I'll show you a way to implement the California SALT deduction limitation in your payroll, kmalhi11.

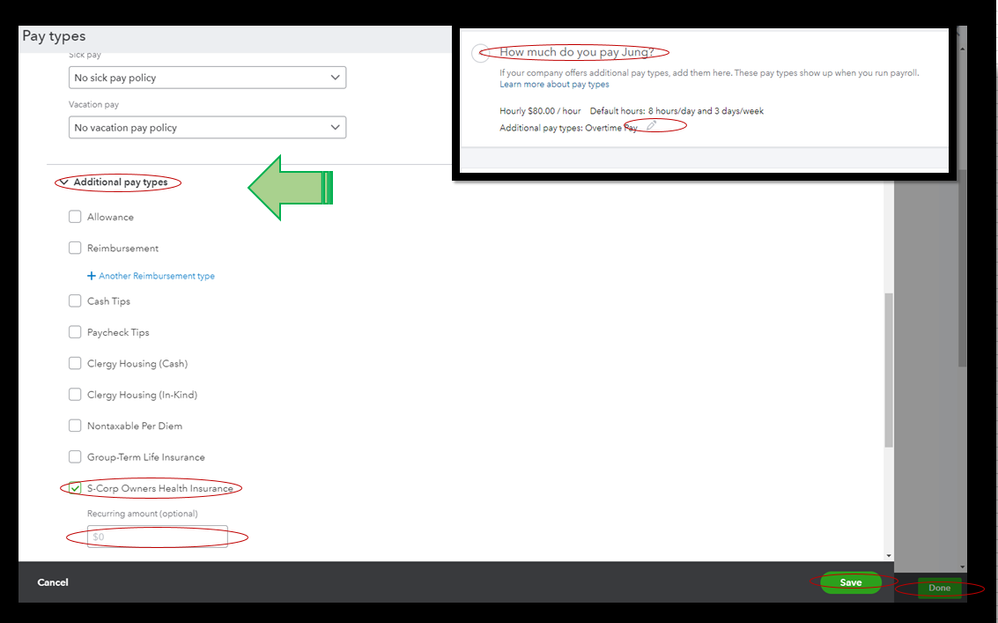

To start, let's make sure to set up the S-Corp pay type in QuickBooks Online. Here's how:

- Go to the Payroll menu and then select Employees.

- Choose the employee's name.

- On the How much do you pay [employee's name], click the pencil icon.

- Scroll down to Additional pay types, then select S-Corp Owner's Insurance.

- You can add the Recurring amount. You will also have the option to enter the S-corp amount when you run payroll.

- Once finished, click on Save, then Done.

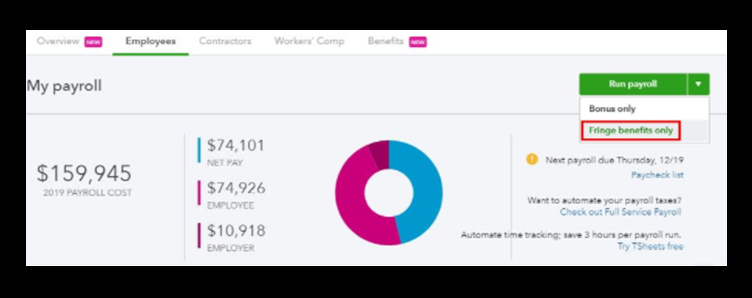

After that, we can now run payroll under Fringe benefits. I'll show you how.

- Go to the Payroll menu and then select Employees.

- From the Run Payroll drop-down menu, select Fringe Benefits only.

- Select Yes, my business will pay the taxes.

- Change the Pay date.

- Choose the employee(s) who need to have S-Corp recorded.

- On the S-Corp Ins. field, enter the dollar amount for S-Corp premiums that need to be recorded.

- Click Preview payroll to review the details.

- If everything is correct, select Submit payroll. Then select Finish payroll.

For more details about the process, please see this article: Set up and Record S-Corp Health Insurance.

Also, you can browse this article to learn more about the supported pay types and deductions: Taxability Types.

Additionally, I encourage running payroll reports in QuickBooks Online. This helps you view useful information about your business and employees.

Feel free to comment down below if you have any other concerns or questions about managing payroll in QuickBooks. I'm always glad to help in any way I can.