I understand the importance of setting up union benefits calculated Per Hours Paid in QuickBooks Online (QBO), tah-difinitigrou.

As of now, the ability to set up Per Hour paid to calculate employee deduction is unavailable in QuickBooks Online. I can see how important and beneficial this feature is for your company. I'd recommend sending a feature request directly to our Product Development team. This helps us improve your experience and the features of the program.

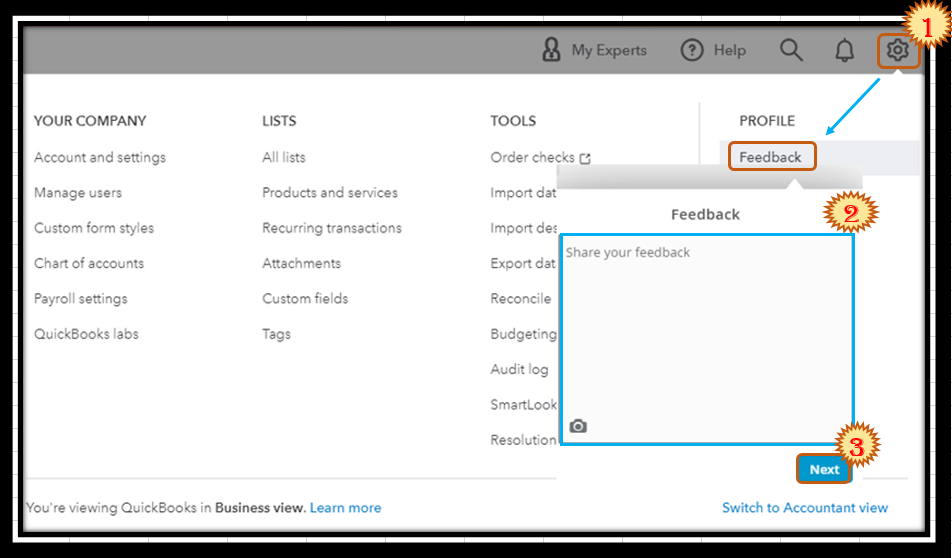

Here's how:

- Go to the Gear menu and then select Feedback.

- Type in your feature request in the description box.

- Once done, click on Next.

You can also track feature requests through the Customer Feedback for QuickBooks Online website.

I suggest consulting your accountant to guide you on the best way to track the deduction since QBO does not have the calculation option for per-hours paid.

Thank you for your patience while we work on this. Feel at ease to get back to this thread if you have other concerns with QuickBooks. I'll be more than happy to help. Please take care.