work period?

My employees will be working in two different states during the same pay period. How do I make sure that they pay the appropriate taxes to each state for the wages earned while in that state?

Thanks for getting back to us, tframer10.

We can ensure they pay the appropriate taxes by creating separate or individual payrolls for each state. In addition to the details shared above, we can review the information and set them up correctly to reflect accurate data when creating payroll for each state.

The steps below will walk you through the complete steps:

Also, We have lists of particular states has a reciprocal tax agreement. I'd recommend checking these articles for more details:

We can visit this article to see several payroll reports we can generate according to your needs. It helps us view information about business, employees, and payroll taxes: Run payroll reports in QuickBooks Online Payroll.

Let me know if you have more questions about payroll and other details in QuickBooks. I'm here to provide additional help. Take care always.

I'm sorry but that isn't the solution. QBO does not seem capable of handling this scenario.

Can you tell me if it is possible to run two separate payrolls each week for two separate states?

I can see how the functionality to run two separate payrolls for two different states would be beneficial to your business, tframer.

Currently, the option to run two separate payrolls for each state each week in QuickBooks Online (QBO) is unavailable. I know that having this option can aid you in managing your business flawlessly.

Rest assured that I'll relay this message to our team in concern here on my end and add your vote for this one. Our product development team reviews all the feedback we receive to ensure we're meeting the needs of our customers.

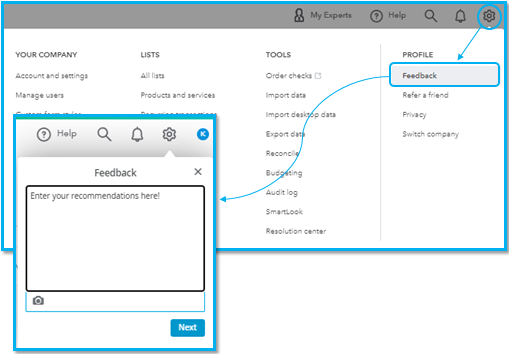

Here's how you can share your thoughts and ideas through your account:

Additionally, you can pull up a variety of payroll reports in QBO that will give you a closer look at your employee's total wages, deductions, and tax information in a certain period. For the complete list of available payroll reports and how to pull them up, kindly refer to this article: Run payroll reports.

You're always welcome to post a reply in this thread if you have any other questions about your QBO account. I'll be here ready to assist you. Stay safe!

You ask such a simple, basic question and all she wants to do is direct you to something that is not even CLOSE to being responsive!

I am facing the same issue. My employees work in two states in one pay period. Did you find a way to make this work? I agree that we can't be the only employers facing this problem. I am at a loss as to how to make it work using Quickbooks online.

I completely understand your concern, and it's indeed challenging when your employees work in two states during a single pay period, @primeidaho.

Rest assured that I am here to help you find a way to make this work effectively within QuickBooks Online.

I acknowledge the importance of running two separate payrolls for two separate states for your business. At the moment, this option is currently unavailable.

Discovering new ways to adapt to our customer’s needs is how QuickBooks gets even better. That said, I suggest submitting a product suggestion directly to our software engineers.

We have an article presenting multiple payroll reports that can be generated to accommodate your unique needs. These reports provide valuable information on your business, employees, and payroll taxes: Run payroll reports in QuickBooks Online Payroll.

If you have any additional questions related to your payroll needs, please feel free to share them with me. I want you to know that we are determined to help you overcome this challenge and ensure a seamless experience using QuickBooks Online.

@Rubielyn_J @LieraMarie_A @Kevin_C

I still don't think you or anyone at Intuit understands the ACTUAL - REAL - BUSINESS - ISSUE here.

This isn't about reports...we are not asking for reports. Reports don't help us withhold payroll taxes from the paychecks for the correct states.

What we NEED is the ability to run payroll and withhold payroll taxes from more than one state. THAT is the issue. Please all of you @Intuit employees Please STOP trying to reframe (minimize) the very real business issue. Also, sending us to "feedback" is also non responsive because we all know that is a black hole.

@Rubielyn_J @LieraMarie_A @Kevin_C

I still don't think you or *anyone at Intuit* understands the ACTUAL - REAL - BUSINESS - ISSUE here.

This isn't about reports...we are not asking for reports. Reports don't help us withhold payroll taxes from the paychecks for the correct states.

What we NEED is the ability to run payroll and withhold payroll taxes from more than one state. THAT is the issue. Please, all of you @Intuit employees Please STOP trying to reframe (minimize) this very real business issue. Also, sending us to "feedback" is non-responsive because we all know that is a black hole to nowhere.

I understand that you can't fix the blatant, short-sightedness of this problem in the software because you don't have those abilities and because you are not in that part of the business. I actually believe that you all would fix it if you could. But constantly trying to redirect us elsewhere is getting really tiresome.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here