Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When is the payroll item going to be set up for this. It says coming soon but all other states have a code. California is CALSAV but colorado just says coming soon

Thanks for getting in touch with the Community, angelarenee31.

Once a name for payroll items associated with Colorado Secure Savings retirement plans is publicized, step 3 (Set up and track your retirement plan in QuickBooks) will be updated to reflect the appropriate information.

I've included a link to that article which may come in handy moving forward: Set up state-mandated retirement plans

I'll be here to help if there's any additional questions. Have an awesome day!

Colorado payroll item for this is still not set up and I need to start deducts this week. Why isnt colorado set up yet?

Come on QB this needs to get setup for desktop users.

I hear you, Angela.

I understand the significance of being able to set up Colorado Secure Savings in QuickBooks Desktop (QBDT). For now, it's still unavailable in QBDT, and rest assured that it will be available soon.

As my colleague mentioned, we'll update the article once the setup is ready for everyone. Let me repost this article for your convenience: Set up state-mandated retirement plans in QuickBooks Payroll.

For now, you can download the latest tax table to ensure that your rates and computations for paychecks are up-to-date and accurate.

Moving forward, you can invite your employees in QuickBooks Workforce to view and print their pay stubs and W-2s online. Every time you process payroll, they'll receive an email informing them that their pay stubs are ready for viewing and printing.

Keep in touch if you have further questions about setting up Colorado Secure Savings. I'll be available to answer your questions at any moment. Have a great day ahead.

This absolutely of no help you have been saying that it will be available soon and you still have not set this up. When will this be set up? (a date not soon).

Do you know how to format the information to upload to Colorado Secure Savings? I did it for one client in an xcel format successfully but I haven't been able to since. I've also been told that it can be in a CSV format but I'm not sure what choices to make to format it. Thanks,

Do you know how to upload the employee info into their website. I was successful with an excel spreadsheet for one client but I haven't had any success since. I also hear that you could upload a csv file but I'm not sure about that format, tab, space etc. Thaks.

This is STILL NOT set up in Quickbooks desktop and we are in July. It was supposed to be mid May, Need some answers on this!

Hello there, @angelarenee31. Let me provide an update about Colorado Secure Savings.

I'll make certain that you can set up your CalSavers in Quickbooks Desktop.

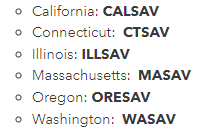

The following states mandate that employers either offer a traditional or enroll in a state-sponsored retirement program. Once you've selected your retirement plan, we can now set up the payroll items.

First, add a new payroll item. Here's how:

From there, add the retirement item to your employees. I'll show you how:

However, it's best to seek professional advice from your accountant to ensure the accuracy of your accounts.

For the detailed step-by-step process of setting up CalSavers, please check out this guide: Set up state-mandated retirement plans in QuickBooks Payroll.

In the same manner, I've got you this relevant article so you can keep up with the latest payroll updates mandated by your local agency: Colorado Payroll Tax Compliance.

If you have any further questions about managing your payroll in QBDT, you can always count on me to assist you. Keep safe, and have a good one!

You reference Colorado, then list states that don't include Colorado. CalSavers is California, not Colorado. How do we set up COLORADO?????

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here