Having control over your tax payments is indeed an important factor in ensuring accurate payroll processing, bardt. I’m here to ensure you have the tools and knowledge to prevent your state taxes from being handled automatically.

You'll need to review your Payroll Settings to identify where the automatic processing is occurring and make necessary adjustments. In this situation, we'll have to turn off the automatic payment feature configured within your system preferences, allowing you to handle your state taxes manually.

Let me walk you through the step-by-step process:

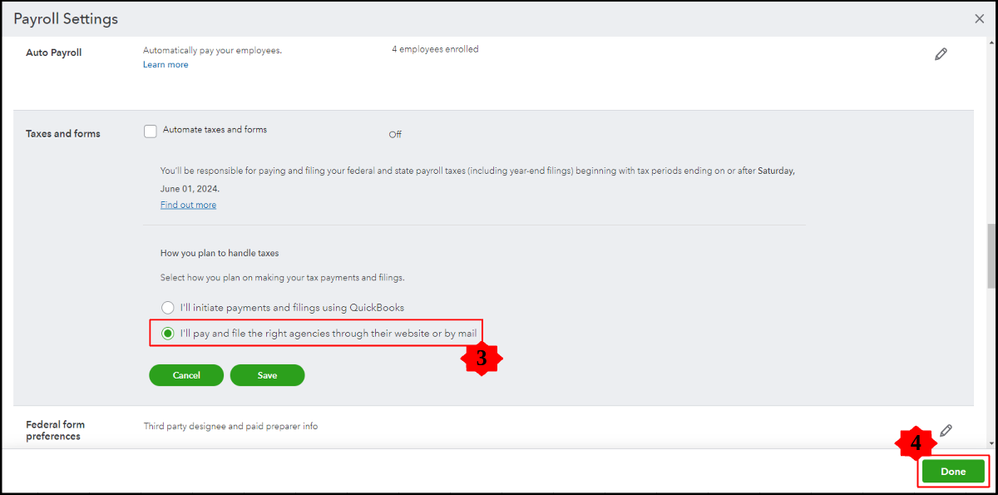

- Go to the Gear icon, then select Payroll Settings.

- From the Taxes and forms section, hit Edit.

- If you want to handle your taxes and filings yourself, choose I’ll pay and file the right agencies through their website or by mail.

- Click Save, then Done.

I’ll be adding a comprehensive guide for more information. This resource is essential for anyone looking to streamline their payroll processes and ensure compliance with tax regulations: Set up QuickBooks Online Payroll to pay and file your payroll taxes and forms.

Whenever you encounter challenges or have questions along the way, share them in the comments section below, bardt. I’ll be here to support you every step of the way, and together, we can ensure your payroll processes run smoothly and efficiently. Let’s take control of this situation and ensure everything is set up just the way you need it.