Thanks for reaching out to the Community, 63maxdieselinc.

Before performing any troubleshooting, let me share the factors of how QuickBooks Online calculates federal taxes.

- Taxable wages

- Number of allowances/dependents

- Pay frequency

- Filing status

To fix the issue, let's review your employees’ profiles and make sure they’re set up correctly. Please know we'll have to open each worker’s information one at a time.

Here’s how:

- Go to the Payroll menu on the left panel and pick Employees.

- From the list, choose the employee you’re working on.

- Click the Pencil icon for Pay to open the Edit employee details screen.

- Review each section from Personal info up to How do you want to pay [employee].

- Then, make sure all fields have the correct information.

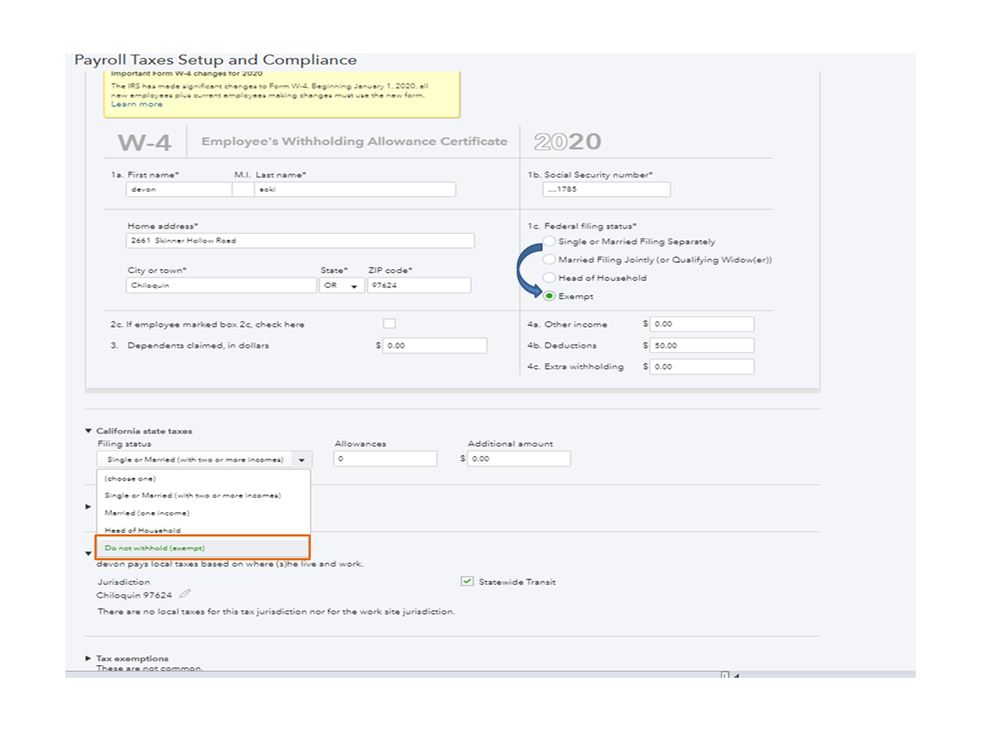

- Also, in What are employee withholdings? section, make sure the Filing status for states taxes is not set to Do not withhold (exempt) as well as the Federal filing status (Exempt).

- Click Done to keep the changes.

After updating the workers' data, delete the incorrect paychecks, and recreate them. For additional resources, check out the following links. From there, you'll see the information related to the redesigned Form W-4 for 2020 and payroll calculation methods.

Don’t hesitate to leave a comment below if you need further assistance in performing any of these steps. I’ll be glad to lend a helping hand. Have a great day ahead.