Hello there, @bkramer1.

I'll ensure you can enter a credit amount for withholding tax to decrease the balance due.

If you want to decrease the credit amount due, you may need to enter a positive amount instead of a negative one.

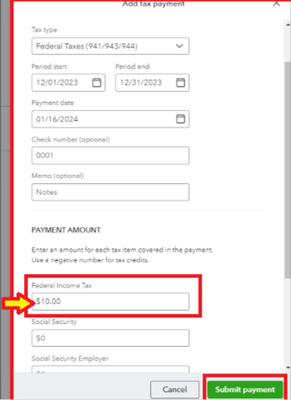

You can refer to the following steps and the sample screenshots below for visual reference:

- Go to the Taxes menu, then select Payroll Tax.

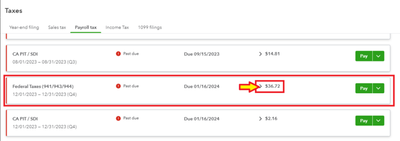

- Locate the withholding tax you want to enter a credit amount and click Pay.

- Fill out all the needed information in the Add Tax payment section.

- In the Payment amount area, enter a positive amount.

- Then, click Submit payment to save changes.

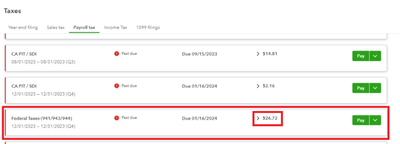

Now, the amount due is reduced by $10 after we apply the positive amount.

Please check out these articles for future reference in managing payroll taxes, forms, and reports in QuickBooks:

Reach back out if you have more tax-related questions or concerns. I’ll be here anytime to help.