I'm here to ensure you can set the right payment frequency for South Carolina taxes. @Demelza6.

QuickBooks Online (QBO) stays compliant with state taxes and regulations. To handle this, I advise reaching out to the state agency/authority in South Carolina (SC) for additional guidance on accurately filing SC taxes.

If the state confirms the need to pay your taxes quarterly, adjust the schedule in QuickBooks to the nearest pay frequency, which is Monthly. In that case, you'll need to pay and file the taxes outside QuickBooks. Thereafter, you can track the payments in our system manually.

Here's how:

- Go to Taxes, then Payroll Tax.

- Head to the Payments tab.

- Click the Record tax payments (prior tax history) text link on the bottom part of the page.

- Pick the Add Payment button.

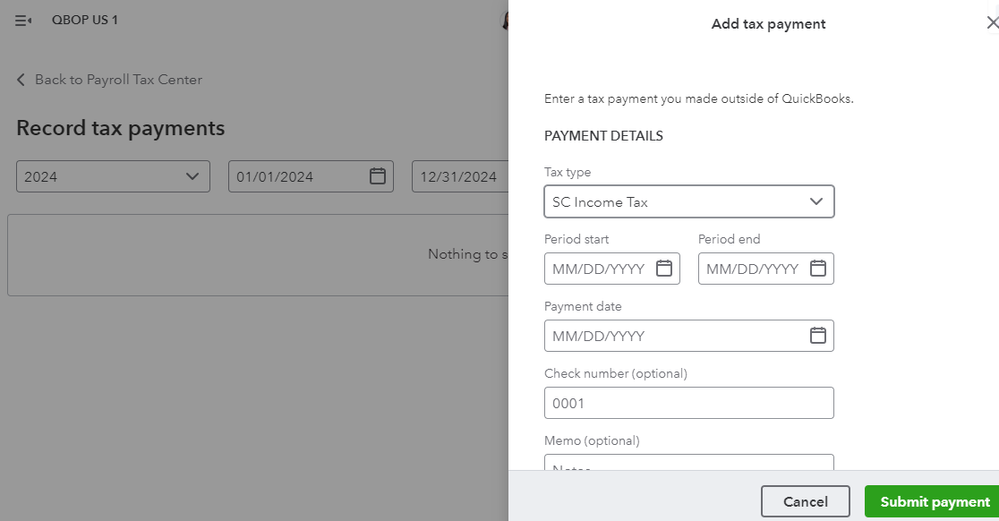

- Choose the SC Tax Type, then enter the following:

- Period Start Date and Period End Date - the period that the taxes were accrued

- Payment Date

- Check Number (optional)

- Memo (optional)

- Payment Amount

- Hit Submit payment.

Feel free to read this article for a more detailed steps: Record tax payments made outside of QuickBooks Online Payroll.

Moreover, I'm adding these articles for better ways to pay and file your taxes in our system:

Feel free to ask any questions about your state payroll tax payment and filing schedule. I'm here to help every step of the way.