I'm here to help you modify your pay period, doublebtufts.

Ensuring your paycheck date is correct helps maintain financial accuracy and smooth payroll operations. If you have QuickBooks Online Payroll Enhanced, please follow these steps:

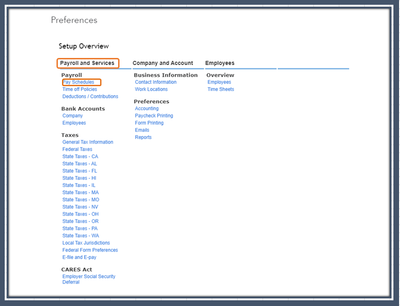

- Go to the Gear icon at the top to choose Payroll Settings.

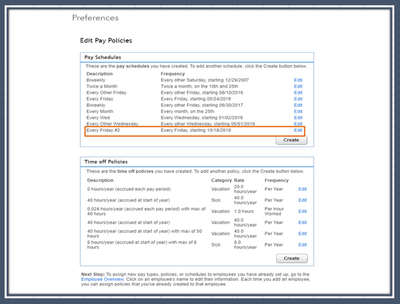

- In the Payroll and Services section, select the link for Pay Schedules.

- From the list, click the Edit button next to the pay schedule you want to update.

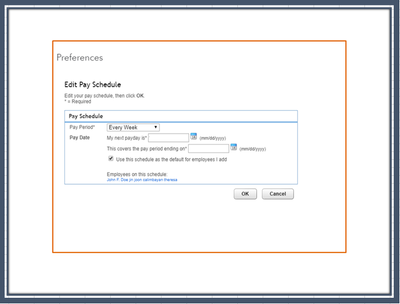

- In the Pay Schedule window, edit the information.

- Click OK and OK to confirm the action.

If you're using QuickBooks Online Payroll Full Service, Core, Premium, or Elite, I suggest performing these steps:

- Go to the Payroll menu and then select Employees.

- Select an employee.

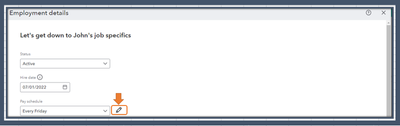

- From Employment details, select Start or Edit.

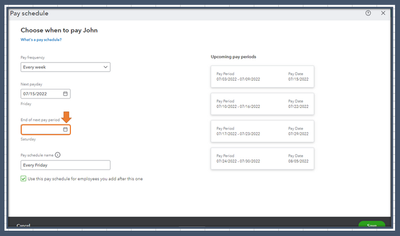

- From the Pay schedule dropdown, click the Edit icon.

- Enter the correct pay period ending in the End of next pay period field.

- In the Pay schedule edit confirmation window, choose All employees listed below (this pay schedule will be updated). Then, Save.

- Once done, select Save.

For more details, I've added an article about this: Set Up And Manage Payroll Schedules.

If you can't change the date, I recommend contacting our QuickBooks Payroll Support. They have tools to help you correct the period.

Additionally, you can invite your employees to Workforce so they can see and print their pay stubs and W-2s online. The feature also helps them see their time off balances and year-to-date pay.

Please let me know if you need additional assistance with the process. I want to make sure this is resolved for you. I'll get back to this thread if you need help processing your payroll.