I appreciate what you've done to address your concern. Rest assured, I'm here to help you fix the runtime error.

Firstly, please know that the error "missing pay rate" indicates that at least one of your employees does not have a designated pay rate. With this, please verify that you've established a pay rate for all employees.

I'll guide you on how:

- Go to the Payroll menu.

- Head to the Employees tab.

- Open the employee's profile.

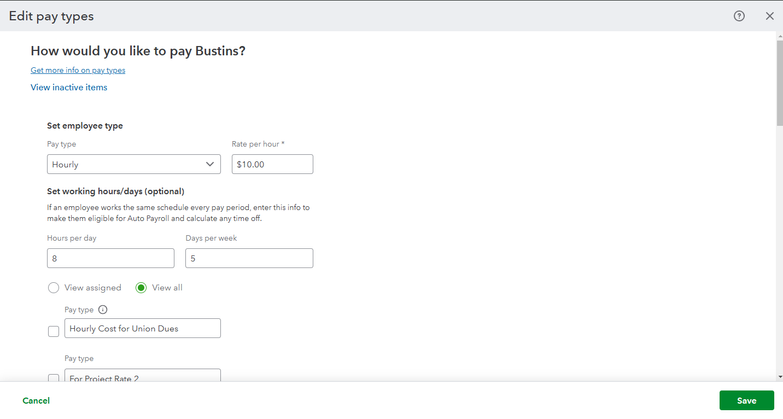

- Scroll down to the Pay Types section, then click Edit.

- Add the appropriate pay type and rate.

- Hit Save to confirm the changes.

I've added this screenshot for your visual reference:

If the issue persists, I recommend contacting our QuickBooks Payroll Support, as they have the necessary tools and expertise to troubleshoot your concern further.

Here's how:

- Hover to the Help menu and press the Search tab.

- Click Contact Us.

- Choose a specific topic or Ask about something else. Type in a short description in the box provided.

- Select Continue, then pick the Chat or Callback option.

Once you've fixed your payroll, you might want to check out this article to learn how to pay and file your 941, 944, 943, 940, state, and local taxes: Pay and file payroll taxes and forms electronically in QuickBooks Online Payroll.

Let me know how this goes, and if you need more assistance with similar tasks, you can always reach out. I'll be glad to help you through it.