Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowIs there a way to adjust the payroll tax payment that QuickBooks automatically creates based on the accrued amount from each payroll? Our client has been accruing company paid payroll taxes for an employee who is exempt. They have been posting the tax payment that QuickBooks creates based on the accrual and then they are also posting a check for the actual amount they paid (so duplicate payments for different amounts). In QuickBooks desktop the accrued amount could be adjusted to reflect the actual payment with the offset account being payroll taxes. Is there a way to adjust the tax payment amount that QuickBooks online creates? I can delete the payment, but then it just shows back up as a past due tax payment (which they would just end up creating again). The only other way I can figure is to post both payments and then do a journal entry to back out the incorrect amount out as to not duplicate it. It would however, then be an in and out of the checking account which is not preferable.

Let's get your payroll records accurate, Shannon36.

Unlike the Desktop version, adjusting payroll liabilities is currently unavailable in QuickBooks Online. I would recommend contacting our Payroll Team. They'll need to access your account so they can create the adjustment for you.

Here's how to reach out to them:

After the adjustments are entered, you'll want to run a payroll report to verify if the amounts are already correct. Just go to the Reports menu and look for Payroll Tax Liability or Payroll Tax Payments.

We're always here if you need anything else. Just add a reply below and we'll be happy to jump right back and help you again.

Is this still true? I'm getting tired of always having to contact Intuit for payroll corrections. Please tell me that this problem has been fixed.

Thank you,

Diana

I'm here to ensure your payroll corrections are taken care of, Flashback69.

I'd recommend contacting our Payroll Support Team to have the payroll corrections checked and investigated. They are equipped with tools to pull up your account and determine the solution to the issue.

Here's how:

To ensure that you'll be assisted on time, please see our support hours.

Additionally, I encourage running payroll reports in QuickBooks. This helps you view useful information about your business and employees.

In case you'll need assistance in dealing with payroll tasks, don't hesitate to get back on this thread. We're always here to help you.

This is so ridiculous. I can almost see that there should be an extra layer of protection from making mistakes with amounts withheld from employees and payable to the taxing authority. However, for employer contribution amounts, we should be able to adjust them as needed without the hassle of contacting someone else to do it for us.

I am so disappointed in QBOA. I should have stayed with Desktop.

I despise QB online for this reason. There are so many things that it doesn't allow and it is almost never accurate with our state taxes. It makes my job as the bookkeeper even harder. Please add the function! Also, QB Online really needs to allow multiple Labor and Industry/workers comp rates. Some companies have several, resulting in the liability adjustments needed. It also costs the company in under collected contributions.

Hi, jennymae1.

I know how important it is to have this function, however, the option to do so is unavailable in QuickBooks Online.

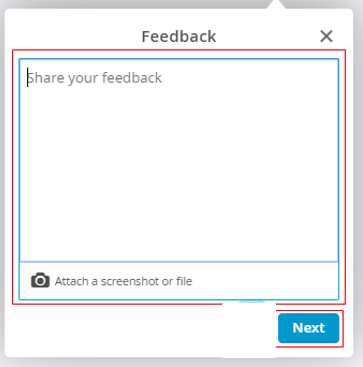

While this isn't an option, I'd suggest submitting feedback within your QuickBooks Online (QBO) account. This way, it goes to our product developers to help improve your experience while using the program. Here's how.

As always, feel free to visit our Help articles for QuickBooks Online in case you need tips and payroll-related articles in the future.

I want to be your main point of contact, so please let me know if you have any other concerns or questions. I'm always ready to assist further. Have a good one.

Your "Specialists" are a joke. I've made the journal entry to correct the SUTA liability and have requested the "specialist" correct QBO so the payment due aligns with the actual liability. She has been "researching" how to fix this problem for 35 minutes now. Will be recommending all clients do NOT use QBO.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here